- in ETFs , Rotation by Cesar Alvarez

Day of month pattern or luck for a monthly ETF rotation strategy?

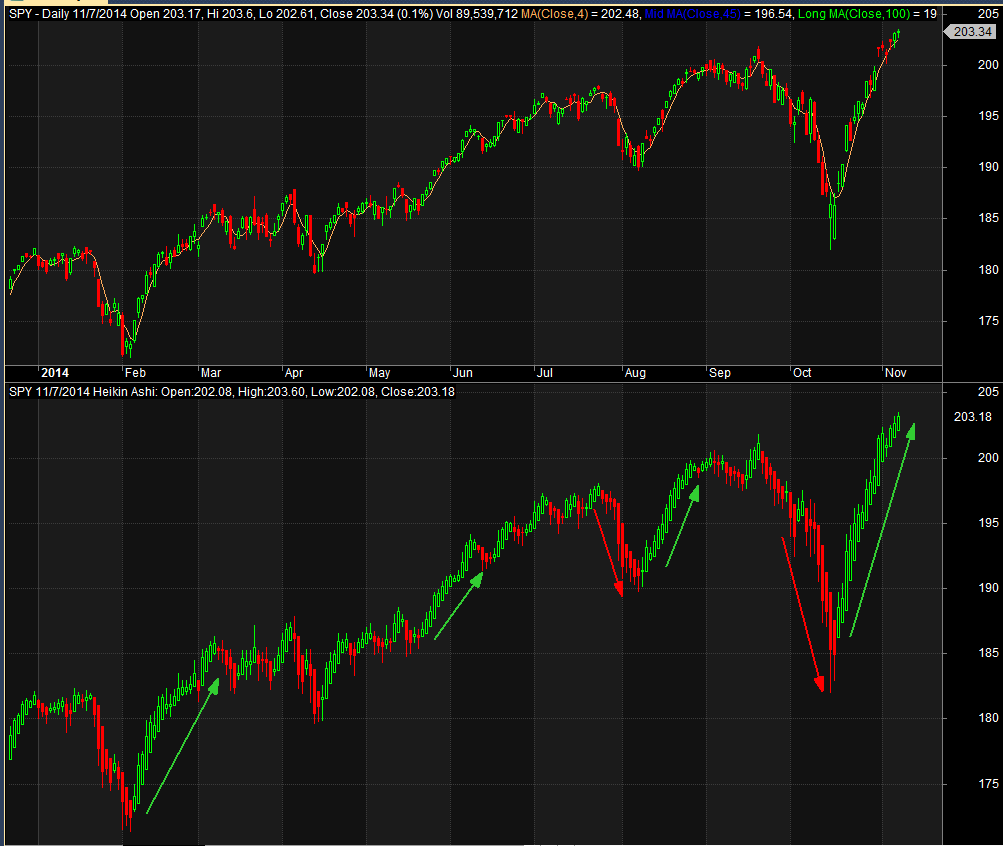

From my post on Heikin-Ashi Charts, another researcher wrote Luck: The Difference Between Hired or Fired about how luck of the draw could account for the difference in returns depending on the starting date. This is a completely valid question. Are three better returns for a strategy in a particular area of the month or is it random? I do believe that luck plays a large part in our trading results, which is a future blog post. But from previous work on 5 day holds, I know that the end of the month and beginning on the month tend to be better times for ETF mean reversion.