- in Mean Reversion , Stocks by Cesar Alvarez

Stop Losses and Profit Targets. Plus Happy Birthday Excel!

In the post, Maximum Loss Stops: Do you really need them?, we looked at how maximum loss stops changed the results of a mean reversion strategy. At the end of the post I asked the readers to vote for what to try next. Let us see how these are ideas turn out.

The rules from the original post

Setup

- Close greater than 100-day moving average

- Close less than the 5-day moving average

- 3 lower lows

- Member of the Russell 1000

- 21-day moving average of dollar-volume greater than $10 million

- Price as trade greater than 1

Buy

- Rank stocks from high to low using 100 day Historical Volatility

- Place orders for the top ranked stocks such that if they all get filled will be 100% invested. This means orders will often not get filled even though lower ranked stocks may have

- Set a limit buy order for the next day if price falls another .5 times 10-day average true range.

Sell

- Close is greater than the previous day’s close

- Sell on the next open

Misc.

- Maximum of 15 positions [Corrected on 10/7/2015 ]

- 6.7% allocation per position [Corrected on 10/7/2015 ]

- No margin is used

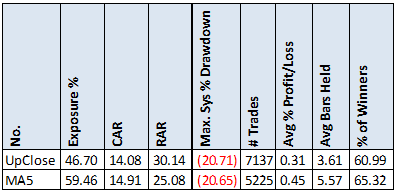

Change exit to use MA5 – No Stops

The winning idea was changing the exit from an up close to a close above the 5 day moving average. First we need to see how the results change without stops.

Changing the exit has minimal impact on CAR and MDD, which surprised me. The exposure and avg %p/l increase significantly. An interesting trade off.

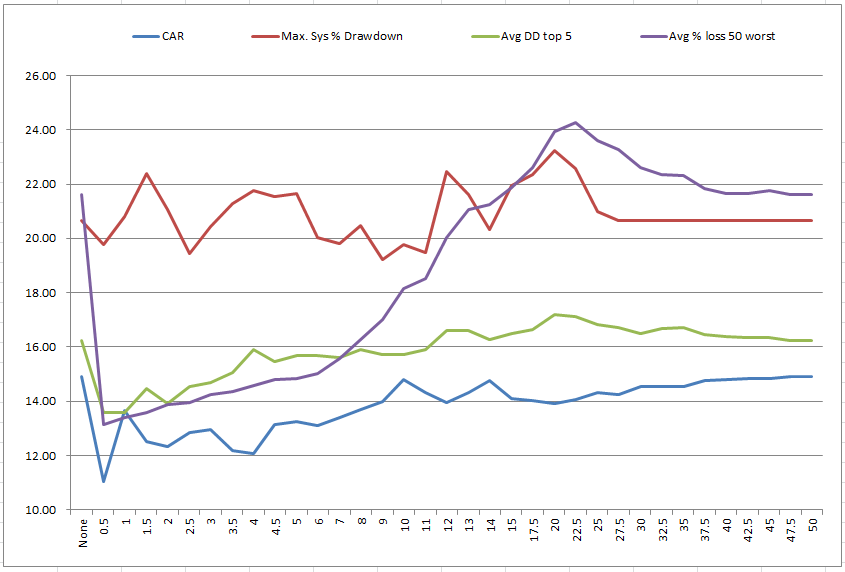

Percentage Maximum Loss Stop

Given the small change in the statistics, I would not expect much change from the Up Close exit in maximum stop loss helping. The stop is evaluated at the close and exited the next day at the open.

Adding a percent maximum stop loss does not really improve your maximum drawdown but hurts your compounded returns. What is interesting the average loss of the 50 worst trades comes down significantly for small percentage stops. Your top 5 drawdowns also improve for small stops.

