- in Mean Reversion , Research , Stocks by Cesar Alvarez

Maximum Loss Stops: Do you really need them?

We hear it all the time. “You must use stops.” And most of us use them. But do you know how they change your strategy results? Are they improving your results by giving you higher CAR or lower maximum drawdown? Recently I was speaking with a reader about this topic and he insisted that it you had to have stops to trade. Well, does one?

Early in my time while working with Larry Connors, he had me do a test on a mean reversion strategy and of course he said put stops in. We tried 5%, 7.5% and 10% maximum loss stops. I ran the test and noticed that higher stops had better results. I then got curious and tested larger and larger stops all the to a 50% stop, which at the level really is not a stop. A general pattern emerged that the larger the stop the better the results. I which point I decided to completely remove stops and this gave the best results. We could not believe it but tests on other mean reversion strategies showed the same thing. From that point on we traded our mean reversion strategies with no stops.

I trade two stock mean reversion strategies with no stops. But it has been 10 years since that original stop research. Does not using maximum loss stops on a mean reversion strategy still produce the best results in terms of Compounded Annual Growth or Maximum Draw Down?

The Strategy

I will be adding stops to one of the most popular posts, Simple Ideas for a Mean Reversion Strategy with Good Results. I will have to make minor changes to test it.

Testing timeframe is from 1/1/2005 to 6/30/2015.

Setup

- Close greater than 100-day moving average

- Close less than the 5-day moving average

- 3 lower lows

- Member of the Russell 1000

- 21-day moving average of dollar-volume greater than $10 million

- Price as trade greater than 1

Buy

- Rank stocks from high to low using 100 day Historical Volatility

- Place orders for the top ranked stocks such that if they all get filled will be 100% invested. This means orders will often not get filled even though lower ranked stocks may have

- Set a limit buy order for the next day if price falls another .5 times 10-day average true range.

Sell

- Close is greater than the previous day’s close

- Sell on the next open

Misc.

- Maximum of 15 positions [Corrected on 10/7/2015 ]

- 6.7% allocation per position [Corrected on 10/7/2015 ]

- No margin is used

General Info

The big change from the original test is only placing orders for the top ranked stocks. I did this to avoid having to run lots of Monte Carlo simulations which would have taken a very long time to run.

All stops tested will be end of day stops. If the closing price is below our stop point, then exit on the open on the next day.

I am not testing other stops because it greatly complicates the testing as each type affects the other. I am keeping position size constant because it also can affect the results. We are trying to isolate the results of only a max loss stop.

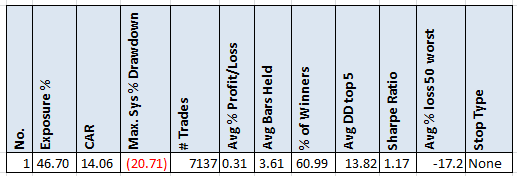

Base case: No Stops

These are good results considering no optimizing has been done. Surely a max loss stop will help. We will focus on Compounded Annual Return(CAR), Maximum Drawdown (MDD), the average of the 5 worst drawdowns and the average % p/l of the worst 50 trades (Avg % loss 50 worst).

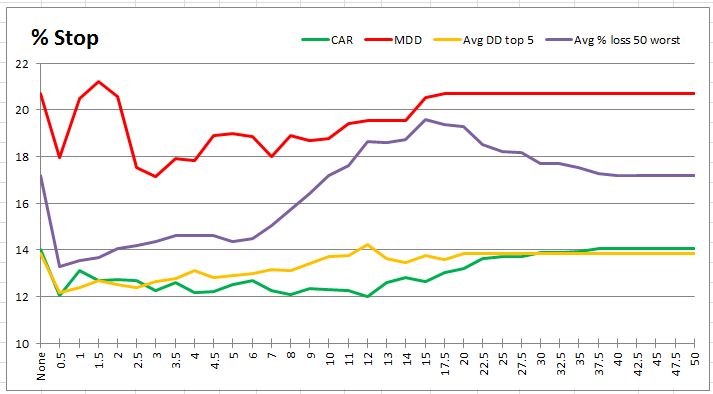

Percent Max Loss Stop

The first test is using a simple percent max loss stop. These tests generated a lot of data which you can get in the spreadsheet.

