- in ETFs , Research by Cesar Alvarez

Re-balancing: Is it worth the time and effort?

David Weilmuenster is today’s guest author. David and I worked together at Connors Research for eight years and is one great researcher and AmiBroker programmer.

Brochures for professionally managed investments and academic white papers on long term investing almost always praise the benefits of regularly re-balancing a portfolio. The benefits can arise from the interaction, or correlation, of periodic returns among the constituent assets in a portfolio. As the correlations among constituent assets decrease, the long term returns of the overall portfolio generally will increase with regular re-balancing. This has become known as “the only free lunch in investing”, although it does not work out that way in all situations.

Let’s look at a couple of straightforward examples to illustrate some of the dynamics of re-balancing.

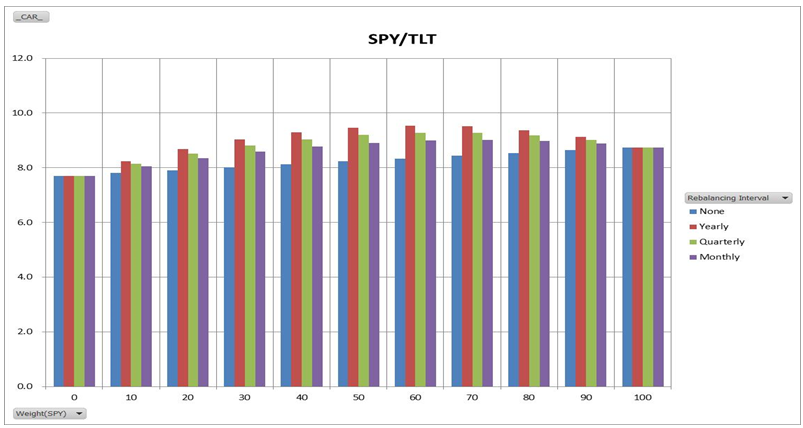

SPY/TLT

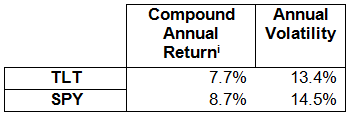

We’ll start with a portfolio consisting of two assets, SPY (SPDR S&P 500 ETF) to represent stocks, and TLT (iShares 20+ Year Treasury Bond ETF) to represent bonds. We’re not shooting for an ideal portfolio here, but one that with sufficient credibility to help us think about re-balancing. Here are some relevant statistics on the two ETFs from 2002-07-31 through 2014-12-31 (TLT was first available to trade on 2002-07-26):

The correlation of monthly returns for TLT and SPY during this history was -0.307. Given that the correlation is negative (i.e., low), we should observe the benefits described above in a regularly re-balanced portfolio of SPY and TLT. The following table shows the benefit for CAR[ii]:

The horizontal axis is the percent weight given to SPY in the portfolio. We can gain as much as 1% extra in Compound Annual Return if we re-balance yearly (at calendar year end), and somewhat less than that if we re-balance Quarterly or Monthly. Of course, the answer varies with the weight that we assign to SPY in the portfolio. An additional return of 1% per year can add significantly to equity over the long run.

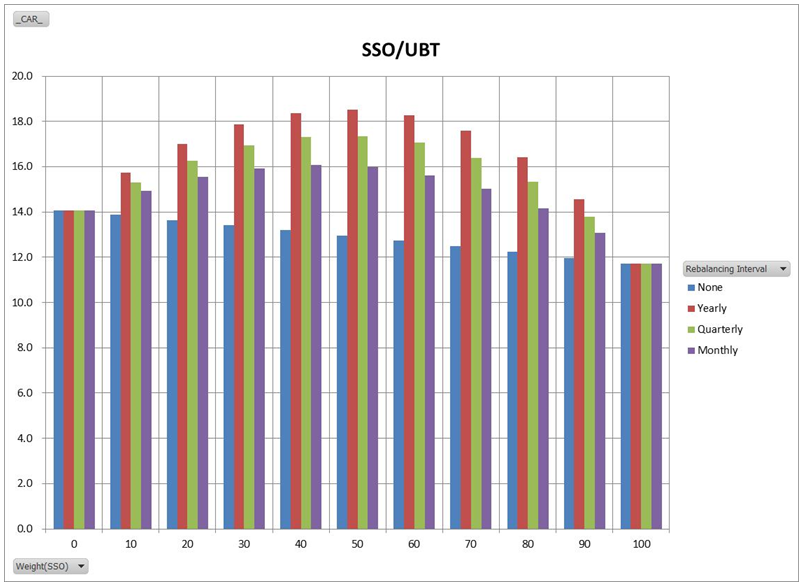

SSO/UBT

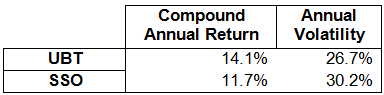

What if, instead, we trade the 2X Leveraged ETFs, SSO and UBT, that are based on the same underlying indices as SPY and TLT? Their statistics for the same time period[iii] are:

