- in Research , Rotation , Stocks by Cesar Alvarez

Should You Buy the Best or Worst YTD Stocks

Is it better to buy the worst year-to-date performing stocks or the best year-to-date performing stocks for the month of December? Common wisdom would say stay away from the losers because those are the one that people are selling for tax reasons. Are fund managers buying the winners for window dressing?

The Best 10 Rules

Buy Rules

- On the last trading day of November

- Stock is member of the S&P500

- Buy the 10 best year-to-date performing stocks

- Buy on the close

Sell Rules

- Sell on the close of the first trading day of January of the next year

The Worst 10 Rules

Buy Rules

- On the last trading day of November

- Stock is member of the S&P500

- Buy the 10 worst year-to-date performing stocks

- Buy on the close

Sell Rules

- Sell on the close of the first trading day of January of the next year

SPX Baseline Rules

Buy Rules

- On the last trading day of November

- Buy SPX on the close

Sell Rules

- Sell on the close of the first trading day of January of the next year

The Results

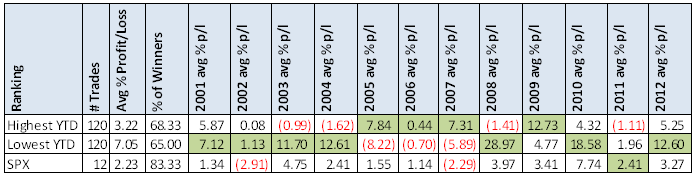

Buying the worst YTD S&P500 stocks is better from an avg. % p/l view. The total avg %p/l is twice that of the highest YTD stocks. Of the 12 years, the worst stocks outperformed the best stocks 7 of the years. What will this year bring?

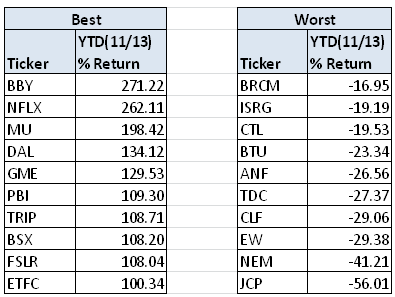

Current Best/Worst YTD (11/13/2013)

Spreadsheet

If you’re interested in a spreadsheet of my testing results, enter your information below, and I will send you a link to the spreadsheet. Additional stats include: a yearly breakdown of avg %p/l of trades, best winner, and worst loser.

Backtesting platform used: AmiBroker. Data provider:Norgate Data (referral link)

Read this similar post, January Effect on Stocks.