- in Stocks , Trend Following by Cesar Alvarez

DTAYS Weekly Breakout Strategy With Time Stops

I recently read on Don’t Talk About your Stocks about an idea that stocks that were losers after (4, 6, 8) weeks should be sold to make way for other stocks that may do better. Will this idea improve the results from the original DTAYS Weekly Breakout Strategy? This reminded me of research I did while working for Larry Connors. On a mean reversion strategy we were researching, we noticed that after 10 days, 95% of the positions end up being losers. Then came the ‘obvious’ rule to add. Exit a position if it had not bounced after 10 days. We both thought this would greatly improve the results. It did the opposite and hurt them. Why? Because it was better to wait for the bounce even if the trade was a loser.

The DTAYS strategy is not a mean reversion strategy but a momentum strategy. How will exiting losing trades after X weeks work? Maybe the strategy is freeing up cash in non-performing trades to get into better trades. Time to see what the numbers tell us.

For this test I am making a slight change from the original test. I am testing on the Russell 3000 universe. Other than that the rules are the same as the original post.

Rules

When I tested several parameters, I bolded, italicized and underlined the parameter that DTAYS uses. Testing timeframe 1/1/2004 to 6/30/2014. Maximum number of open positions (10, 20). When have multiple signals, they are ranked from highest NWEEK return to lowest.

Buy

- End of trading week

- NWEEK values of (10,20,30)

- Stock closes at a new NWEEK high of closes

- The return for the last NWEEKs is greater than (20, 30, 40)

- The 21 day moving average of Close*Volume is greater than $15 million.

- Stock is member of the Russell 3000. This is a change from the original post rules.

- SPY closes above its 100 day MA

Stops

Stops are evaluated at the close.

- Maximum loss stop of (8, 12)%

- Trailing ATR(100)*(3, 5) stop based on highest close since in position

- If after (NA, 2, 4, 6, 8) weeks, exit the stock if it is under the entry price. This rule is only evaluated at the end of the week. This is our new rule.

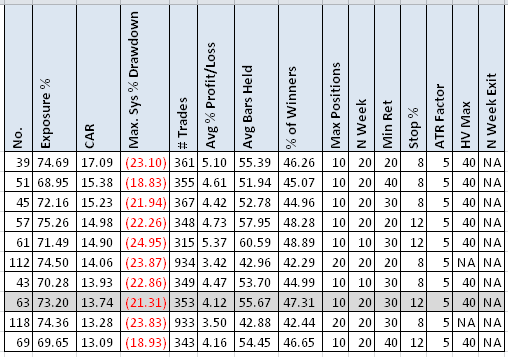

Results without the N Week stop rule

The highlighted row is the best variation from the original post.

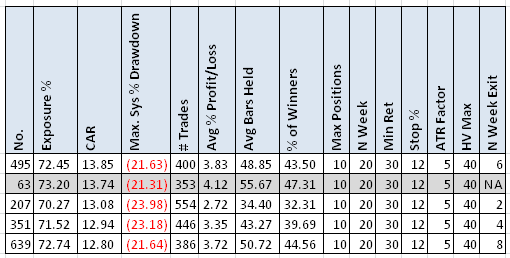

Results – With Stop – Using Original Best Parameters

The highlighted row is the base rules without the N week stop exit. The CAR and MDD are basically unchanged when we add the stop. The ‘% winners’ and the ‘Avg. % P/L’ drop dramatically. But the number of trades increases and this offsets the drop to keep the CAR about the same.

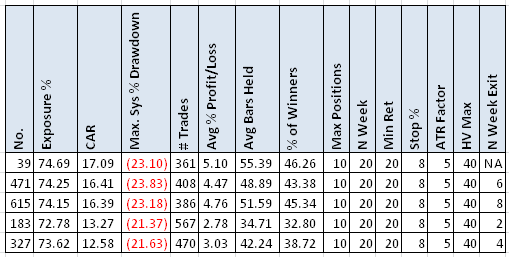

Results – Best variation of all runs

Here we see the CAR drop with some of the stops. MDD stays about the same. We see the same pattern with ‘# Trades,’ ‘Avg % P/L’ and ‘% of Winners.’

Spreadsheet

If you’re interested in a spreadsheet of my testing results, enter your information below, and I will send you a link to the spreadsheet. The spreadsheet contains more variations tested along with yearly returns.

Backtesting platform used: AmiBroker. Data provider:Norgate Data (referral link)

Final Thoughts

Even though the N week stop rule does not improve the CAR and MDD, one still may want to add this rule. Psychologically it is always good to get out of losers. Some people would prefer to have the more trades because it improves the chances of getting big winners.