- in ETFs , Mean Reversion by Cesar Alvarez

Developing Leveraged ETF Strategies

How should one develop a strategy for leveraged ETFs? Do you develop the strategy on the unleveraged ETF and then apply the rules to the leveraged ETF? Or do you develop the strategy on the leveraged ETF directly? Or do you develop the strategy on the unleveraged ETF then use signals on that to trade the leveraged ETF? On first blush one would think that all three methods would produce identical results. But as we know, the obvious is rarely the right thing for strategy development.

From a base strategy on the unleveraged ETF, we will compare the results of using those rules to trade the leverage ETF. The first instinct is that CAR and maximum drawdown would double. But are they?

The basic strategy

Testing dates are from 2007 to 2014. We start in 2007 because that is when our leverage ETF data starts. I spent five minutes developing these rules so don’t expect stellar results.

Buy rules

- RSI2 < 5

- Down two or more days

- Buy on the close

Sell Rules

- RSI2 > 50

- Sell on the close

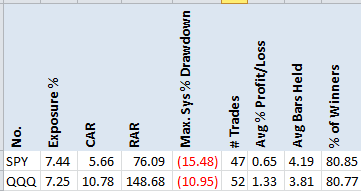

Results on SPY & QQQ

Not great results but what would happen if we apply these rules to the 2x leveraged ETF. The results could be good. Looking at the QQQ results one would think that the CAR would double to 21.6 with MDD to 22. But is that what happens when we trade QLD?

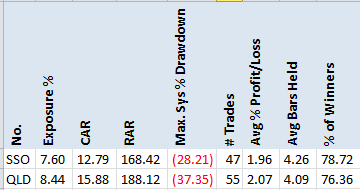

Results on SSO & QLD

Applying the rules to SSO has the CAR more than double and the MDD almost double. But when we look at QLD, the CAR only increases by 50% while the MDD increases by more than 150%. Clearly one cannot develop on the unleveraged ETF and then use those rules to trade the leveraged ETF. People sometimes do this because they want to test farther back in time and then double the results to get the expected stats of trading the leveraged ETF.

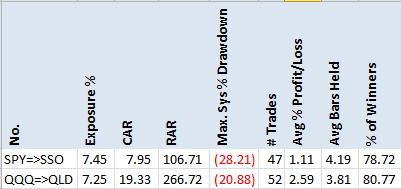

Using the base ETF to signal trades

A valid method pf developing a leveraged ETF strategy is to use the base ETF to give signals to when to trade the leveraged ETF. When we get a buy signal on the SPY, we trade SSO instead.

Now this is the case that people expect the results to double. As we can see the SPY-to-SSO CAR only increased by 40% while MDD increased 100%. While the QQQ-to-QLD results do nearly match the expected doubling. Why is this?

Why don’t we get 2x results?

Leveraged ETFs goal is to do 2x the daily return. What percent of time from 2007 to 2013 are the leveraged ETF daily return minus two times the unleveraged return was within .2%. If the SPY was up .5% then then leveraged ETF return needs to be between .98% and 1.02% to be considered within range. If the SPY was up 1%, then the range of SSO must be in between 1.98% and 2.02%

The SPY/SSO pair is within .02% 82% of the time. The worst example of mismatch is on 10/13/2008 when the SPY was up 14.5% but SSO was only up 22.4%. While the QQQ/QLD pair was within .02% 80% of the time. The worst mismatch happened on 9/30/2008 when the QQQ was up 2.9% while the QLD was up 10.4%.

These large errors tend to happen on large moves.

The other reason for not having 2x results has to do with math. It is the same concept of when you have a 10% positive return followed by a 10% negative return. You are not at breakeven but down 1%.

In the tables below are hypothetical daily returns and the results of 2x returns. One would expect that the ratio would be 2 but as one can see it is not. The bottom table shows as the daily returns get larger the discrepancy also grows. This is why using leveraged ETFs for long term holds can be dangerous.

Even if the leveraged ETF had perfect 2x daily returns, our trade returns and thus CAR, MDD and other stats would not be 2x.

Spreadsheet

Fill in the form below to get a spreadsheet with yearly breakdown of results, trade lists, and daily return comparison between unleveraged and leveraged ETF.

Final Thoughts

If you are developing a strategy using leveraged ETFs, either develop directly on the leveraged ETFs or use the unleveraged ETF to signal trades on the unleveraged ETF. As we saw above the same rules can lead to very different results.

Backtesting platform used: AmiBroker. Data provider:Norgate Data (referral link)

Good quant trading,

NOTE: I am a consultant in quantitative analysis using AmiBroker. If you research that could benefit from my skills, contact me.