- in Stocks , Trend Following by Cesar Alvarez

DTAYS Weekly Breakout Strategy

After my interview on ‘Don’t Talk About Your Stocks’, (site no longer exists)’ Andrew pointed me to a strategy he is trading called the DTAYS Quantitative Growth Fund. He was curious to see back tested results. Always looking for new ideas to write and tested, I jumped on it.

Unfortunately, the results will not be exactly as he trades it. Andrew uses the IBD50 as his trading universe. As is the bane to stock researchers, I do not have historical data on the IBD50. One could create some great models using that data. Instead, the test will be on the standard stock universe

Even though I am changing the universe, if the concept works on my general stock universe then it should work on the IBD50. One should be worried if it does not work on a general stock universe.

Rules

When I tested several parameters, I bolded, italicized and underlined the parameter that DTAYS uses. Testing timeframe 1/1/2004 to 12/31/2013. Maximum number of open positions (10, 20). When have multiple signals, they are ranked from highest NWEEK return to lowest.

Buy

- End of trading week

- NWEEK values of (10,20,30)

- Stock closes at a new NWEEK high of closes. (using weekly bars)

- The return for the last NWEEKs is greater than (20, 30, 40.) (using weekly bars)

- The 21 day moving average of Close*Volume is greater than $15 million. This is used instead of the IBD50. (using daily bars)

- SPY closes above its 100 day MA. (using dailybars)

Stops

Stops are evaluated at the close.

- Maximum loss stop of (8, 12)%. (using daily bars)

- Trailing ATR(100)*(3, 5) stop based on highest close since in position. (using daily bars)

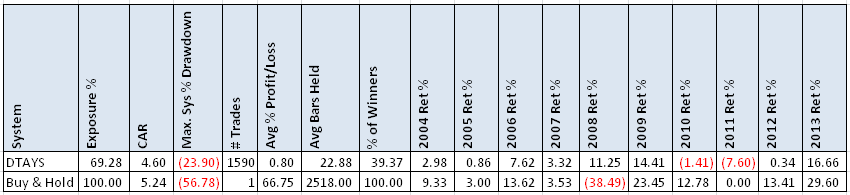

Base Results

The results are pleasantly surprising. For such a simple system, the base system almost matches Buy and Hold but with only 69% exposure. The surprise was a maximum drawdown of only 24%. Drawdowns are usually larger for longer term strategies. The main reason for matching buy and hold is the market timing filter but there appears to be potential here.

Variations

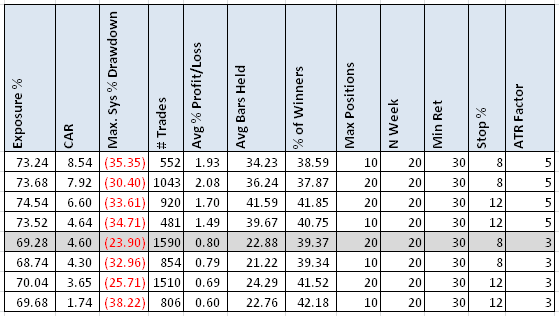

To improve the results, we focus on two things. One, larger position sizes because I find 20 positions too many. Two, larger stops because we want to give the stocks some breathing room.

This gives us some better numbers. So far, the rules have a small edge. The average hold is about 1 to 2 months for the variations.

Low Volatility

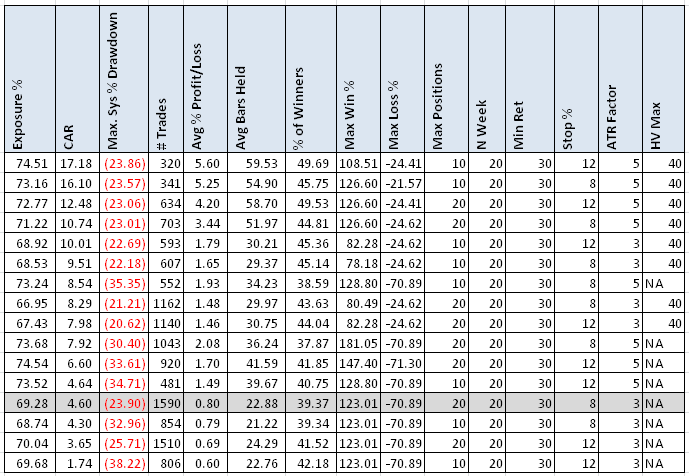

From my work with Connors Research and a research paper we produced, Historical Volatility: The Holy Grail Found? I know that one should focus on lower volatility stocks when having longer hold periods. We now add that the 100 day Historical Volatility is less than 40.

Now are we getting some good looking numbers from a simple breakout system.

Spreadsheet

If you’re interested in a spreadsheet of my testing results, enter your information below, and I will send you a link to the spreadsheet. The spreadsheet contains more variations tested along with yearly returns.

Final Thoughts

Once we added larger stops, the strategy has some promise and I would expect even better results using the IBD50 because IBD has applied their own fundamental and technical filters to them. Adding the rule HV100 < 40, starts making this a viable strategy.

I will be investing this more in future post. Definitely looking for suggestions on what to add to this to improve the results. Thank you Andrew Selby for sharing.

Backtesting platform used: AmiBroker. Data provider:Norgate Data (referral link)