On the far left we have the no stop case. Using no stop produces the best CAR of 14.1. The worst CAR is 12.0 at a 12% stop. OK, maybe we are willing to give up some CAR if the drawdowns and worst trades come down. The MDD goes from 20.7 to as 17.2 low as at a 3% stop. A 15% improvement which is good but not great. The average of the top 5 drawdowns also improves from 13.8 to as low as 13.4. A minimal improvement. The worst trades drop from 17.2 to 14.4 again an improvement but still a big losses. What is interesting here is that at around 15% stop, you are now making your worst trades worse than not even having stop. If I had to pick a stop to trade it would be at 4%. I like keeping things simple. If was evaluating this rule to add or not, I would not do it.

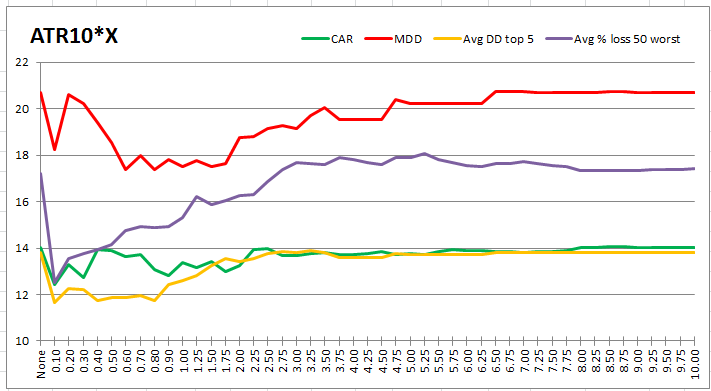

Using ATR for Maximum Stop Loss

Next we look at using a factor of the 10 period ATR.

The same general pattern holds. Using a .1*ATR10 really has significant impact. A common value for the factor that I read about is using 2.5 or 3. At that level, the results are very similar to not using a stop. Most of the bang comes with a factor under 1. Again, I probably would trade none of these values. Adding complexity but not getting enough reward for it.

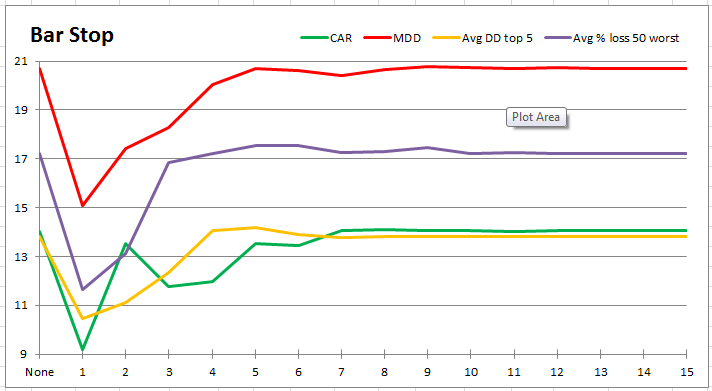

Bar Stop

This is not a maximum loss in the traditional sense. If you are still in the stock after N bars, you exit.

Now this is interesting. The exit after 1 bar, meaning if you entered on Monday, you exit on the open on Tuesday, really improves the negative numbers but a significant hit to CAR. This stop would warrant more investigation but looks promising.

Spreadsheet

Fill the form below to get the spreadsheet with lots of additional information. This includes yearly breakdown and top 5 drawdowns.

Final Thoughts

The results for using stops vs not are not as clear cut as when I did the tests ten years ago. One factor that may influence the results is the exit. The exit of one up day is not a very traditional exit as opposed to a Close above a short moving average.

A question often asked, if you use no stop how do you determine position size? One could use the average losing trade or the median losing trade. Or some factor of those values.

Backtesting platform used: AmiBroker. Data provider: Norgate Data

Guide the research

Do you want to see how intraday stops would do? What about checking the exit from up-day to crossing above the five day moving average? What about profit targets?

I am trying something new. This survey is open until 8/19/2015. Fill in the survey if you want to see more on this area of research. Or if you have a different idea on the stop research, enter it in the comment section below.

Backtesting platform used: AmiBroker. Data provider:Norgate Data (referral link)

Good quant trading,

Results

See test results from this survey at Stop Losses and Profit Targets. Plus Happy Birthday Excel!

| Answer | % |

| Change exit to Close > MA5 | 39% |

| Profit Targets (intra-day) | 25% |

| Intraday stops | 20% |

| Profit Targets (using close) | 13% |

| No more research on this topic | 3% |

Fill in for free spreadsheet:

![]()