- in Mean Reversion , Research , Stocks by Cesar Alvarez

Mean Reversion Entry: At Open vs. Intraday Pullback vs Confirmation

For the mean reversion strategies that I have created in the past and are trading now, they typically enter at the next day’s open or wait for a further pullback intraday before entering. My current mean reversion strategy, which enters on a limit down, was doing great until a few months ago when the performance started to slip. Looking at the missed trades and the trades taken, it seemed like the best trades would have been entering at open or waiting for some intraday confirmation.

Waiting for a pullback to take out the previous day’s high was very popular when I started trading. But my testing then showed that it was better to wait for a further intraday pullback to enter. Have the markets changed such that waiting for confirmation is better?

The Three Types of Entry

For a mean reversion setup, there are three popular ways to enter.

On the next open

After the setup, the strategy enters on the next open. The advantage of this entry method is that you know that you will get into the stock. The disadvantage is the potential for gap opens.

On intraday pullback

After the setup, the strategy places a limit order below the closing price. This typically is limit entry on x% below the close. Some like to use a multiple of ATR. The idea being waiting for further weakness before entering. This is the method I typically use. The advantage is that you get a better price. The disadvantages are that you may not get filled if the stock rebounds before getting to this price. Also, if the stock continues to downtrend, the strategy will get into the trade.

On confirmation

After the setup, the strategy places a stop entry order above the closing price. Typically, this is just above the high of the setup day. I like using an x% above the closing price because it gives flexibility on how quickly to enter. The advantage of entering on confirmation is that if the stock continues to fall, the strategy will likely not enter it. The disadvantages are you give up some profit entering higher. Also, the actual entry price can be substantially higher than the stop price if it is moving quickly up. Of course, you could add a limit price but then you may not get filled which then complicates backtesting even more.

The Entry on Open Strategy

Test dates 1/1/2007 to 6/30/2021.

I wanted a very simple mean reversion strategy to compare the entries. I did not care about how good the strategy was because I want to see how the entries would change the results.

Setup

- Stock is or was a member of the Russell 3000

- The original close is above $1

- The 20-day moving average of the Close times Volume is above $500,000

- The $SPX is above the 200-day moving average

- The stock is above the 200-day moving average

- The 2-period RSI is under [.5 to 5 steps .25]

- Rank stocks from high to low using 100-day historical volatility

Entry

- Maximum 10 positions

- Enter next day on open

Exit

- 2-period RSI greater than 70

- Exit on the next open

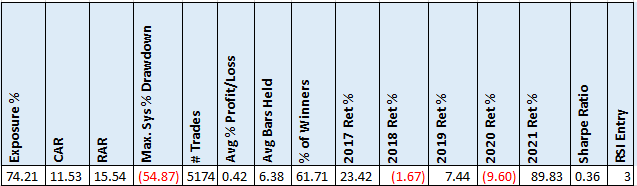

Results

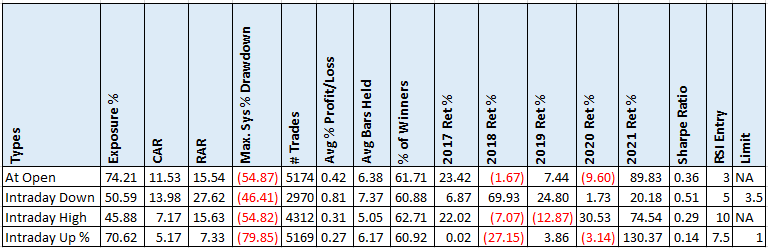

I will be comparing the best optimization result from each of the entry methods. Full results can be found in the spreadsheet.

Not great returns but something to compare against. I am showing only the last couple of year returns because that is what is of interest.

The Entry on Intraday Weakness Strategy

Change in Setup Rules

- The 2-period RSI is under [2.5 to 10 steps 2.5]

Change in Entry Rules

- Enter on limit order [1 to 4 steps .5]% below the close

- The number of orders to place is assuming all get filled will be 100% invested. No leverage.

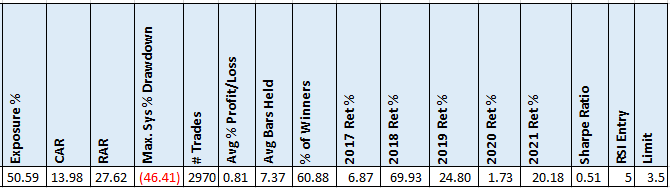

Results

The CAR improved by 21%, Exposure dropped 33%, MDD dropped and the avg % p/l doubled. All big improvements by using this entry method which has been my preferred method for years.

Looking over the last 5-year returns, we can see substantial differences. Notice the difference in 2021.

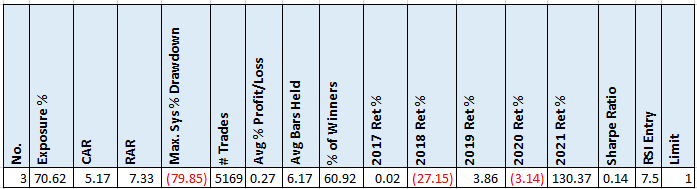

The Entry on % Confirmation Strategy

Change in Setup Rules

- The 2-period RSI is under [2.5 to 10 steps 2.5]

Change in Entry Rules

- Enter on stop order [1 to 4 steps .5]% above the close

- The number of orders to place is assuming all get filled will be 100% invested. No leverage.

This is the best result and it still sucks compared to entry on open. Except one detail did jump out at me. Look at 2021. This is showing that this year is different in that waiting for confirmation is what works best.

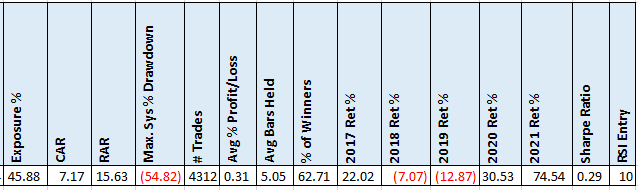

The Entry on High Confirmation Strategy

This is the more popular method of entry on confirmation.

Change in Setup Rules

- The 2-period RSI is under [2.5 to 10 steps 2.5]

Change in Entry Rules

- Enter on stop order at the high of the setup bar

- The number of orders to place is assuming all get filled will be 100% invested. No leverage

This helped the results some but still not as good as entering at the open. Though the 2021 results are not as good as the limit percent confirmation entry.

Spreadsheet

Fill in the form below to get the spreadsheet with lots of additional information. See the results of all variations from the optimization run. This includes top drawdowns, trade statistics, yearly returns and more.

Final Thoughts

This year is highlighting the issue that no one method always works. Most of the time entering on further intraday weakness is the best way. But this year, it clearly is not. And the method of waiting for confirmation which rarely works well is doing great this year.

One of my biggest issues with waiting for confirmation is that for your backtesting, it is unclear what your actual fill price will be. One needs to build in slippage for the entry price. Adding a limit simply complicates the issue.

Will I change my strategy which enters on a further intraday pullback to enter on the open or on confirmation? No. But I will keep an eye on things to see if this is something that may be a permanent change in the markets.

Backtesting platform used: AmiBroker. Data provider: Norgate Data (referral link)

Good quant trading,

Fill in for free spreadsheet:

![]()