- in Mean Reversion , Stocks by Cesar Alvarez

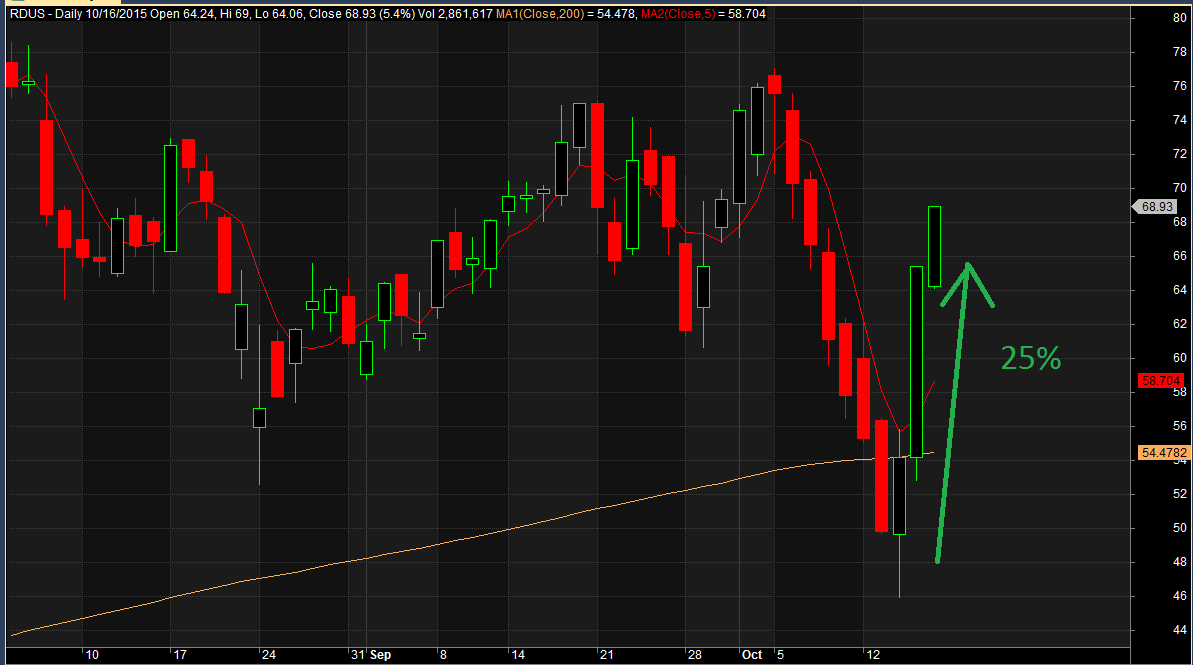

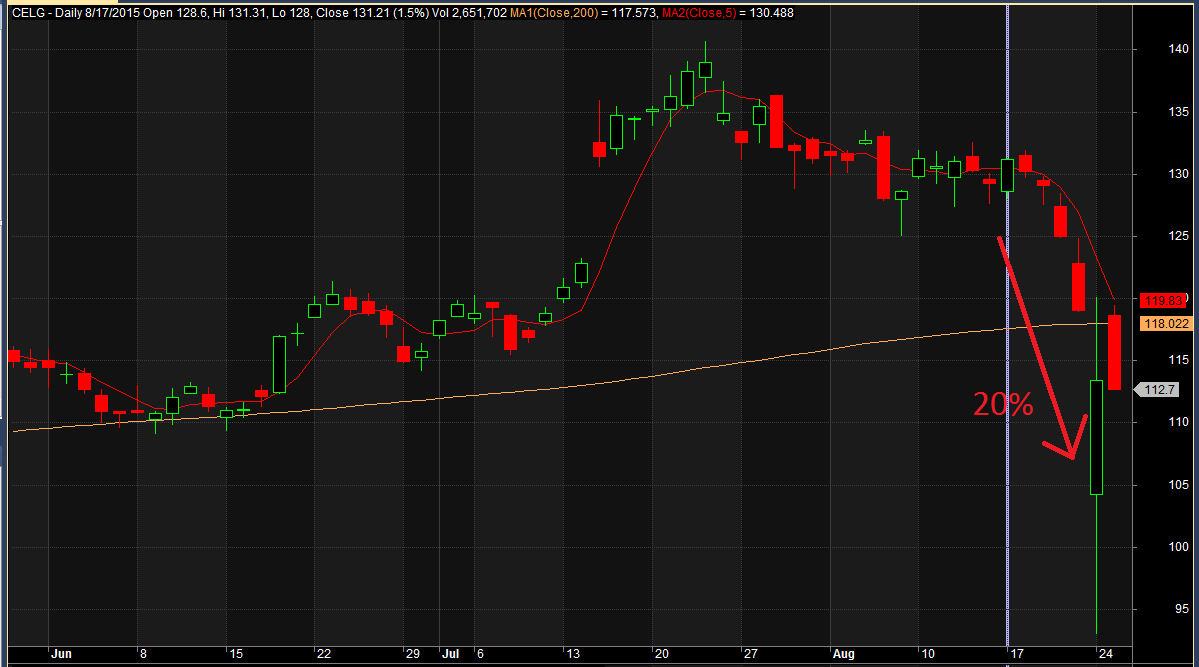

Biotech: My love-hate relationship

My love

My hate

The two charts above are from recent trades I have taken. Charts created in AmiBroker.

