- in Stocks , Trend Following by Cesar Alvarez

Trading stock splits

Trading stock splits is something that I have read about for long time but never researched. This article, A simple way to beat the market with stock splits, caught my eye and gave me the push to investigate the topic. This falls into the category of a topic I have heard a lot about that I can’t believe that it would work but as always one must test. One never knows.

Unlike the last post where I took a concept with a long holding period and tested it with one month holds, in this case I will test holds from one to twelve months. I am doing this for two reasons. One, does the concept really work? Two, can it work on a monthly timeframe so I can incorporate it into my current trading.

Finding a stock split

Since my data provider, Norgate Data, does not provide the days of stock splits, I had to figure them out. Using the as traded price, which is not adjusted for stock splits or dividends, and the stock-split-dividend-adjusted price, I came up with a formula for determining the day of a stock split. The focus will be on splits between 2-to-1 and 10-to-1. My definition of the day of the stock split is the day that the stock is trading at the new adjusted price. Using my new formula, I randomly selected twenty splits and then looked them up at StockSplitHisotry.com. They all were verified by this site which gives me confidence in my formula. This is the first big grain of salt one must take about today’s research.

Test parameters

The tests will be performed on the Russell 3000 index constituents as they existed from 1/1/2005 to 12/31/2014. We will hold a maximum of 10 stocks in each portfolio with 10% allocated to each stock.

Before the split. After the split.

We will assume that we know a split is happening with at least 2 week’s notice. A before the split test, enters a position anytime during the 2 weeks before the split when all the other buy conditions are true and there is room in the portfolio. This is the second grain of salt of the research. We do not know if this was always true for every stock. It seems like a reasonable assumption but it is a guess.

An after the split test, enters a position anytime during the 2 weeks after the split when all the other buy conditions are true and there is room in the portfolio. This we know is a tradable strategy because the first possible entry date is the day after the split, which is known.

N-Month hold test

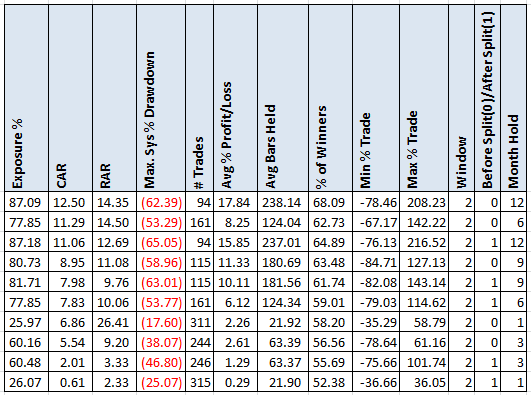

For the first test we will simply buy the splits and hold them for N-months. Nothing fancy but this what the original article stated.

Buy Rules

- Stock is a member of the Russell3000

- The 21 day moving average of Close*Volume > 1,000,000. A simple liquidity filter.

- It is 2 weeks before the split. Will also test it is 2 weeks after the split.

- Buy at the next open

- Maximum of 10 positions with 10% per position

Sell Rules

- Sell (1,3,6,12) months later.

The comparison stats

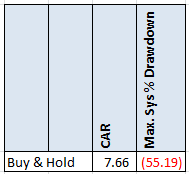

Test results will be compared to buying and holding the SPY.

Results

Very interesting. The results are about 50% more return for the same risk. The longest hold of 12 months is where the good results are. For that long of a hold the results are not that different if one trades before or after the split.

For long term hold strategies, I find this is where having stop losses and profit stops help, which we will test next.

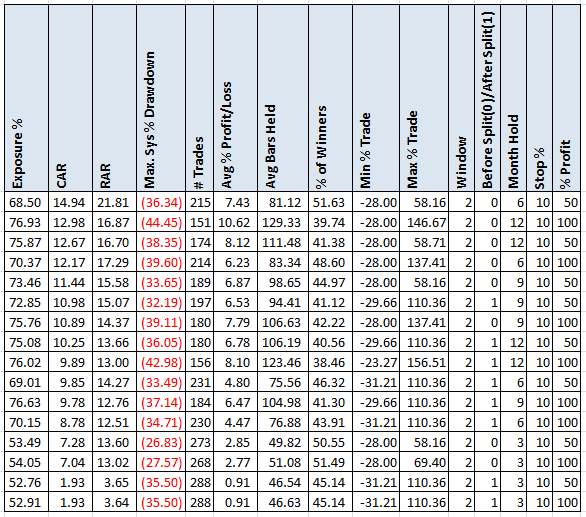

Profit Stops/Stop Losses

New Sell Rules – exit when any of them is true

- Max loss stop: If at the close, the stock has a 10% or more loss, exit on next open

- Profit exit: If at the close, the stock has a (50,100)% or more profit, exit on next open

- Time Exit: If in the positions (3,6,12) months, exit on next open

Results

A good improvement in the results. We have cut down the drawdowns. It is still too high for most people to trade but this showing that using stock splits as a filter for a longer term strategy is viable. Very cool. Not what I expected.

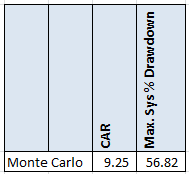

Nagging thoughts

I had finished the research and written the post but still had a nagging thought in the back of my head. Are these results that good? I ignored them for a day because part of me just wanted to believe. Eventually the researcher in me won out and I did a Monte Carlo test. I took the profit and loss stops tests from above and simple entered stocks randomly with a 6 month hold, 10% max loss stop and a 50% profit stop. The top line of the above table. This would let me know if the splits were helping or not. The results below are of 500 runs.

Close to the buy and hold results of the SPY. Waiting for the splits is helping. Nagging thought relieved.

Potential future tests

If I have enough reader interest, there are some obvious tests we could add. These include a market timing filter, a trend filter, a volatility filter and any reader ideas. Post in the comments what you would like to see more done on this concept.

Final Thoughts

Using a stock-split to trade a stock is a viable filter for a long term hold strategy. Not what I expected and why I love to do research for these unexpected results. Unfortunately I am not looking for six month hold strategy at this point but there is some other research that I want to do later in the year where this could become a component in.

Fill in the form for the spreadsheet

For a spreadsheet with yearly return, different split windows, and more stop prices, fill in the form below.

Backtesting platform used: AmiBroker. Data provider:Norgate Data (referral link)

Good quant trading,