- in Research by Cesar Alvarez

Trading the Equity Curve – More Ideas

A couple posts ago, I looked at Trading the Equity Curve and found interesting results but nothing that made me decide this works for me. Using the equity curve to decide when to stop trading a strategy just sounds like it should work. But for me it is always about testing. I cannot count how often I thought an idea would help the results only to see them dramatically hurt them. Remember test everything!

I have been thinking about other methods to use to trade the curve. I also wondered maybe it is the strategies I tested against that caused less than stellar results. I am working on a SP500 weekly mean reversions strategy with an average hold of three months. Maybe new methods of trading the curve or the different strategy will give better results.

The Strategy

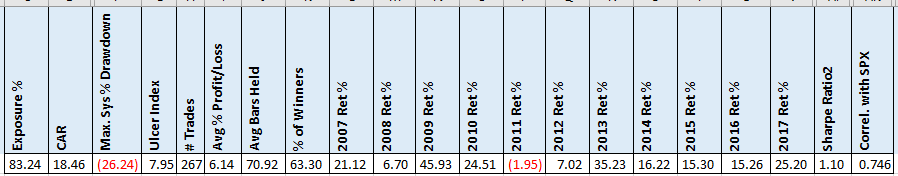

No rules will be given. Here is the general concept. Buy S&P500 stock when it is a weekly pullback. Of course, there is a market timing filter to keep out of bad markets. Then exit with a profit target or maximum loss. These are the baseline results without trading the equity curve.

Clearly this strategy has not had problems. Now can we add trading the equity curve and not dramatically change the results for the worse?

The Methods

These are the methods I will test. If you have other ideas, put them in the comments below. If I get enough new ones, I will test them. The first two ideas are similar to what I tried on the previous post. The drawdown idea resonated with me and was curious to see how it would work out. The last rule I decided to simply try combing two rules that did well from last time.

- The curve is above the (100,200) day moving average

- The (50,100,200,252) day return is greater than zero, (ROC)

- The current drawdown is less than (10,15,20,25)%

- The 252 day return is greater than five percent

- The 252 return is greater than 0 or the equity is above the 200 day moving average

When the equity curve test is not true, we stop taking new trades. Any currently open trades we simply exit as they normally would. When the equity curve test is true again, we can take trades

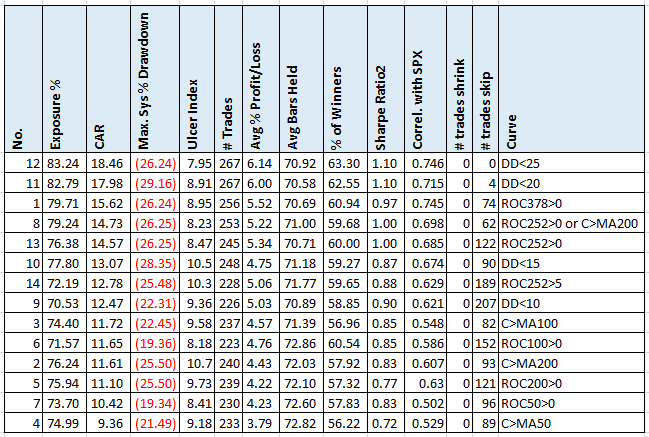

Results of Trading the Equity Curve

Two columns need explaining. # trades skip, is the number of trades the strategy did not take because of the equity curve rule. As you can see the top row missed no trades and this is basically the original strategy results. My goal is no more than a 10-15% reduction in CAR. At 15%, this cut off is 15.69, which only one version beats. This version, drawdown<20%, skipped only 4 trades. Too small of a sample size.

Rules Don’t Need to be Black or White

One thing I am bad at is having rules be black or white. In trading the equity curve rule, the rule either allows trades to happen or does not. One thing I have seen in lots of strategies is that they have a steep sell off and then have a quick bounce back up. I was wondering if the equity curve rule was getting us out and then not letting us enjoy the bounce back up.

Position Sizing Rule

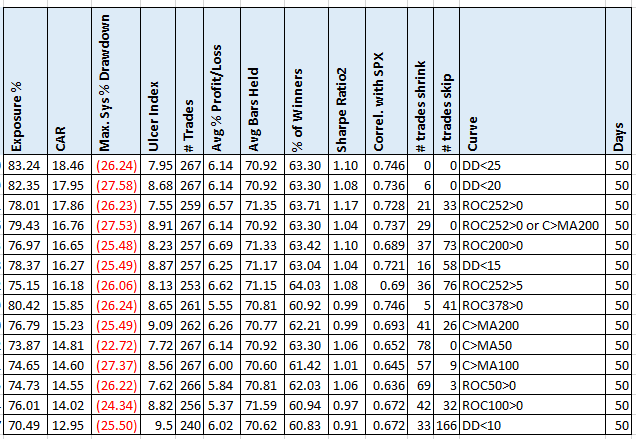

My next idea was to shrink the position size depending on how long it has been since the rule was true. For example, our equity rule is ROC252>0. It has been 10 days since this has been true and the cutoff value is 50. Our allocation to the trade is

New allocation = Normal Allocation * (1- (days since equity rule true)/(rule cutoff)

New Allocation = (10%)*(1-10/50) = (10%)*(.8) = 8%

Each day the potential size shrinks. When it has been more days the cutoff value, then the strategy stops shrinking the trade and starts skipping trades.

Shrinking Position Sizing Results

How we have several results with CAR greater than 15.69. Off these, I like the RO252>0 and DD<15. The MDD stays about the same which is good.

Broken Strategy

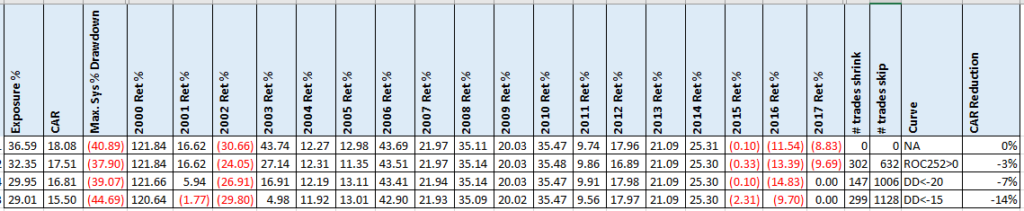

From the original post, I wanted to see how these methods would do. I also added DD<20 because this strategy is much more volatile

Click for larger image

The goods news is the CAR does not drop over 14% with these methods. The MDD stays about the same, which is good. The interesting part is looking at the 2016 & 2017 results. For the ROC252>0 method these two years are worse. The DD<20, gets you out for 2017 but did worse in 2016. Only the DD<15 method helped for those two years.

Spreadsheet

Fill the form below to get the spreadsheet with all the results and additional stats. I also ran with many more parameters for Days cutoff value.

Final Thoughts

I heard on a podcast that a quant trader was using the equity curve to decide when to stop trading. But it did not sound like they had tested it. Even though the idea sounds great, they may be dramatically reducing their results if their strategy continues to do well.

These methods can help you of a strategy but then comes the next question. How long do you give it before saying it is broken?

The position shrinking methods have produced good results without severely compromising the strategies. I must try these methods on my other strategies and see if they hold up. Remember test everything!

Backtesting platform used: AmiBroker. Data provider: Norgate Data (referral link)

Good quant trading,

Fill in for free spreadsheet:

![]()