- in Rotation , Stocks by Cesar Alvarez

S&P500 Monthly Rotation-Readers’ Ideas

The ‘Intermediate Term Stock Rotation Strategy Using S&P500 Stocks’ post generated lots of reader suggestions on what to investigate further.

The ideas we will investigate are:

- Monthly rotation (instead of quarterly)

- Using an additional filter to make sure the stock is healthy. These include

- Close above 200 day moving average

- Close above 50 day moving average

- 50 day moving average above 200 day moving average

- Stock return over look back period is positive

- In the last 10 days the stock has made a 1 month high

- In the last 10 days the stock has made a 3 month high

- Maximum loss stops

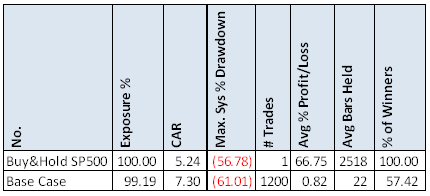

The Base Case

The test range will be from 1/1/2004 to 12/312013, giving us 10 years of data. The difference in the base case between monthly and quarterly rotation was little so I used monthly because it gives us more trades. The spreadsheet will contain results with quarterly rotation.

The Rules

- It is the rotation date, which is the first trading of the month

- Stock is a current member of the S&P500

- Rank stocks based current 9 month performance, from high to low

- Buy the top 10 stocks at the close

Base Results

The base case only gives slightly better results.

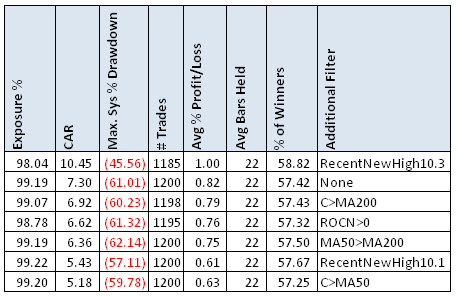

Additional Filters

Most filters hurt the results. Only one rule helped, requiring that the stock has mode a 3 month high in the last 10 days improved the results. Compounded growth rate went up 43% while maximum drawdown went down 25%. Do stops help this improved version?

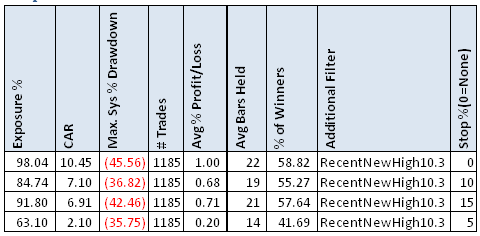

Stops

The stops are triggered intraday. The stop is set x% below the entry price and left there until the position is exited. Stops helped the maximum drawdown but at a significant decrease in CAR. Maybe end of day stops would do better? Trailing stops?

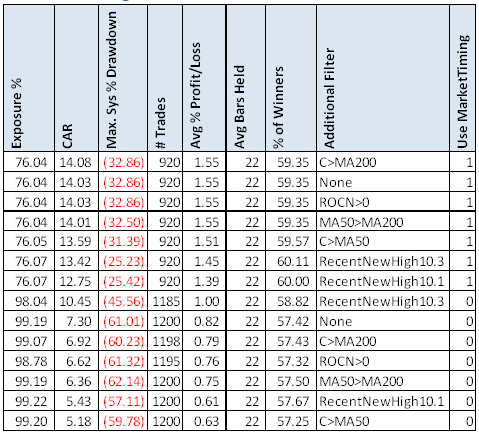

Market Timing

Adding that the SP500 closes above 200 day moving average, helps all variation results by increasing CAR and reducing MDD. A future post will be looking at other market timing indicators as this is an area that improves the results but currently is a very simple rule. Sometimes simple works best.

Spreadsheet

If you’re interested in a spreadsheet of my testing results, enter your information below, and I will send you a link to the spreadsheet. The spreadsheet contains more variations I tested along with yearly returns.

Backtesting platform used: AmiBroker. Data provider:Norgate Data (referral link)