- in Mean Reversion , Research , Stocks by Cesar Alvarez

The Health of Stock Mean Reversion: Reader’s Ideas

My previous post The Health of Stock Mean Reversion: Dead, Dying or Doing Just Fine generated good reader’s suggestions on other ways to check on mean reversion health. Let us see what these tests tell us.

The Base Test

Date Range: 1/1/1995 to 6/30/2015.

Entry:

- Stock is part of the Russell 1000

- Close > $1

- RSI(2) < 5

- Entry on Close

Exit:

- RSI2 > 70

- Exit on Close

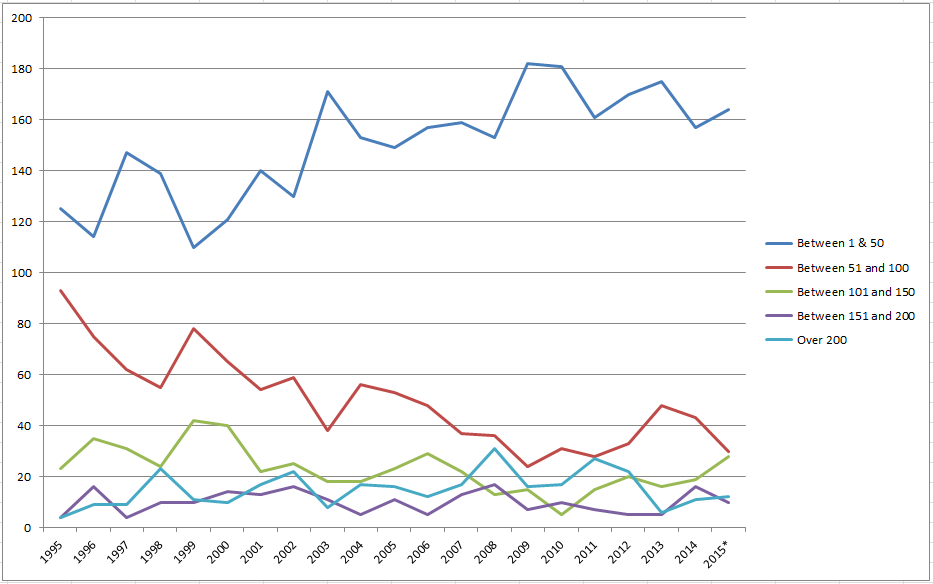

Bunching of Oversold Opportunities

This idea is that even though the number of stocks selling of each years is about the same, they are occurring more on the same day as opposed to spread out throughout the year.

For each year, I counted the number of days with stocks that had entry signals within a range.

Note: I double the value for 2015 since it was only a half a year of data.

The top blue line represents how many trading days each year there were between 1 and 50 entry signals. This line is up. The red line which is the number of days between 51 and 100 signals is clearly down. All the other lines are trendless. One way to read this is that we are getting a little more bunching. What are your thoughts? Put them in the comments below.

Mean Reversion is Correlating with the Market

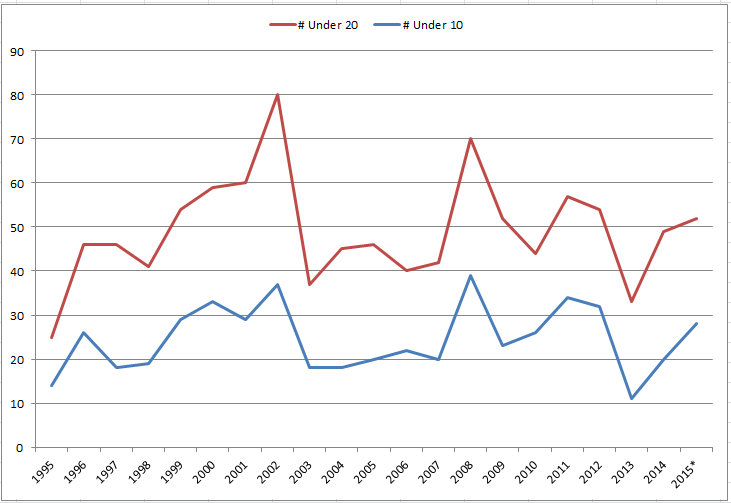

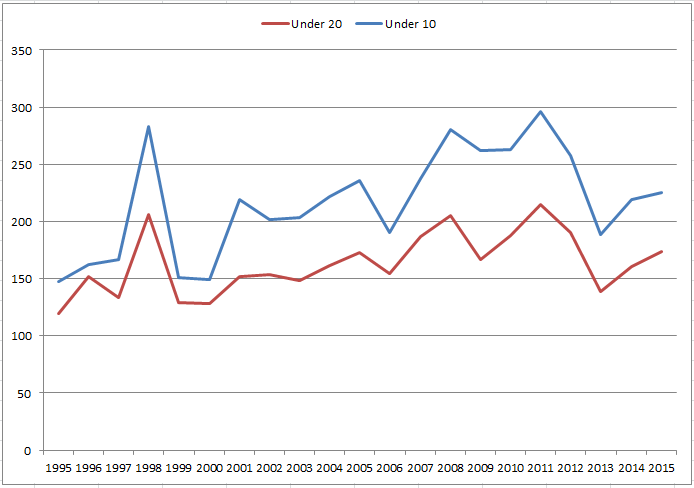

Are we getting more trades on the days that the market sells off?

