Author Archives: Cesar Alvarez

- in Rotation , Stocks by Cesar Alvarez

Monthly S&P500 Stock Rotation Strategy

From the “Should You Buy the Best or Worst YTD Stocks” post, several readers made comments if one could make a monthly rotation system from this idea. From that post, buying either the strongest or weakest stocks out-performed the SPX with the weakest giving the best results. Will that be the case again?

- in ETFs , Rotation by Cesar Alvarez

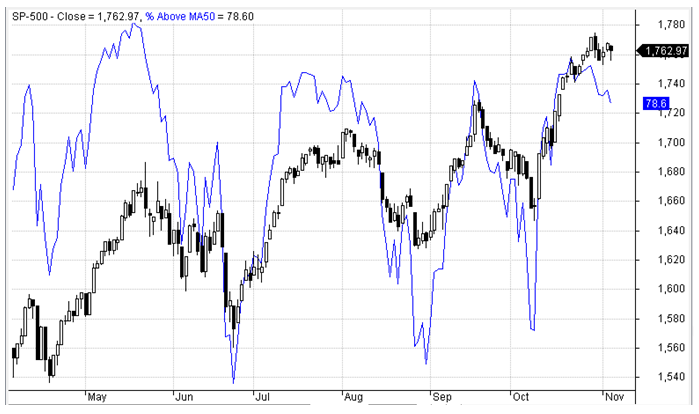

Percent S&P500 Stocks Trading Above MA50 as Market Timing Indicator

Does the percent of S&P500 stocks trading above their 50 day moving average predict future market returns? Over the last several weeks, I have seen several charts of the percent of S&P500 stocks trading above their 50 (or 200) day moving average overlaid on the S&P500. From these charts, it appears one could build a market timing indicator. The concept really looks like it has promise.

Chart from April to November 2013.

- in Research , Rotation , Stocks by Cesar Alvarez

Should You Buy the Best or Worst YTD Stocks

Is it better to buy the worst year-to-date performing stocks or the best year-to-date performing stocks for the month of December? Common wisdom would say stay away from the losers because those are the one that people are selling for tax reasons. Are fund managers buying the winners for window dressing?

- in ETFs , Mean Reversion by Cesar Alvarez

SPX Closes Above MA10 For 15 Days

As of Friday’s close, the SPX has closed above its 10 day moving average for 17 days. What does the market do when it finally closes below the MA10? Which S&P500 stocks do we want to focus on when it finally does?

- in Mean Reversion , Research , Stocks by Cesar Alvarez

Is mean reversion dead – reader suggested research

My article on “Is mean-reversion dead?” produced lots of suggestions from readers on other tests to try. We will jump right in and look at what these research suggestions produced.

- in Rotation , Stocks by Cesar Alvarez

My quest to find the best performing S&P 500 stocks after several up days

In the previous post “Which S&P500 stocks to focus on when the SPX has 5 higher closes,” we discovered which stocks (from the S&P 500) produced the best returns when the market closed higher five consecutive days . The results from that work, as often happens, suggested a deeper look; specifically, can those concepts be applied to S&P 500 stocks without having to wait for specific market conditions (e.g. five up days in the SPX)? If so, maybe this is the start of a viable, standalone trading strategy. As indicated, this post builds on the previous post, so please refer as needed.

- in ETFs , Rotation , Stocks by Cesar Alvarez

Which S&P500 stocks to focus on when the SPX has 5 higher closes

Rob Hanna had a good post recently; titled What the String of 5 Higher Closes Under These Circumstances is Suggesting . With mean reversion trading, you are expecting stock prices to snap back towards their mean, like a rubber band stretched too far. But, sometimes, that rubber band can be stretched so far that it breaks (and therefore, won’t snapback). For some time, I have been searching for how to tell when that rubber band is stretched so far that it is broken. Rob’s post had several key concepts that might help us to solve this puzzle and possibly even be the foundation of a stock strategy.

- in Mean Reversion , Research , Stocks by Cesar Alvarez

Is mean reversion dead?

My great friend and expert trader Steven Gabriel often pushes me to answer this question; and prove it. We, perhaps too fondly, remember the great mean reversion trading years of 2005, 2006, 2008, 2009, 2010. We discussed this topic often in 2011 and 2012. Steven Gabriel would often call me on days when in the past, we would both be making 5+% on a day that our stocks would be mean reverting, but now we would be making a mere 1%.

