- in ETFs , Rotation by Cesar Alvarez

Mutual Fund Sector Rotation – Ideas from readers

The post ETF Sector Rotation generated good ideas on what to try differently. This post will research two ideas using Fidelity sector mutual funds. The previous post focused on two ideas on the Select Sector SPDR ETFs.

Mutual Fund Universe

These tests will use the Fidelity Sector Mutual Funds. The list was provided by a reader from the original post. The data is from Yahoo.com.

Mutual funds used are: FBIOX, FSHOX, FBMPX, FSCHX, FSRPX, FDLSX, FSCPX, FSPHX, FPHAX, FSAIX, FSCGX, FCYIX, FSRFX, FSDAX, FBSOX, FDFAX, FIUIX, FSCSX, FSDPX, FSVLX, FSHCX, FSPCX, FSAVX, FDCPX, FSTCX, FSUTX, FSPTX, FWLRX, FSRBX, FSENX, FNARX, FSFSX, FSELX, FIDSX, FFGCX, FSNGX, FSAGX, FSLEX, FSLBX, FSDCX, FSVLX, FSESX and FSDPX.

Testing is from 2005 to 3/31/2015.

Dual Momentum Baseline

From the original post, the dual momentum gave the best results which will be our baseline. For the rules go see that post at ETF Sector Rotation. Even though these test are on mutual funds, I still want to compare to our original best test.

Idea 1: Rank by multiple ROCs

The first idea submitted by multiple readers is to use multiple look back periods for Rate of Change. This test was also done on the ETFs.

Rules

- At the end of the month, rank the Funds by the average of the 3/6/9/12 month’s performance. Formula is (ROC 3 month + ROC 6 month + ROC 9 month + ROC 12 month)/4.

- Buy the top 3 Funds if the Fund average performance is greater than the average performance of the safe ETF (SHY, IEF, TLT)

- Buy at the close at beginning of the month.

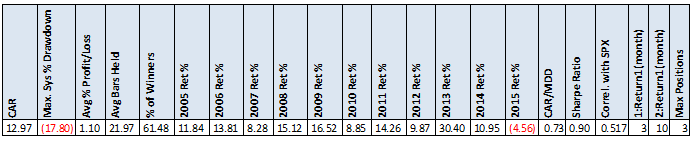

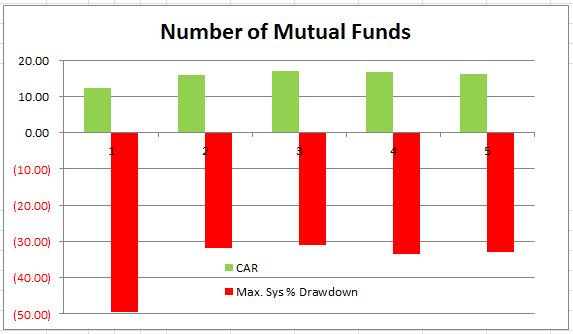

Results1

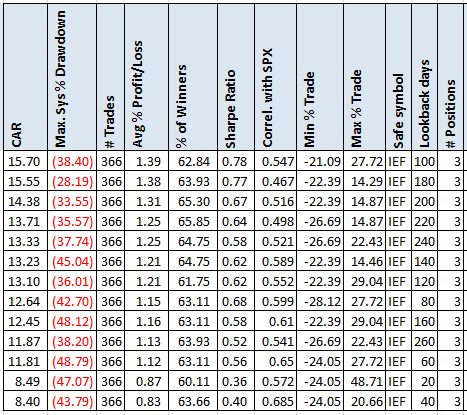

This idea has good annual returns but with a significant increase in MDD. What is interesting is that holding from two to five funds produces about the same numbers. Without looking at the trade lists, my guess is that the funds being entered are highly correlated. Looking at the yearly numbers it is 2008 and 2011 that have the bad returns and likely the drawdowns, which you can see in the spreadsheet.

Idea 2: Rank by N day return

A very simple idea of ranking by only one variable. Sometimes the simplest ideas produce the best results.

Rules

- Rank Funds from high to low using the N day return.

- If the return during this period does not exceed the safe ETF (IEF, SHY, TLT), invest in the safe ETF.

- Buy at the close at beginning of the month.

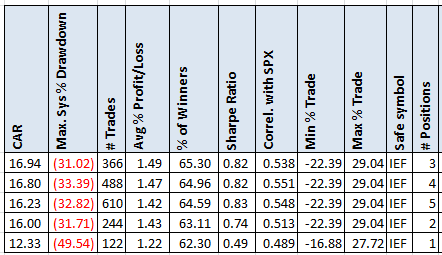

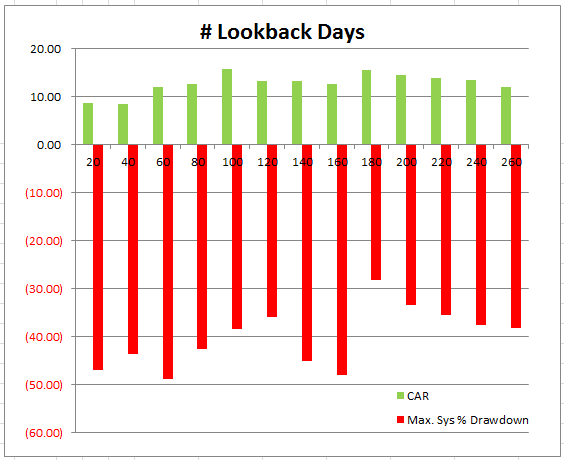

Results 2

A much simpler idea, but the results are not as good as the first one. CAR and MDD both get worse. The only pattern seems to be stay away from the short look back.

Spreadsheet

Fill the form below to get the spreadsheet with lots of additional information. This includes yearly breakdown, different maximum holdings, and additional statistics.

Final Thoughts

I don’t trade mutual funds but thought it would be interesting to do research on this topic using them because several readers’ comments on it. There is nothing here I would continue to research since I don’t trade mutual funds but maybe if you do trade them, this is a starting point to future research. Could a simple market timing filter help the numbers?

I am currently doing some research on a volatility ETF which may be the topic of the next post.

Good quant trading,

Fill in for free spreadsheet:

![]()