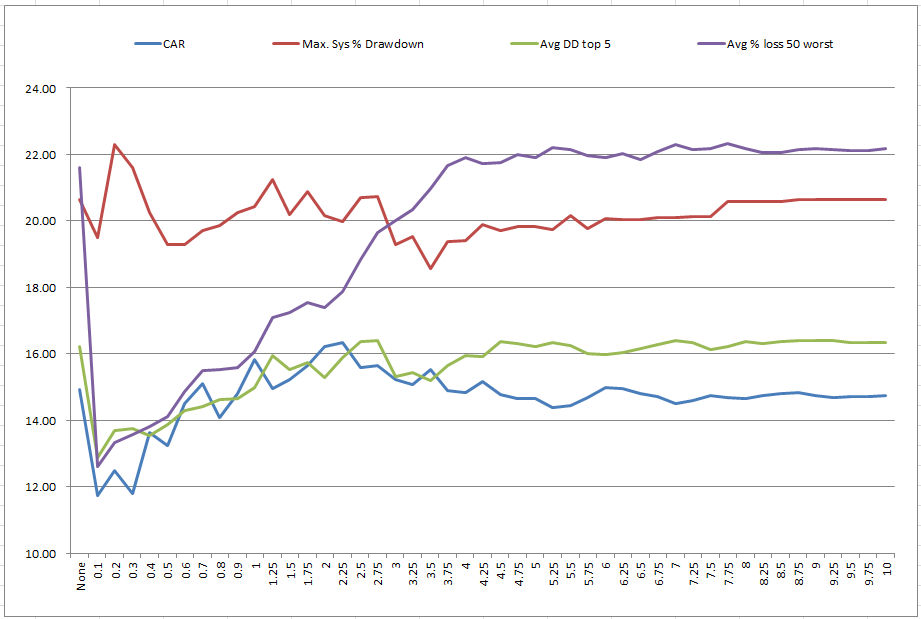

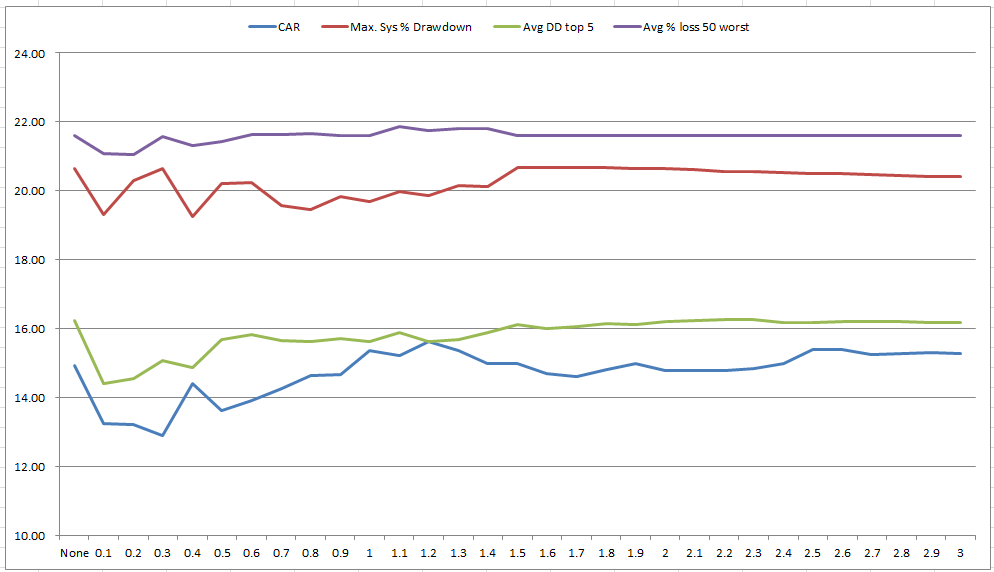

ATR Maximum Stop Loss

Next we look at using a factor of the 10 period ATR. The stop is evaluated at the close and exited the next day at the open.

Again we see the same general results. Adding the ATR max loss hurts with CAR or MDD. Again we see big improvements in the worst 50 trades and worst 5 drawdowns. I like the ATR factor between 1 and 2 they seem to strike a good balance.

Profit Targets

The second most voted on research idea was profit targets. Unfortunately I was not clear on how to add these. I tested intraday based targets. If you voted for this and you had something else in mind, comment below on what you wanted tested. Because these are intraday targets and I do not have intraday data, we cannot exit on our entry day.