My theory is that mean reversion is in hibernation waiting to come back; or said another way, mean reversion is simply mean reverting. I think that when too many people trade mean reversion, the space gets crowded and we see fewer winning trades and smaller returns. However, this has always been conjecture never backed up with numbers. Are we really seeing fewer trades? Smaller returns? Time to do the research and see what the numbers tell us.

- in General by Cesar Alvarez

Dealing with Broken Arrows

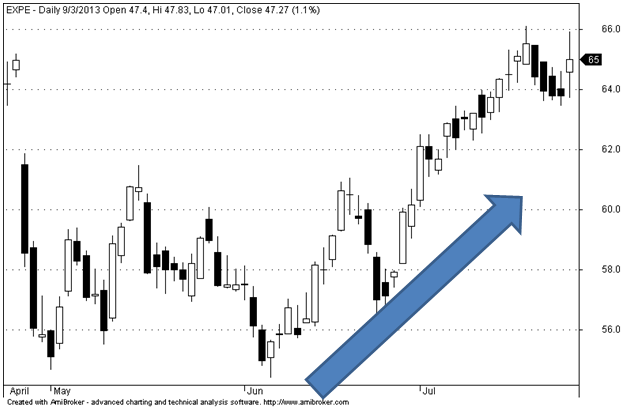

When I buy a stock, I know the edge is for the stock to go up. I know that does not mean every stock is a guaranteed winner. Or that my losses will be small. But every now and then you get what I call a broken arrow. I was in Expedia (EXPE) as it triggered in my SP500 rotation system. It was in a nice up trend, everything looking great.

And then …earnings happened.

- in General by Cesar Alvarez

Welcome

My Background

I have been interested in the stock market since 1990. I was fortunate enough to be trading in the late 90’s and got to enjoy those incredible years. Then came the 2000 bear. I tried my hand at day trading but soon discovered it did not fit my personality. It took a long time to realize that trading style must match personality. I turned to building strategies using quantitative methods. What I discovered was, the testing results from most trading methods didn’t hold up as expected. Soon after discovering this I was hired by Connors Research, and from there, my trading knowledge greatly expanded. Larry Connors taught me how to properly look at short term market behavior and how to find edges. I spent nine years looking deeper into indices, stocks, ETFs, futures and options.

Research Set up

I have used AmiBroker, since 2001, as my backtesting platform, into which I feed CSI Data’s stocks database, which includes delisted stocks. The data is adjusted for dividends and capital gains. The data contains the as traded price such that one can use price filters without having to worry about stock-splits. AmiBroker is a powerful platform at a reasonable price. I highly recommend it to anyone looking to get into backtesting. Microsoft Excel and MySQL are tools I use to analyze the output from AmiBroker.

Favorite Trading

Over the years I have traded stocks and ETFs, and options, both on the long side and short sides. My primary methods are reversion-to-the-mean and rotational. These strategies fit my personality and allow me to stick to the strategies even when things are not going well.

Holy Grail Strategy

Every researcher has a Holy Grail strategy they pursue. Mine is the breakout strategy. I would love to complement the reversion-to-the-mean strategies I trade.

Unexpected Results

The unexpected result is my favorite thing about research. I have added filters to a strategy that I just knew that it would make it better, and then it makes it worse. Or the reverse, when I thought it was crazy to try an idea because it would lose money and it makes money.

Idea Generation

My ideas for what to research often come from my trading. I will see some pattern or the market will do something that makes me curious. Another great source is my trading buddy (which all traders should have), Steven Gabriel. He is a wealth of ideas and always has more than I can test. Last but not least are other traders. Often they will say “did you trying testing XYZ?” And my response is “No, but that is a great idea. Let me test it and get the results to you.”

Postings

Most of my posts will be from research I am doing for my own personal trading. Trading ideas from my great friend and trading expert Steven Gabriel are often a wonderful source. Sometimes I will see something on another blog and want to take those results a step further, or apply them to a specific stock universe. Every now and then I will post results that did not work out. Maybe it will trigger new ideas to test and improve the results. Sometimes a simple tweak transforms a poor idea to a winning one. Understanding what does not work is every bit as important as knowing what does. And if my readers have good ideas, I can verify and validate them.