- in General by Cesar Alvarez

The issues with back testing a short stock strategy

I have been shorting stocks since 2006 using a quantified strategy that has remained relatively unchanged through the years. From 2006 to 2012, the strategy was one of my most consistent and profitable of all the strategies I have traded. I love shorting stocks because it is very hard psychologically, because of that, I believe that there is a good edge there. The test results have always bothered me because of the differences between back tested assumptions that sometimes are challenging to actually reproduce in real-world trading. Then in 2013 my fears became realized and all four fears below really hit me.

The issues with back testing shorting stocks

There are several issues with trading a short strategy that one cannot easily take into account when back testing. They are:

- Are shares available to borrow?

- Borrow interest

- Losses grow

- Overnight gaps – the Black Swan

Are shares available to borrow?

This is a constant problem. I use InteractiveBrokers and they are very good about having shares to borrow but there are still times when I cannot. Even with highly liquid stocks, one may not be able to borrow shares. In 2008, I could not borrow GM. Missed out on a good trade there. One could add a random possibility of shares not being available in the back test, but this does not really capture how real trading is. I will sometimes go months borrowing shares and then have several stocks in one week that I cannot borrow. Overall, missing these stocks has been a drag on my performance. In 2013, this was a much more common problem.

Borrow interest

I have had some insane borrow interest rates for some stocks. Sometimes it is next to nothing. Since there is no consistency on this, it makes it hard to model in back tests. One could use a constant value of borrow interest that would help make back tested results more realistic. In 2013, I saw so huge numbers.

Losses grow

One problem that has always bothered me with short trading is that as the position goes against you, it becomes a larger size of your portfolio which magnifies your losses. This is the opposite of a long trade. For example, if one shorts $10,000 of XYZ. It goes up 20% the first day, this means you lost $2000. The next day it goes up 25%, which means you lost an additional $3000, for a total loss of $5000. Now take a long position that does the same. The first day it loses 20% and then the next day it loses 25%. After the first day you are down $2000 and after the second day you are down a total of $4000. In 2013, this concept became real and painful.

Overnight gaps – the dreaded Black Swan

The large overnight gap is the biggest fear of any short trader. If in one’s back tested results, a stock had gapped up 100%+, of course, one would not trade that system. That’s because the overall system performance numbers would not look good and therefore, one would continue testing other parameters.

Because of this, I have realized that shorting stocks is similar to selling options. You may make money consistently for a long time, but all it takes is one trade to wipe out your profits from several months to years.

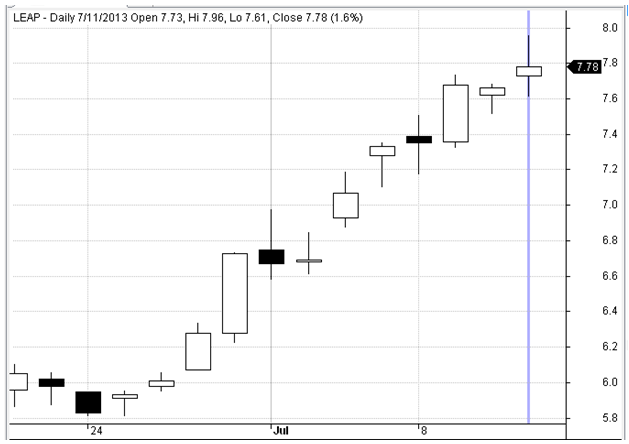

Here is the trade that did it to me in 2003.

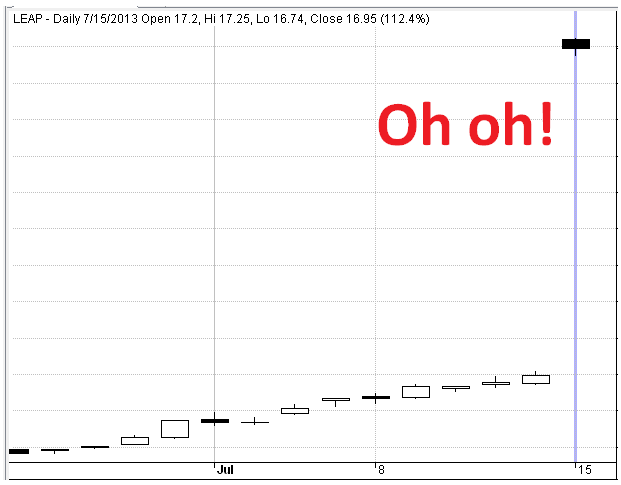

This was looking like a perfect setup for my short system. Then two days later this happens.

Suddenly, months of profits are gone. I had another trade almost as bad as this one happen later in the year. Black swans showed up in 2013.

Final Thoughts

Given all the issues with short stock trading, I am really close to pulling the plug on my short strategy. Do you short stocks? How do you deal with these issues? What are your thoughts?

Backtesting platform used: AmiBroker. Data provider:Norgate Data (referral link)