- in Rotation , Stocks by Cesar Alvarez

Monthly S&P500 Stock Rotation Strategy

From the “Should You Buy the Best or Worst YTD Stocks” post, several readers made comments if one could make a monthly rotation system from this idea. From that post, buying either the strongest or weakest stocks out-performed the SPX with the weakest giving the best results. Will that be the case again?

Test Parameters

- From 1/1/2001 to 10/31/2013

- $.01/share for commission

- 3 month T-bill interest rate used for cash

Best N Month Rules

- It is the first trading day of the month

- Stock is a member of the S&P500

- Rank stocks from the highest to lowest by (6,12) month return

- Buy the top 20 ranked stocks at the close

- Optional market timing rule: SPX close > 200 day moving average of SPX closes on the entry day

- Hold until next month

Worst N Month Rules

- It is the first trading day of the month

- Stock is a member of the S&P500

- Rank stocks from the lowest to highest by (6,12) month return

- Buy the top 20 ranked stocks at the close

- Optional market timing rule: SPX close > 200 day moving average of SPX closes on the entry day

- Hold until next month

Results

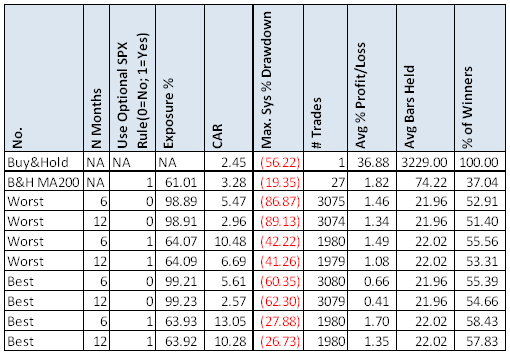

The concept has possibilities as a trading strategy. What jumps out is that both the worst and best variations outperform the Buy and Hold variations. The scary stat is the horrendous drawdowns. I can’t believe that one of the variations had an 89% drawdown but still outperforms Buy and Hold. Not a strategy I would trade but something that has lot more potential than I expected.

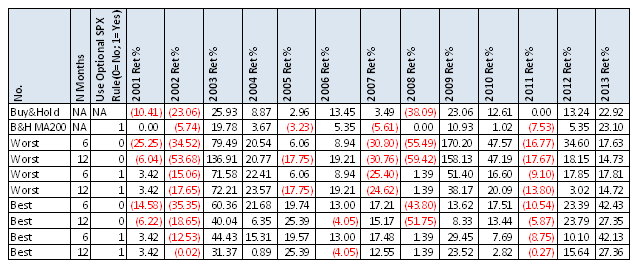

Looking at the yearly returns:

Some years it is better to buy weakness and some years, as this year is, it is better to buy strength.

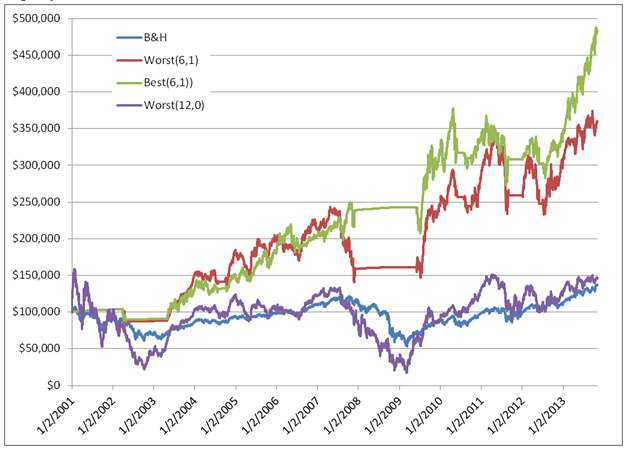

Equity Curves

- B&H = Buy & Hold

- Worst(6,1) = Worst 6 month return ranking. Using the market timing rule

- Best(6,1) = Best 6 month return ranking. Using the market timing rule

- Worst(12, 0 ) = Worst 12 month return ranking. No market timing rule

Spreadsheet

If you’re interested in a spreadsheet of my testing results, enter your information below, and I will send you a link to the spreadsheet. Along with the above results the spreadsheet includes buy the 10 & 50 stocks each month and look backs of 3 and 9 months.

Backtesting platform used: AmiBroker. Data provider:Norgate Data (referral link)