- in Mean Reversion , Research by Cesar Alvarez

The importance of testing different exits

When developing a strategy, exits are often not given a second thought. If you are creating a mean reversion, you may default to using Close greater than the 2-period RSI. If you are trading a trend strategy, you may default to trailing exit using 14-day ATR. You try a bunch of entry filters but rarely try a different exit. Or maybe a slight change in the exit.

If you are having success, with your strategy. You think great and don’t change the exit. If you are not getting anywhere, you think the idea did not work and stop testing.

A slight change in your exit can have a huge impact on the results as was driven into me during some recent research. I am guilty of not be as thorough in my testing of exits as I should be. Hopefully, this will convince you to look at them more at the beginning of your research.

The Strategy

I was talking with a fellow researcher about a mean reversion strategy I created a while ago. How it was a simple strategy but did well then. We were wondering how it held up recently. We did not remember the rules exactly.

A typical mean reversion strategy:

- Stock above the 200-day moving average

- A severe sell off. We did not remember the specifics.

- Get in the next day at the open

- Sell when the stock bounces. We could not remember this rule.

In the next post, I will reveal the exact rules. But not in this post because there are huge caveats before one should trade this strategy. Edit on 8/24/2020. The fellow researcher no longer wanted to share this strategy. Since he was the one that brought this idea back to me, I will follow his wishes and not share it.

Given we could not remember the exit, I was forced to test several common exits I used back then.

Testing dates are from 1/1/2007 to 12/31/2019. Why did I not include 2020? They skewed the results too much. As you will see in the next post.

The Exits

These are the exits I tested.

- 2-period RSI greater than 30

- 2-period RSI greater than 50

- 2-period RSI greater than 70

- ConnorsRSI greater than 50

- ConnorsRSI greater than 70

- Close above the 50-day moving average

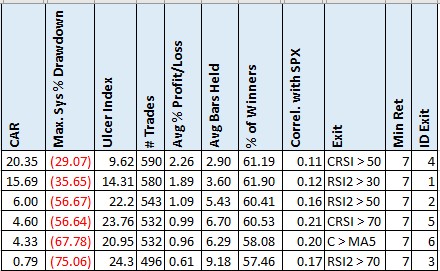

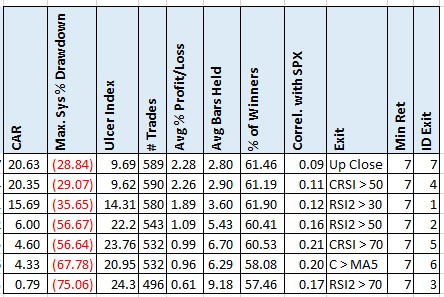

The Results

These results really surprised me. What I would call the most common exit RSI2 > 70, barely made money. Four of these did so poorly that if I was testing this idea with that exit, I might have stopped my research

Looking over the results, you will notice that the smaller the hold, the better the results. There is an exit I tested back when I was with Larry Connors, which surprised me that it even worked. It is exiting on the first up close. I believe this idea first came from Larry Williams.

It is such a simple exit idea. I am surprised I have not written about it before.

Exit on the first up close

The simple up close exit produces the bests stats across the board. Being the creator of ConnorsRSI, I should have realized that CRSI > 50, is close to an up exit. After a strong sell off, it takes little to move up to get a CRSI > 50.

Spreadsheet

Fill in the form below to get the spreadsheet with lots of additional information. See the results of all variations from the optimization run. This includes yearly returns, top drawdowns, trade statistics and more.

Final Thoughts

It was purely accidental that I needed to focus on the exits for this research project. Had I started with a RSI2 > 50 or 70 exit, I would have thought that the strategy no longer worked and probably would have stopped.

The up exit did greatly improve the results from the standard exits and you should look at this for your own trading.

In the next post, I will reveal the rules of this simple strategy and another lesson learned while testing it. Edit on 8/24/2020. See the top of the post about why no longer revealing rules.

Backtesting platform used: AmiBroker. Data provider: Norgate Data (referral link)

Good quant trading,

Fill in for free spreadsheet:

![]()