On July 20, 2015 IBB, iShares Nasdaq Biotechnology ETF, made a closing high of 398. About three months later it closed at 289 for 27% loss. A very common thing I hear from traders is that they “don’t trade biotechnology or pharmaceutical stocks.” I completely understand. These stocks tend to be very volatile and news driven. But does removing these stocks really reduce your drawdowns? What happens to your Compounded Growth Rate? Time to see what the research shows us.

The data

I am using Norgate Data which has Industry Classification Benchmark (ICB) for most stocks. One bias to this test is that the classification is only for the last day of the stock. If a stock changed classification through its history, this would not be caught. I am not too concerned about this.

The rules

Setup

- Close greater than 100-day moving average

- Close less than the 5-day moving average

- 3 lower lows

- Member of the Russell 1000 (will also test Russell 3000)

- 21-day moving average of dollar-volume greater than $10 million

- Price as trade greater than 1

Buy

- Rank stocks from high to low using 100 day Historical Volatility

- Place orders for the top ranked stocks such that if they all get filled will be 100% invested. This means orders will often not get filled even though lower ranked stocks may have

- Set a limit buy order for the next day if price falls another .5 times 10-day average true range.

Sell

- Close greater than 5 day moving average (Corrected on 11/4/2015:

Close is greater than the previous day’s close) - Sell on the next open

Misc.

- Maximum of 15 positions

- 6.7% allocation per position

- No margin is used

The results

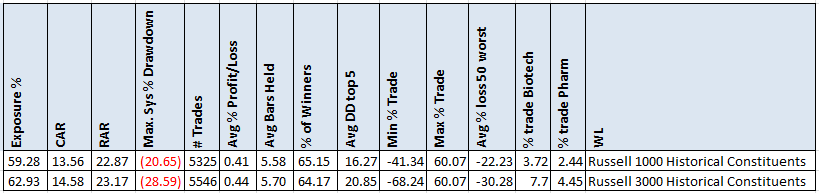

Tested from 1/1/2005 to 9/30/2015

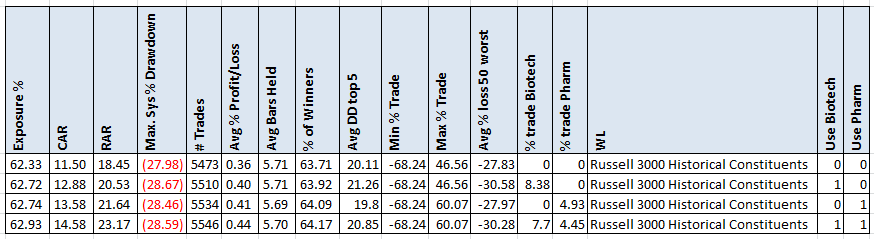

Will be focusing on CAR, MDD, the average of the 5 worst drawdowns, the worst trade, and the avg of the worst 50 trades. Biotech makes 3.7% of trades when using the Russell 1000. While Biotech and Pharmaceuticals are a total of 6.2% of the Russell 1000 trades. The total for both jumps to 12.2 when using the Russell 3000.

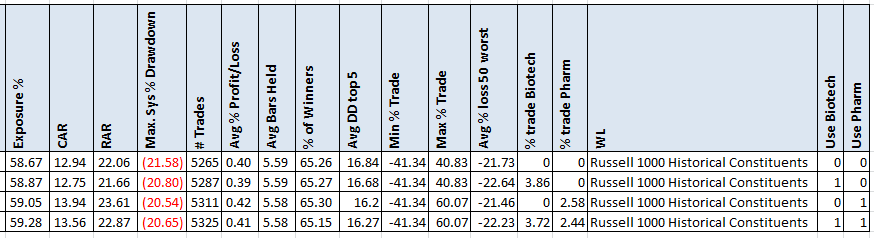

Removing biotechnology and pharmaceutical stocks

Next we remove any stocks classified “Biotechnology” or “Pharmaceuticals.”

Russell 1000 Results

Removing them, reduces the CAR with a slight increase in the MDD and worst 5 drawdowns. The top 50 losses does improve slightly. In this case removing them has a negligible effect on the results.

Russell 3000 Results

This test has a bigger change. Removing them reduces the CAR 21% while only reducing MDD 2%. The worst 50 trades does improve by 8%.

Spreadsheet

Fill the form below to get the spreadsheet with lots of additional information. This includes yearly breakdown, top 5 drawdown and other stats.

Final Thoughts

As tends to happen often, one cannot generalize test results. Removing biotechnology and pharmaceutical stocks had minimal change in the numbers on the Russell 1000. Small enough that I would likely not trade them if that was my strategy. Even though you may get some large winners having to deal with the large losers is psychological tough.

But the results on the Russell 3000 are different enough. In this case I would likely stick with biotechnology and pharmaceutical stocks.

I will be revisiting my current strategies to see what happens to them when I remove biotech and pharma stocks.

As always test what you are trading. You cannot generalize test results.

Tell Me

Tell me in comments below if you trade or don’t trade biotechnology and pharmaceutical stocks and why.

Backtesting platform used: AmiBroker. Data provider:Norgate Data (referral link)

Good Quant Trading,

Fill in for free spreadsheet:

![]()