- in ETFs , Trend Following by Cesar Alvarez

The 50/50 SPY Strategy

I was talking to my trading buddy about the annoying part of trend following strategies. They may get you out of the major sell off but then you miss part of the run up. Using a 200-day moving average on the SPY would have got you out in late 2018. This would have been within 10% from the top and you would not had the pain of the additional 10% drop in December. But one would not have gotten back in until late February, missing a good part of the run up.

There is a dual nature of trend following strategies. They generally reduce your drawdowns during the bad years at the expense of underperforming during the good years. This underperformance can be big and difficult to deal with. Now if one is in the conserve wealth (vs grow wealth) part of their life, then this may be okay, but still difficult to deal with.

What follows is a possible way to balance these issues.

SPY Trend Following Strategy

This is a modified 200-day moving average strategy to help deal with whipsaws.

Buy

- SPY closes above the 200-day moving average 5 days in a row

- Buy on next open

Sell

- SPY closes below the 200-day moving average 5 days in a row

- Sell on next open

Results

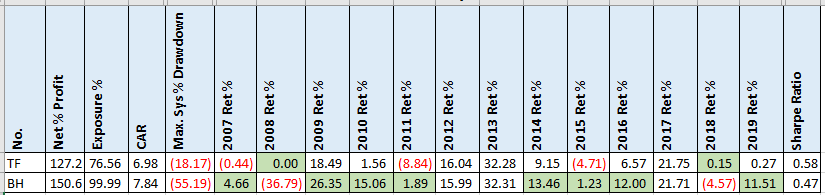

Test date from 1/1/2007 to 2/28/2019

The top row is Trend Following and the bottom row is Buy and Hold. Green cells mean that strategy outperformed that year. If the results are close I did not color either cell. As expected, the trend following strategy has a much lower drawdown. But at the expense of performance. The CAR is about 1 point lower and the total net profit is 15% lower. Trend following also underperformed eight of the thirteen years. This year has been tough with the SPY up 11.5% and trend following barely above break even. It is times like this that one decides trend following is not worth it.

The 50/50 SPY Strategy

What if instead of picking either trend following or buy and hold, we combined them?

Rules

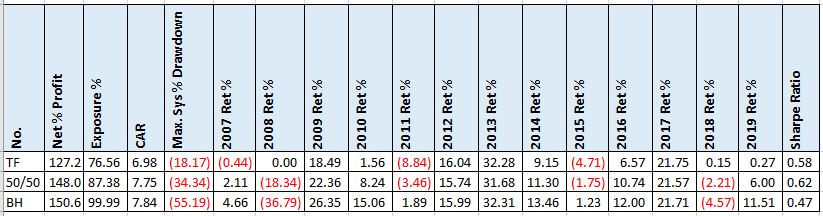

The portfolio is allocated 50% to each trend following and buy and hold. Each year we rebalance the portfolio to be back at 50% trend following and 50% buy and hold.

Results

The CAR and Net % Profit numbers surprised me. They basically match buy and hold. No surprise that the drawdown increased. Would I have been happy with a 34% drawdown? No. But given human nature, the fact that I was doing better than the buy and hold people, would have made it OK.

The 2019 return of 6% is also easier to live with.

The big surprise is the Sharpe Ratio. The 50/50 version has the best value of .62.

Spreadsheet

File the form below to get the spreadsheet with lots of additional information. It contains allocations for Buy and Hold from 0 to 100% in increments of 5. This includes top drawdowns, trade statistics and more.

Final Thoughts

Yes, I know that this is not some earth-shattering test. But these simple ideas are always fun to test because they are quick and easy to do. And sometimes, they surprise you.

The surprise was that the 50/50 method captured most of the gains and had a higher Sharpe Ratio. Now the maximum drawdown went up by quite a bit compared to trend following but it still is significantly less than buy and hold. I must think about how I can incorporate this concept into my dual momentum strategies.

Would you trade 50/50 instead of buy and hold or trend following?

Backtesting platform used: AmiBroker. Data provider: Norgate Data (referral link)

Good quant trading,

Fill in for free spreadsheet:

![]()