- in Research by Cesar Alvarez

Are S&P500 Stocks Moving Less In Tandem?

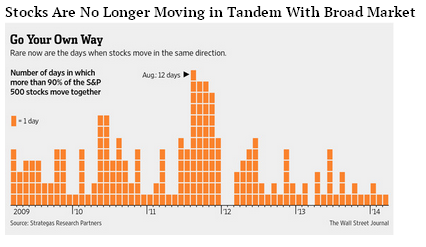

I saw this interesting graph the other day on The Big Picture and wanted to know more. Are stocks really moving less in tandem? Could there be another explanation for what is going on? Researching the numbers behind the chart may provide some interesting insights.

From: WSJ

As always the first steps is confirmation of the results. My data yielded nearly identical results which is always good especially since this is the WSJ.

Research Details

All the tests and data are from 1/1/2009 to 12/31/2010 using historical S&P500 constituent data.

S&P500 Index Daily Returns

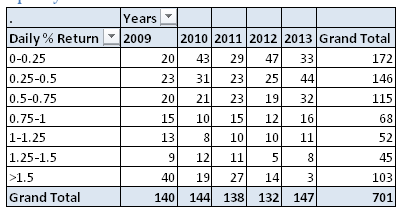

The first step is looking at the daily returns for the S&P500 Index and putting them into return buckets. Is the market having less frequent large moves in one direction?

Up Days

The first thing that pops out is the steady drop of up days greater than 1.5%. Only 3 such days last year. Wow! Moves between .75% and 1.5% have been steady over the last 5 years. We have seen an increase in the small daily moves between 0% and .75%.

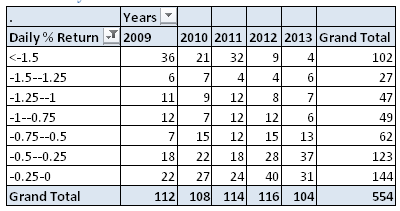

Down Days

Again we see the same general pattern. Large drop in the number of daily moves more than -1.5%. An increase in the amount moves between 0% and -.5%.

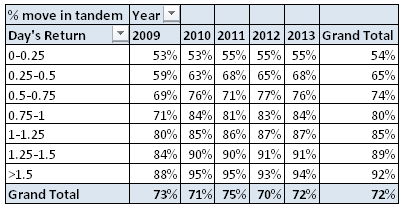

Tandem Up Moves

Now let us look at what percent of S&P500 stocks are moving up when the index moves up. Are we having less stocks moving in tandem?

Very interesting. For any row in this table, the number of stocks moving in tandem with the market has been very consistent over the years. Especially since 2010. I like that the data shows as the up day in the index is larger, the index has more stocks moving in tandem. A very consistent pattern.

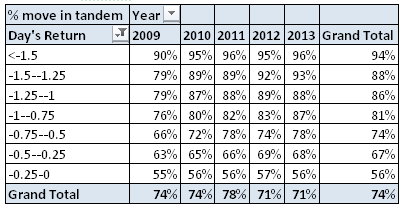

Tandem Down Moves

Again we see the same general pattern as up moves

Spreadsheet

If you’re interested in a spreadsheet of the data used to generate these tables, enter your information below, and I will send you a link to the spreadsheet.

Conclusion

The volatility in the markets has decreased dramatically over the last few years. It is not that stocks are not moving in tandem as much but the market is not having large moves as frequently. This seems like a chicken vs egg argument of which came first. What are your thoughts?

Backtesting platform used: AmiBroker. Data provider:Norgate Data (referral link)