- in ETFs , Mean Reversion by Cesar Alvarez

SPX Closes Above MA10 For 15 Days

As of Friday’s close, the SPX has closed above its 10 day moving average for 17 days. What does the market do when it finally closes below the MA10? Which S&P500 stocks do we want to focus on when it finally does?

SPX Test

From 1/1/2001 to 9/30/2013

Buy

- Yesterday: Close > MA10 for 15+ days

- Today: Close < MA10

- Entry at Close

Sell

- Five trading days later

- Exit at Close

The setup has occurred 29 times with an average profit/loss of .68%. What we can conclude from this, is that after a very strong market, the first pullback does not appear to be a sign of future weakness.

S&P500 Stocks Test

Next we want to know which S&P500 stocks to focus on. Searching for the best 10 stocks to focus on after a very strong market with a subsequent pullback, the test uses the rules below. Then, while keeping those rules constant (below), we try different stock ranking methods to see which “ranking method” would produce the best performing stocks.

Buy

- Yesterday: SPX: Close > MA10 for 15+ days

- Today: SPX: Close < MA10

- Stock is member of the S&P500

- Stock has been trading for 200 days

- Entry at Close

Sell

- Five trading days later

- Exit at Close

Results

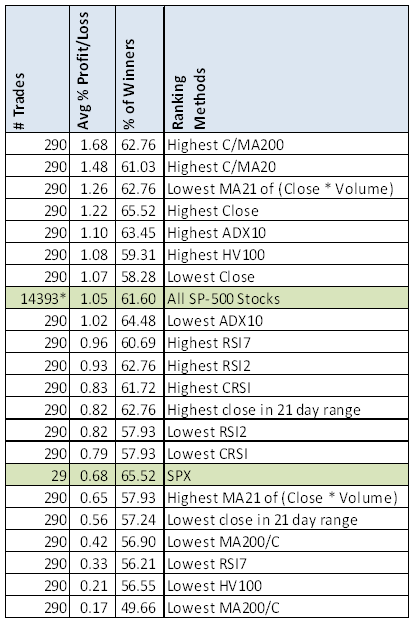

The table includes buying all 500 stocks on the signal days (“All SP-500 Stocks”). The results suggest that we want to focus on the stocks that are trading over the MA200 by the highest percentage. It appears, that another subset of stocks to focus on, are the stocks that have the lowest dollar volume (“Lowest MA21 of (Close*Volume)”). These results are something to think about when the SPX finally closes below its MA10.

Spreadsheet

If you’re interested in a spreadsheet of my testing results, enter your information below, and I will send you a link to the spreadsheet.

Backtesting platform used: AmiBroker. Data provider:Norgate Data (referral link)

*The reason there are not 14,500 trades is because the test requires 200 days of trading history and not all the stocks do when we have a signal day.