- in ETFs , Rotation by Cesar Alvarez

Country ETF Rotation

My recent research has been focused on finding strategies that are not highly correlated with the S&P500 index. One of my most popular posts is ETF Sector Rotation. The idea for this post is to apply those concepts to a list of country ETFs. Would this produce decent returns that were not highly correlated to the S&P500 index? I would like to see the correlation under .50. What about adding a filter to not enter an ETF when it is highly correlated with the S&P 500?

ETF Universe

We will be using this list of country ETFs.

- iShares MSCI Israel Capped (EIS)

- WisdomTree India Earnings (EPI)

- iShares MSCI Australia (EWA)

- iShares MSCI Canada (EWC)

- iShares MSCI Sweden Capped (EWD)

- iShares MSCI Germany (EWG)

- iShares MSCI Hong Kong (EWH)

- iShares MSCI Italy Capped (EWI)

- iShares MSCI Belgium Capped (EWK)

- iShares MSCI Switzerland Capped (EWL)

- iShares MSCI Malaysia (EWM)

- iShares MSCI Netherlands (EWN)

- iShares MSCI Austria Capped (EWO)

- iShares MSCI Spain Capped (EWP)

- iShares MSCI France (EWQ)

- iShares MSCI Taiwan Capped (EWT)

- iShares MSCI United Kingdom (EWU)

- iShares MSCI South Korea Capped (EWY)

- iShares MSCI Brazil Capped (EWZ)

- iShares China Large-Cap (FXI)

- VanEck Vectors Russia (RSX)

- iShares MSCI Thailand Capped (THD)

- iShares MSCI Turkey (TUR)

- iShares MSCI South Africa (EZA)

- iShares MSCI Mexico Capped (EWW)

- iShares MSCI Singapore Capped (EWS)

- iShares MSCI Japan (EWJ)

- iShares MSCI Chile Capped (ECH)

Testing will be from 1/1/2007 to 12/31/2016.

Simple Rotation Test

The first test is a simple momentum method.

Rotation Rules

- At the end of the month,

- Consider ETFs only with the 21 day moving average of Close * Volume over $5 million

- Rank the ETFs from high to low of their (6,12) month returns

- Buy the top (1,2) ETFs on the next open

The six and twelve month values were chosen because those are most often referenced in the research I have seen. The spreadsheet also contains 3 and 9 month rotation periods.

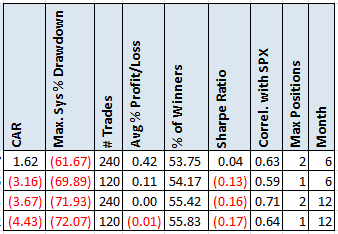

Results

Not a great start. I could not believe how bad the results were. The correlations are all above .50. On to the next idea.

Rotation with trend filter and backup ETF

Dual Momentum has the concept of when an ETF does not pass some filter, instead of investing in that ETF you invest in some alternative ETF. This ETF could be SHY (iShares 1-3 Year Treasury Bond) or IEF (7-10 Year Treasury Bond).

New Rotation Rules

- At the end of the month, rank the ETFs from high to low of their (6,12) month returns

- Buy the top (1,2) ETFs on the next open

- But if the top ranked ETF is below the their (6,12) month moving average, then instead of buying the ETF buy the alternative ETF(SHY,IEF)

In this example we are using 6 month return and IEF as the alternative ETF. If EWA and EWC are the two top ranked ETFs by 6 month return. Before buying them we check and see if they are trading above their 6 month moving average. Say that EWA is not, then instead of buying EWA we buy the alternative ETF, IEF.

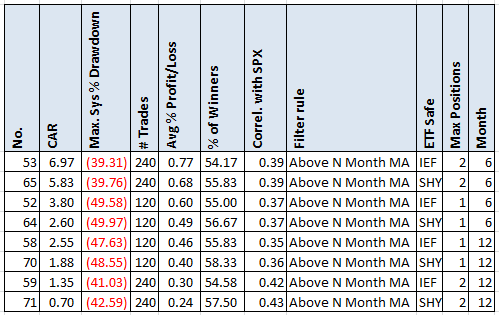

Results

The results have improved. Higher returns and lower drawdowns but still not very good. The correlation has dropped under .50. I would like to see the CAR over 10% and MDD under 30%.

Rotation with dual ranking, trend filter and backup ETF

Another concept with ETF rotation strategies is using more than one ranking. We rank the ETFs by two time periods, add the rankings and then rank again. Taking the top ranked.

New Rotation Rules

- At the end of the month,

- Rank1 = rank the ETFs from high to low of their (3,6,9,12) month returns

- Rank2 = rank the ETFs from high to low of their (3,6,9,12) month returns

- Rank3 = Rank1 + Rank2

- Rank rank3. In case of ties, use Rank1 as the tie break.

- Buy the top (2) ETFs on the next open

- But if the ETF is below the their (6,12) monthly moving average, then instead of buying the ETF buy the alternative ETF(IEF)

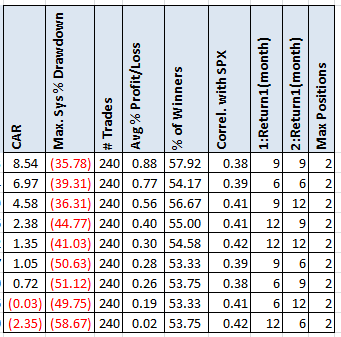

Results

A slight improvement but still not very good. The correlations are under .50.

Correlation Filter

For the last test, we will try adding a correlation filter. An ETF will not be considered if the 21 day correlation between it and the S&P500 index is over .75.

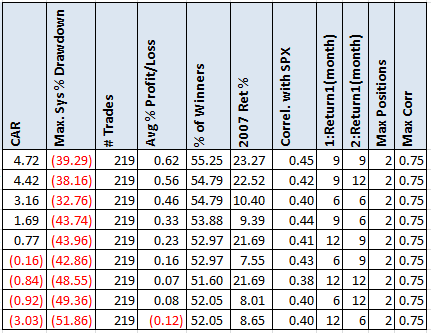

Correlation Results

Well this is surprising. The results got worse and the correlation with the SPX went up. That was a fail. I looked at a maximum correlation of .50 and the results are even worse which you can see in the spreadsheet.

Spreadsheet

File the form below to get the spreadsheet with lots of additional information. This includes yearly breakdown, (3,6,9,12) results, and much more.

Final Thoughts

This test did not come close to what I was hoping for. I am surprised on how poor the results were. Got any ideas?

Backtesting platform used: AmiBroker. Data provider:Norgate Data (referral link)

Edit 2/22/2017: See the results of reader’s suggestions at Country ETF Rotation – Reader’s Suggestions

Good quant trading,

Fill in for free spreadsheet:

![]()