- in Mean Reversion , Stocks by Cesar Alvarez

Adding Stops and Scaling Out to a Mean Reversion Strategy

I came on an idea recently that I had tested. I have tested adding max loss stops to a mean reversion strategy, with no success. See this post for more on that. About eight years ago, I tested scaling out of trades. But this person claimed that adding the two together was how to improve a mean reversion strategy. Interesting idea I had not tested.

I have a one question poll below about what to do with my research. Take 15 seconds to fill it out.

Base Strategy Rules

Setup

- Stock is member of the Russell 1000

- Close is above $1

- The 21 day moving average of Dollar Volume is greater than $10 million

- Close is above the 100 day moving average

- RSI(2) crosses below 5

Buy

- Enter the today at 1/2 of ATR(10) below previous close

- 20% of portfolio in each position

- Only enter orders so if they all fill will not have more than 5 open posiions

Sell

- RSI(2) greater than 30, sell on next open

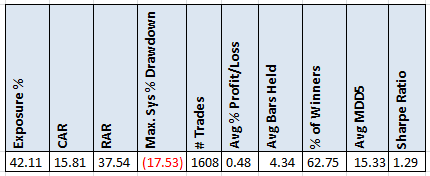

Results

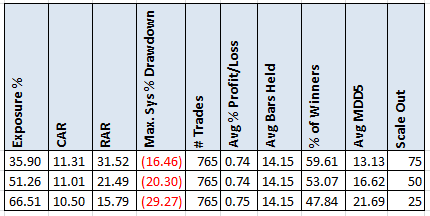

Scaling Out

Now we add the scaling out rule. On the original exit signal, we exit (25,50,75)% of the position. The rest of the position is exited when the close is below the 3 day low of lows. This exit is on the next open.

We see a large drop in CAR with either no change or large increase in MDD. That did not seem to help. What about having a max loss stop?

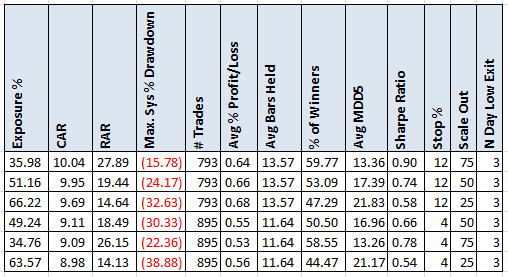

Adding Max Loss Stop

Using the rules from scaling out, we now add a max loss stop of (4,12)%. The stop is evaluated at the closing price and exited on the next open. Using end of day stops tends to produce better results.

The number just get worse.

Spreadsheet

Fill the form below to get the spreadsheet with lots of more information. This includes other parameters (stop % and N Day Low exit), yearly breakdown, worst 5 drawdowns and more statistics.

Poll

We all want our research to produce great results. I do a lot of research that does not lead to tradeable results. I like seeing but want to know your thoughts. Fill in the poll to guide me what to do with this research. Poll will close on 3/31/2016. Thank you.

The results were clear with 95% of you saying to keep posting research like this.

Final Thoughts

Although this led nowhere, one must always be testing ideas. Sometimes the combination of two ideas that did not work separately work great together. Or an idea that did not work years ago, now is working.

Backtesting platform used: AmiBroker. Data provider:Norgate Data (referral link)

Good Quant Trading,

Fill in for free spreadsheet:

![]()