AmiBroker Courses

Beginning AmiBroker & Backtesting 101

Course Highlights

- No programming experience needed

- Create a mean reversion strategy from beginning to end

- Read backtest reports, look for errors and verify your strategy

- Add stops and market timing to your strategies

- Generate trading signals

The way the classes are structured gives you a solid confidence to advance and progress in your learning process of developing a custom backtesting strategy and guarantee you to understand how the built-in functions works in order to then create your own code and discover the results of your backtesting strategy. The flexibility of the recorded classes were all I needed as a full-time university student, because it let me to continue with my day to day activities and learn Amibroker without sacrificing my studies at the university.

Professor Alvarez gives you the opportunity to e-mail him at any time for any hesitation and he will reply you very fast – believe me.

Giancarlo Salirrosas

AmiBroker 101

AmiBroker Custom Charts Course

Course Highlights

- Create custom indicator

- Place your market timing indicator over a price chart

- Plot multiple timeframes on the same price chart

- Create your own custom backtest report charts

- And more!

Intermediate AmiBroker & Backtesting 201

Course Highlights

- Learn about optimization and smart optimization

- Create custom charts, indicators and backtest reports

- Work in multiple timeframes

- Write code in the high level Custom Backtester (CBT)

- Add scaling in and out to a strategy

Thanks for everything, you are doing an “awesome” job at teaching this. I have no programming experience whatsoever, and new to Amibroker, but because of your ability to break this down, I am actually learning the material. Thanks for being so mindful in covering each and every step so that even a beginner with zero experience can get so much from the course.

Michael Tracy

AmiBroker 101

AmiBroker Custom Backtester Course

Course Highlights

- Determine when to use each of the three levels of the CBT

- Add custom metrics via the CBT

- Control the processing of entry and exit signals

- Enter, modify, and exit trades

AmiBroker Rotational Strategies Course

Course Highlights

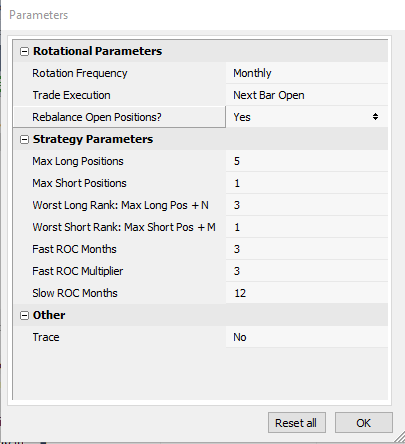

- Review what rotational strategies are and how they work

- Learn three different methods to implement rotational strategies in AmiBroker

- Understand what each different method offers and what challenges it might present

- Determine when you need to “bite the bullet” by using a low-level CBT

AmiBroker Adaptive Trading Strategies Course

Course Highlights

- Define your own Market Regimes

- Consider how trade setup, entry, and exit are assigned to a regime

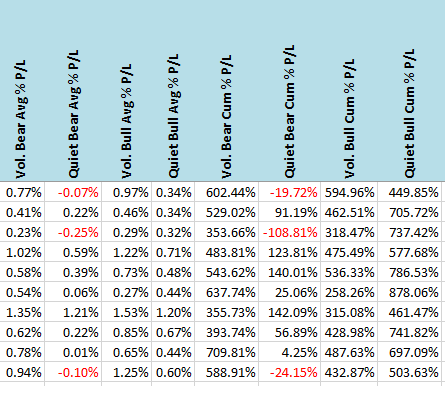

- Summarize metrics by regime

- Select the best parameters for each regime

- Modify your AFL to use adaptive (regime-specific) parameters

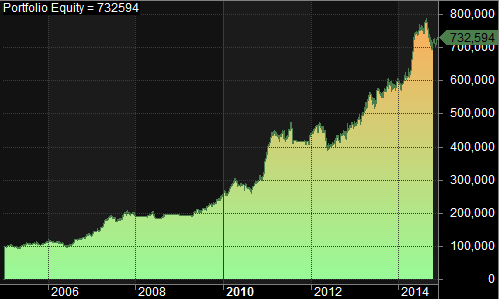

- Compare the adaptive strategy performance to a baseline