First let us look at if the market, the SPY for this example, is selling off more or less. Are we seeing more days with RSI2 less than 10 or 20?

Note: I double the value for 2015 since it was only a half a year of data.

The trend has been flat. Then let us see how many setups we are getting on these days that the SPY is sold off.

Here we see a slight trend up. It appears that mean reversion is bunching up very slightly from this chart but it could just be noise.

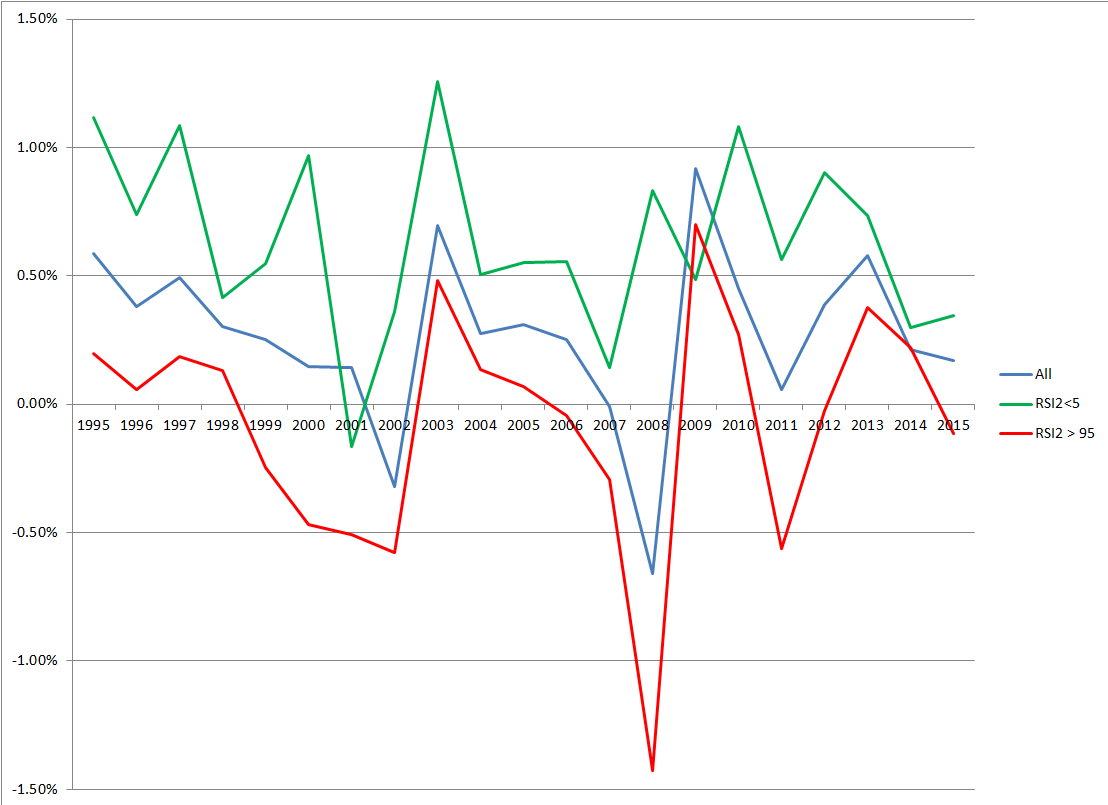

Five Day Hold – All vs RSI2<5 vs RSI2>95

Another idea was how have the returns for RSI2 < 5 compare to the average of all stocks. Along with how did this compare to if you change RSI2<5 to RSI2>95. To do this comparison, I change the exit to a 5 day hold.

If mean reversion is working on both the long and short side, one would be expect the order of the lines from top to bottom to be green, blue and red. In most years this is the case. From this point of view mean reversion is OK.

Spreadsheet

Fill the form below to get the spreadsheet with the yearly numbers used to generate this data.

Final Thoughts

These were good tests to run but none gave any solid proof that mean reversion is dying. Have the edges shrunk yes. Are they to where it is not worth trading, not in my opinion.

Tell Me

Tell me in the comments how you read these charts and the health of mean reversion.

Backtesting platform used: AmiBroker. Data provider:Norgate Data (referral link)

Good quant trading,

Fill in for free spreadsheet:

![]()