Articles I enjoyed from the past week.

In any field where complexity is part of the discipline (think: finance, technology, etc.) there is a temptation to appear more sophisticated than others. More specifically, the idea is to appear to know the information that other people do not know and to have a certain cleverness about your approach and how you look at problems.

If your so-called “Absolute Returns” hedge fund crushed it over the last 18 months, I have two pieces of news for you: A) it’s not really an absolute returns vehicle after all and B) it’s going to crush you when the worm turns, regardless of what you’re counting on it to do.

Here’s an update of a 2009 post, showing how daily volatility in the S&P 500 Index varies as a function of daily volume. Specifically, we’re looking at daily true range in percentile terms as a function of hundreds of millions of shares in SPY. What we can see is that, as volume comes out of a market, movement also becomes less.

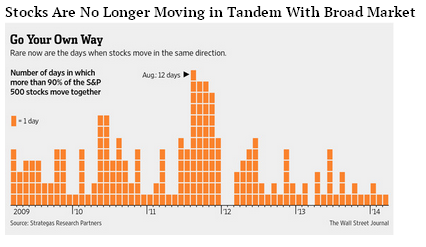

It’s been a long time now since the S&P 500 had a big change in a single day. You have to go back to November of 2011 to find the last day that the S&P 500 rose or fell by 3% in one day. Since 1950 there have been 200 trading days out of 16,202 in which the S&P changed by 3% or more, which implies that we get one 3% day for every 81 days.

Testing my next idea is taking longer than expected. Blog post next week on the test.