The correlation of their monthly returns was -0.330. In comparison to TLT/SPY, the individual annual volatilities are much higher, but the correlation of monthly returns is not much different.

Now the impact on CAR is considerably greater, as much as 3-5% in CAR depending on the weight assigned to SSO and the re-balancing periodicity. This is more pronounced than the effect on the TLT/SPY portfolio, even considering that the un-re-balanced “2X” portfolio has a higher CAR than for TLT/SPY.

This example illustrates that the effects of re-balancing are generally more significant when the assets being re-balanced are more volatile on their own.

What’s the catch? Of course, there are several:

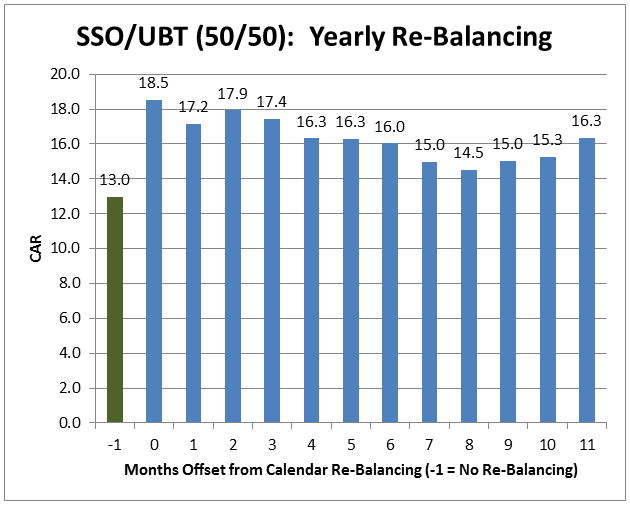

- What does “yearly” re-balancing mean in practical terms? Does the effect on CAR change substantially if we choose to re-balance at the end of every February, rather than every December? The following chart shows that timing can make a noticeable difference.

For example, re-balancing at the end of August (offset = 8) produces much less benefit to CAR for this portfolio than re-balancing at the end of December. The effect of timing is unique for every set of assets, so unfortunately, there is no general rule to guide us. And, quarterly re-balancing is subject to similar variability due to timing.

- Our results ignore tax effects from gains and losses realized when re-balancing. They could be relatively negligible, or significant. Again, there is no general rule to guide us, except perhaps to re-balance less frequently. Note that, in these examples, yearly re-balancing outperforms more frequent re-balancing either quarterly or monthly over the long run. So, a less aggressive re-balancing schedule could both reduce tax effects and generate higher CAR (before tax).

- Probably of least importance, we have not included transaction costs or slippage in this analysis.

Spreadsheet

Fill in the form below to get the spreadsheet with additional information: yearly returns, different weightings.

Backtesting platform used: AmiBroker. Data provider:Norgate Data (referral link)

Conclusions:

- In a perfect world, regular re-balancing of a portfolio almost always improves long term returns (CAR), but there are real world caveats to consider, i.e., the periodicity and timing of re-balancing, tax effects, and transaction costs.

- Even given the caveats regarding long term returns, regular re-balancing is probably worth the effort even if only to assure that no single asset, or small group of assets, grows to dominate a portfolio. I.e., regular re-balancing can be sound risk management, with the potential to increase returns through the effects that we’ve illustrated in this posting.

See the accompanying spreadsheet for other portfolio metrics, including annual returns, for the examples discussed here. They show, for example, that re-balancing does not generate higher returns in every year. Neither does annual re-balancing outperform monthly re-balancing in every year.

What are your thoughts on re-balancing?

David

[i] Includes dividends [ii] Re-balancing on the Close of each calendar period; no Commissions; no Tax Effects [iii] UBT and SSO began trading after 2002-07-31, so we created a “synthetic” version of each based on 2X the daily returns of TLT and SPY enable us to run the unleveraged and leveraged tests over the same timeframe.

Fill in for free spreadsheet:

![]()