- in Research , Stocks by Cesar Alvarez

How to beat the market by throwing darts

During some recent research I noticed that picking random stocks in the SP500 produced returns much better than I would expect. This observation was recently echoed by another researcher that I know. Could one make a market beating system by basically randomly pick stocks?

The research that led to this observation was on market timing. Can having a good market timing rule, a profit target and stop loss be enough to randomly pick stocks and beat the market. The answer may surprise you.

Testing Parameters

Test date range is from 1/1/2004 to 12/31/2013. Entry an exit are done at the close. Maximum number of open positions is 10.

Market Timing Rules Tested

- Close is above 200 day moving average (MA200)

- The 252 day return greater than zero (ROC)

- Close is in the top 75% of the 252 day range of closes (Closing Range)

- The 3 month (63 day) HV of the SPX ix in the bottom 60% of the prior 252 (HV Range)

- The 50 day moving average is above the 200 day moving average (Golden Cross)

All the rules apply to the SPX. Random entries are allowed when the market timing rule is true. Positions are not exited when the market timing rule goes from true to false. The stock exits when one of the sell rules trigger.

Buy Rules

- Market Timing rule is true

- Randomly pick stocks from the S&P500 until reach 10 positions

Sell Rules

- 2% intraday profit target

- 10% intraday stop loss

These values were chosen off the top of my head. I did not try any other parameters.

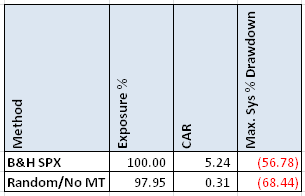

Base Results

For the base results we have two methods. One is buying and holding the S&P500 index. The other is randomly choosing stocks and using the exit rules. Now we have are targets to beat. Time to add some market timing rules and throw some darts.

Market Timing Results

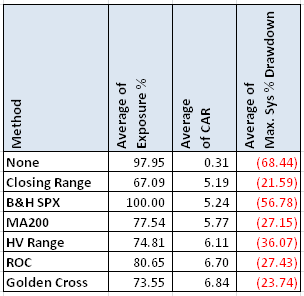

For each of the market timing methods, I ran a Monte Carlo simulation of 250 runs.

Several of the market timing rules beat Buy and Hold with significant reduction in the maximum drawdown. Over the years, my research has shown that market timing improves a system by being out in the bad times and this confirms it.

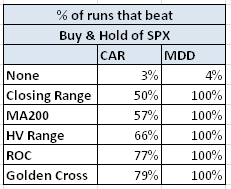

The next table shows the percent of runs that beat Buy and Hold’s CAR and Drawdown.

Here one can see that the Golden Cross and ROC market timing methods really shine by beating B&H CAR over 75% of the time while always having a lower drawdown.

Spreadsheet

If you’re interested in a spreadsheet of the data used to generate these tables, enter your information below, and I will send you a link to the spreadsheet. The spreadsheet includes yearly breakdown and minimum and maximum values for the Monte Carlo runs.

Conclusion

One can beat buy and hold using simple market timing method, basic exit rules and throwing darts. Would I trade this way? No. But this sets a bar for research. One could have easily picked a ranking method and came up with these market beating results. It would have seemed impressive until one realizes that the random method does just as well. Good luck on your dart throwing,

Backtesting platform used: AmiBroker. Data provider:Norgate Data (referral link)