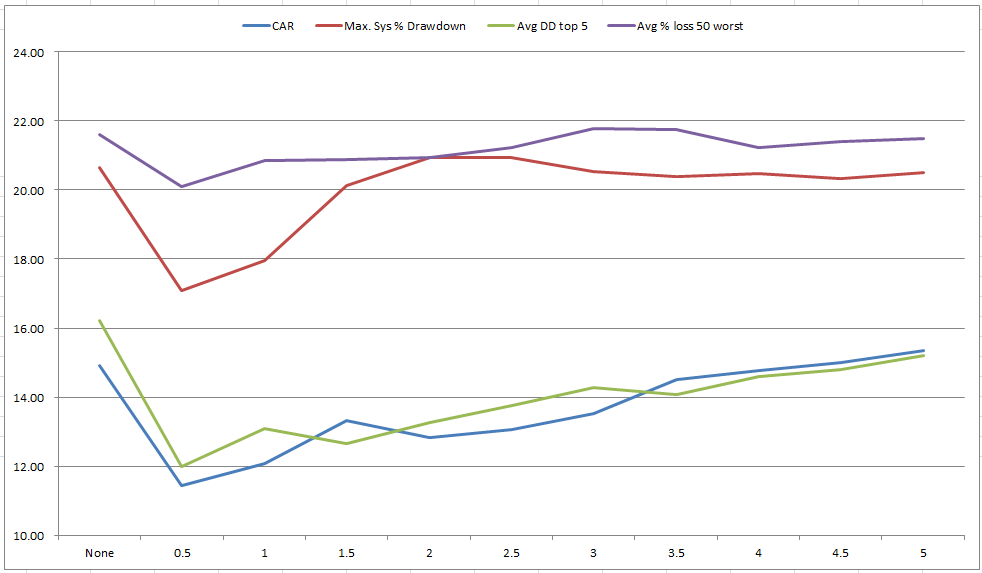

Percent Profit Target

Now we add an intraday profit target with no maximum stop loss but with the 5 day moving average.

For small percentage stop we see a large reduction in MDD, top 5 MDD and worst trades. Is it worth the reduction in CAR? Good question?

No stop + ATR Profit

Using Factor*ATR10 as our intraday profit target does not produce as good results as using the percent. Not what I expected.

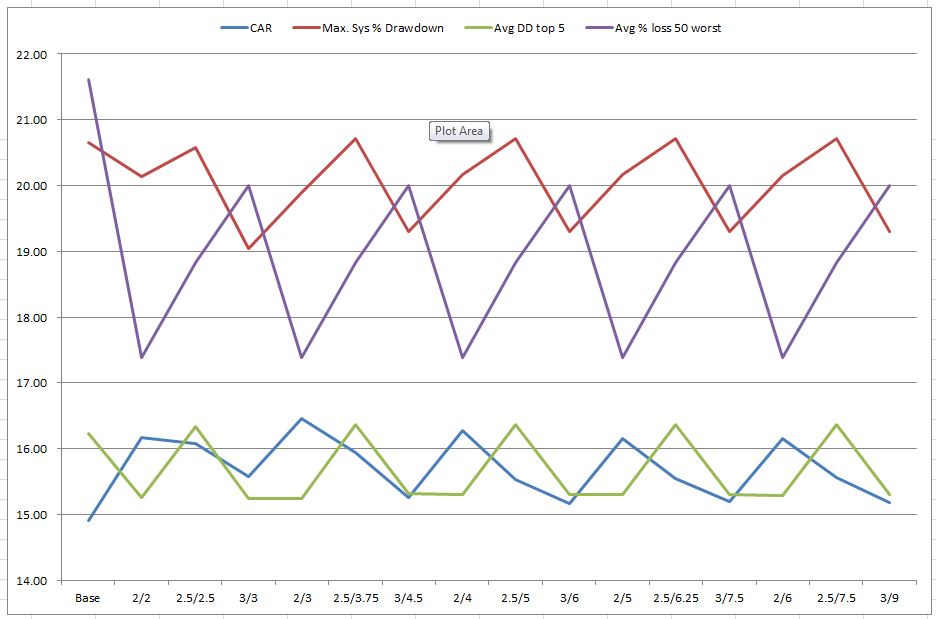

ATR Max Loss + ATR Profit Target

Now combing the two we get.

This chart is harder to read but we can overall improvement in all stats. The best results occur using a a two times ATR10 maximum stop loss and a three times ATR10 profit target. This gives us a 16.46 CAR which is 33% better than the base with slight decrease in drawdowns. The avg of the worst 50 trades decreases by 20%. It is rare to see that combination happening.

Spreadsheet

Fill the form below to get the spreadsheet with lots of additional information. This includes yearly breakdown, top 5 drawdown, more variations.

Happy Birthday Excel!

September 30, 1985 Excel 1.0 was launched on the Mac. Last weekend I attended a reunion with former and current people who worked on Excel. It was great to see old friends from the Excel 3, 4, 5 timeframe that I was there. Heard good stories about the shipping of Excel 1.0. Excel is my favorite program that I use every day.

This is most of the development team in their Excel ship leather jackets. That is me in the front row holding an Excel 3.0 box. I have eight unopened boxes of various versions of Excel from back then. My favorite being the Japanese version of Excel 4.0 in which I added candle stick charts for them. I guess that one the first hints of my future stock market work.

What is on the back on the jackets?

Our slogan at the time “Recalc or Die.”

Final Thoughts

I want to be clear that I am not saying one should trade mean reversion without stops. One must understand what stops add or don’t add to your strategy. I was surprised with some and will have to try the ATR max loss and ATR profit target on some of my own strategies to see how that changes the results. Remember test everything.

Backtesting platform used: AmiBroker. Data provider:Norgate Data (referral link)

Good Quant Trading,

Fill in for free spreadsheet:

![]()