- in ETFs , Rotation by Cesar Alvarez

ETF Sector Rotation

My recent research has been in ETFs which I have not explored in several years. ETF sector rotation has always intrigued me. The idea seems so simple that it should work. Always be in the sector that has been doing the best. I like simple but does it work? If not, can we make it work?

ETF Universe

For these test, we will using the Select Sector SPDR ETFs. They have a long history. The list is

- Consumer Discretionary (XLY)

- Consumer Staples (XLP)

- Energy (XLE)

- Financials (XLF)

- Health Care (XLV)

- Industrials (XLI)

- Materials (XLB)

- Technology (XLK)

- Utilities (XLU)

Testing will be from 2005 to 2014.

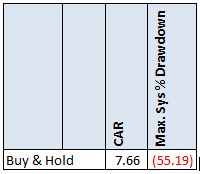

Baseline

Our baseline will be buy and hold on the SPY. My typical goal when trading ETFs is to beat CAGR of Buy & Hold by 50% but with significantly less drawdowns. Under 25% would be good and under 20% would be great.

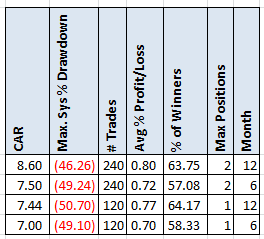

Simple Rotation Test

The first test is a simple momentum method.

Rotation Rules

- At the end of the month, rank the ETFs from high to low of their (6,12) month returns

- Buy the top (1,2) ETFs on the next open

The six and twelve month values were chosen because those are the ones that are most often referenced in the research I have seen. The spreadsheet contains 3 and 9 month rotation periods.

Results

Not a great start. The results match buy and hold but with a lot more trading. How can we improve on this? Something that I have learned about most rotation strategies is that there are times when even the top ranked ETF is not something that you want to be trading.

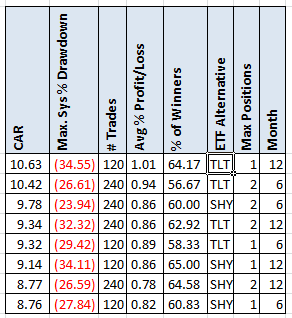

Rotation with trend filter and backup ETF

A very popular topic recently is Dual Momentum which has the concept of when an ETF does not pass some filter, instead of investing in that ETF you invest in some alternative ETF. This ETF could be SHY (iShares 1-3 Year Treasury Bond) or TLT (iShares 20+ Year Treasury Bond).

New Rotation Rules

- At the end of the month, rank the ETFs from high to low of their (6,12) month returns

- Buy the top (1,2) ETFs on the next open

- But if the top ranked ETF is below the their (6,12) month moving average, then instead of buying the ETF buy the alternative ETF(SHY,TLT)

In the following example we are using 6 month return and TLT as the alternative ETF. If XLE and XLF are the two top ranked ETFs by 6 month return. Before buying them we check and see if they are trading above their 6 month moving average. Say that XLE is not, then instead of buying XLE we buy the alternative ETF, of TLT.

Results

The results have improved but are still short of my targets.

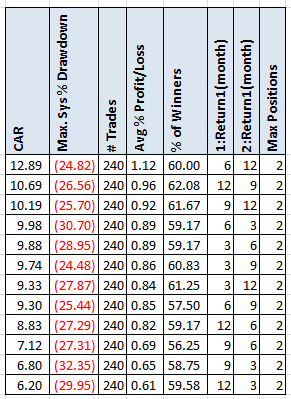

Rotation with dual ranking, trend filter and backup ETF

Another concept that I have seen with ETF rotation strategies is using more than one ranking. What we do is rank the ETFs by two time periods, add the rankings and then rank again. Taking the top ranked.

New Rotation Rules

- At the end of the month,

- Rank1 = rank the ETFs from high to low of their (3,6,9,12) month returns

- Rank2 = rank the ETFs from high to low of their (3,6,9,12) month returns

- Rank3 = Rank1 + Rank2

- Rank rank3. In case of ties, use Rank1 as the tie break.

- Buy the top (2) ETFs on the next open

- But if the ETF is below the their (6,12) monthly moving average, then instead of buying the ETF buy the alternative ETF(TLT)

Results

Now we are getting somewhere. Both CAR and MDD meet my goals but only barely so and only with one variation. Not shown here but you can see in the spreadsheet, is that the top variation made money every year.

Spreadsheet

File the form below to get the spreadsheet with lots of additional information. This includes yearly breakdown, (3,6,9,12) results, and (TLT,SHY) results.

Final Thoughts

I did not quite get the results I wanted but I am getting close. I will have to think about other ideas to try. I would like to find a sector rotation strategy that works. Got any ideas on what to try? Send them my way.

Backtesting platform used: AmiBroker. Data provider:Norgate Data (referral link)

Edit 1/25/2017: See this post on Country ETF Rotation based on the same concepts.

Good quant trading,

I am now off to enjoy my birthday. Good lunch followed by a long massage. Then getting beat up by my BJJ friends in class tonight. What a good day!

Fill in for free spreadsheet:

![]()