- in ETFs , Market Timing , Rotation by Cesar Alvarez

SPY, SSO and TLT Strategy

A reader sent a strategy to test which is a basic monthly rotation strategy between stocks and bonds. What caught my attention was the use of SSO, the 2x of S&P 500. The main idea being to use SSO when in a low volatility bull market.

Looking over the rules, I could tell this strategy was created before the recent bear market in bonds.

Initial Rules

At the close on the last trading day of the month:

- Is SPY greater than the 200-day moving average

- If not, then buy TLT.

- If yes, then is $VIX below 25

- If yes, then buy SSO.

- If not, then buy SPY

A simple strategy. Initial observations. Assumes it is always good to be in TLT during bear markets. The $VIX cut-off value seems too high.

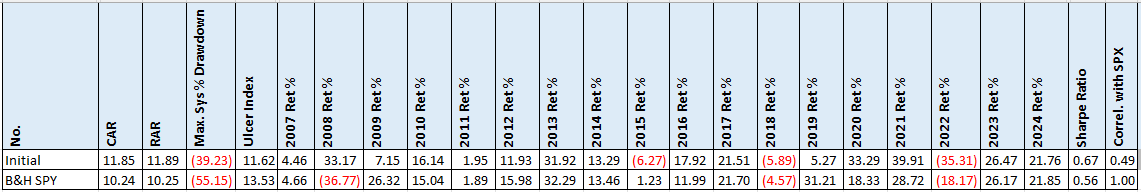

Initial Results

All testing was done from 1/1/2007 to 9/30/2024

Initial impressions are good. CAR is slightly better than Buy & Hold and drawdown is greatly reduced.

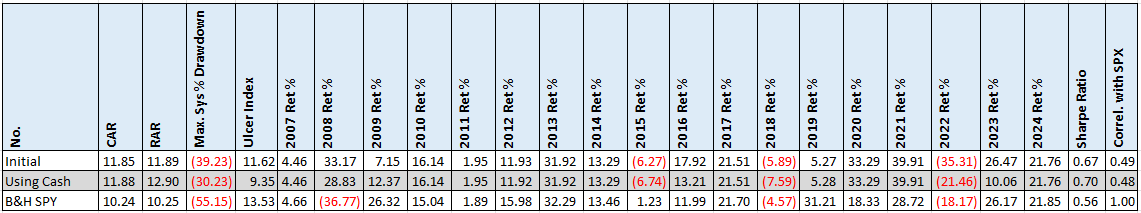

Adding TLT filter

The initial rules assume that if in bear market we should be in TLT. What if SPY and TLT are both in a bear market as in 2022? I will add one more rule.

- Is SPY greater than the 200-day moving average

- If no, then is TLT greater than the 200-day moving average

- If yes, then buy TLT

- If no, then stay 100% in cash

- If yes, then is $VIX below 25

- If yes, then buy SSO.

- If not, then buy SPY

For rule 2B, I could not decide between SHY and cash. In the downloadable spreadsheet, I show the results for SHY which are barely worse.

Doing this has a huge impact on MDD with only a slight change in CAR. Many people created strategies assuming if SPY was in a bear market, that TLT would be a good alternative. Myself included. 2022 fixed that illusion.

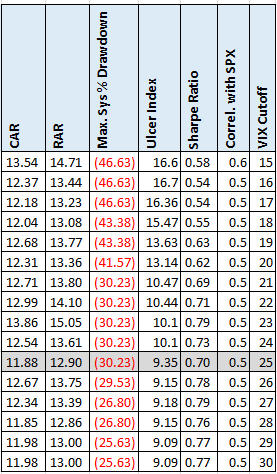

Different $VIX Values

The $VIX cut-off value of 25 seems high. A value of 20 seems better. Let’s see what other values produce. These results are using the cash rule.

Well that is not what I expected. Lower $VIX values gave higher returns with much higher drawdowns. While higher $VIX values gave about the same returns with lower drawdowns. Thinking about this, I realized the obvious that the lower values got us into SSO which is more volatile.

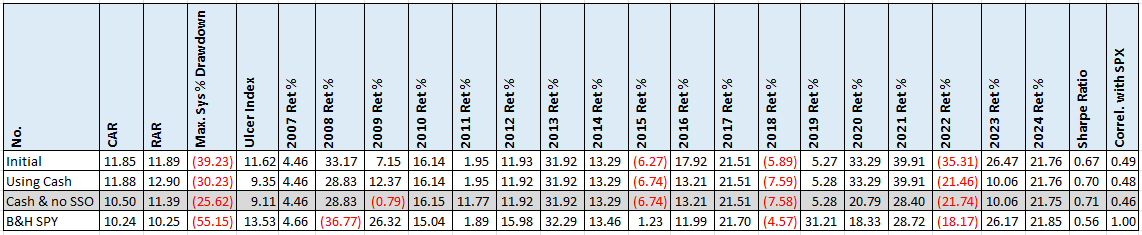

No SSO

What if SSO is removed from the strategy? New rules are

- Is SPY greater than the 200-day moving average

- If no, then is TLT greater than the 200-day moving average

- If yes, then buy TLT

- If no, then stay 100% in cash

- If yes, then buy SPY

Sometimes, simple is better. CAR comes down by about 1 point but MDD drops by almost 5.

Spreadsheet

Fill in the form below to get the spreadsheet with lots of additional information. See the results of all variations from the optimization run. This includes top drawdowns, trade statistics and more.

Final Thoughts

I was intrigued by the SSO rule. It made sense. And the initial results were encouraging. As strategy builders, we usually add rules to make them better. I added the cash rule and the results improved. I looked for a better $VIX value. It is easy to forget the step of removing rules. Removing the SSO rule shows that it was mostly adding volatility. Yes, if you lowered the $VIX threshold you got a nice bump in CAR but at the expense of MDD. Is it worth it?

Backtesting platform used: AmiBroker. Data provider: Norgate Data (referral link)

Good quant trading,

Fill in for the free spreadsheet:

![]()