- in Mean Reversion , Stocks by Cesar Alvarez

Simple Ideas for a Mean Reversion Strategy with Good Results – Part 2

The Simple Ideas for a Mean Reversion Strategy with Good Results post generated lots of comments and emails about other ideas to try. This post will cover three of the most interesting ones.

Rules

See the original post for rule details. Tested from 1/1/2004 to 6/30/2014

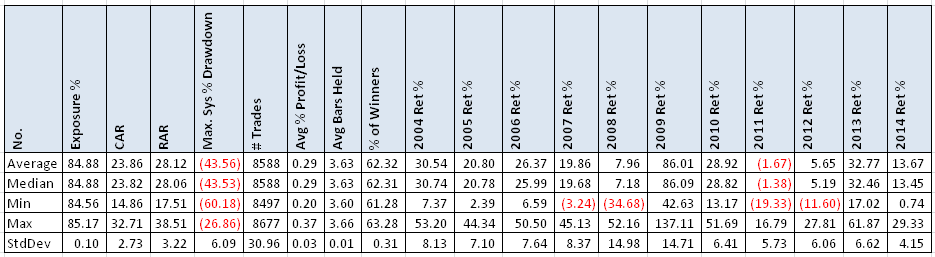

Idea 1 – Remove MA100 rule

Comparison is on Russell 1000 only. For S&P500, Russell 3000 and NDX100 see the spreadsheet. Take the original rules and remove the rule that the Close is greater than the 100 day moving average.

New Results

Original Results

For this time period, as expected the exposure went up but the CAR did not increase that much. The max drawdown increased dramatically. Definitely in the realm of very few people could handle. The year 2008 is still positive without the MA100 which is interesting. I expected that year to get crushed.

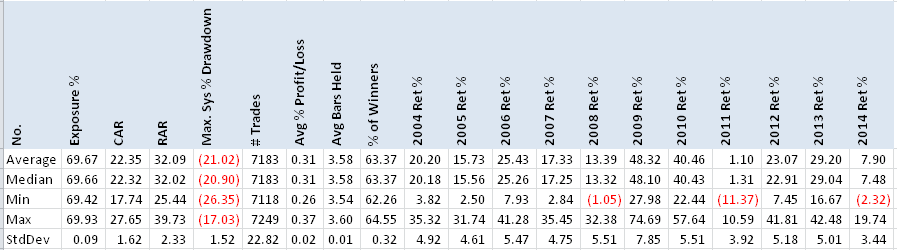

Idea 2 – Enter on open after setup day

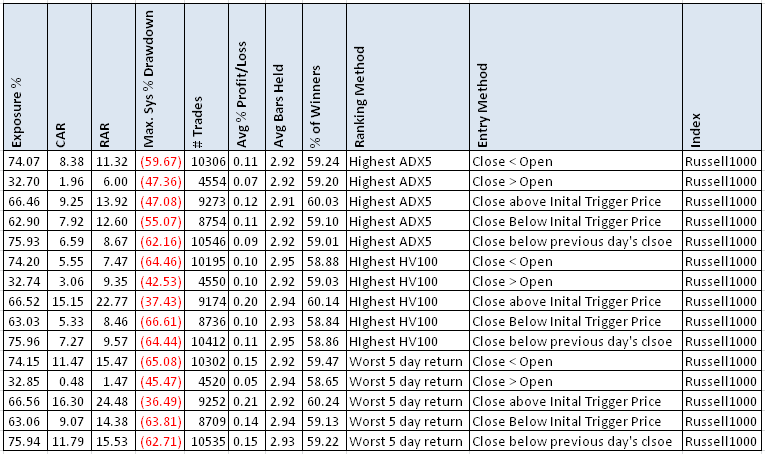

Starting with the initial rules we make the following changes. Instead of waiting for the stock to trigger at our limit price, we enter at the open. Three ranking methods were tested.

- Highest 100 day Historical Volatility

- Worst 5 day return

- Highest 5 period ADX

Not exactly the best of results but expected. In my book Short Term Trading Strategies That Work” we show how waiting for intraday pullback improves results.

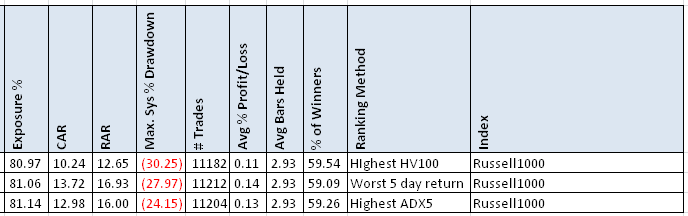

Idea 3 – Wait an extra day after setup day to enter

Starting with the initial rules we make the following changes.

- Two days ago was set up day

- Yesterday the stock’s low is below the limit entry price

- Today becomes the new setup day if the condition below is satisfied. Also today must be a down day because if it was an up day, the Sell rule would trigger

o Close below initial trigger price

o Close above initial trigger price

o Close below previous day’s close

o Close less than open

o Close above the open

- Then enter on the next day on the open. Use the same rankings as in Idea 2.

Nothing here. Waiting for the ‘trigger’ and then entering does not work. The average % p/l is low along with the exposure.

What is a little interesting is what happens if you take the above test and remove the MA100 rule.

Entering when the Close is above the initial trigger price produces OK results.

Spreadsheet

If you’re interested in a spreadsheet of the data used to generate these tables, enter your information below, and I will send you a link to the spreadsheet. The spreadsheet includes the full Monte Carlo run data. In the spreadsheet are details on how to obtain the AmiBroker code used for Idea 2 and Idea 3.

Final Thoughts

Even though nothing really came of these ideas, I am glad we tested them. One never knows what will work and what does not. I want to share good results and poor results with you. Someone might see something in the above tests I missed for yet another round of tests.

Backtesting platform used: AmiBroker. Data provider:Norgate Data (referral link)