- in ETFs , Mean Reversion , Stocks by Cesar Alvarez

Double 7’s Strategy

In the book, Short Term Trading Strategies that Work, which Larry Connors and I published in early 2008, we wrote about a simple strategy called “Double 7’s Strategy.” Through the years people often ask about this strategy. Does something that simple really work? How does it do in a portfolio? Does the concept work on stocks? Today, we will be answering these questions.

The Original Rules

Buy

- Close is above 200-day moving average

- Close is a 7 day low of closes

- Buy on Close

Sell

- Close is a 7 day high of closes

- Sell on close

A clarification on what it means to be a “7 day low of closes.” There are two ways one can understand this.

Method 1. Today’s close is less than or equal to the previous 6 day closes. The AmiBroker code for this is “Close<= LLV(Close, 7).”

Method 2. Today’s close is less than the previous 6 day closes. The AmiBroker code for this is “Close < Ref(LLV(Close, 6), -1).”

As we originally tested and I will test today is method 1. In the spreadsheet, I also include the results of Method 2 when tested on stocks. Short story is there is little difference.

Changes from the original test. I don’t like testing with execution at the close. I will then change that to execute at the next open. The original test was a points test. These tests will be a portfolio test.

New Rules

Buy

- Close is above 200-day moving average

- Close is a 7 day low of closes. Method 1.

- Buy on next Open using 100% of cash

Sell

- Close is a 7 day high of closes

- Sell on next open

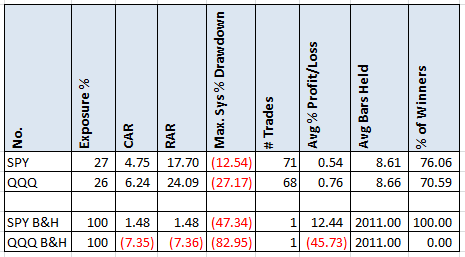

Results on SPY & QQQ (2000 to 2007)

First we will see how the rules did during the time period that we originally tested.

The CAR numbers are not ‘go open up a fund’ numbers. But they beat buy and hold with only ~26% exposure and substantially better drawdown. But how has it done since then? Has this simple mean reversion edge shrunk or disappeared?

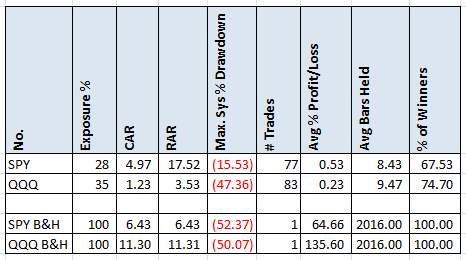

Results on SPY & QQQ (2008 to 2015)

The Double 7’s Strategy has not held up as well since 2008. Both CARs now are less than buy and hold. The SPY’s drawdown is much lower but the QQQ’s is just as bad. I got curious about this and it all comes from one bad trade in 2008.

What about stocks?

I wanted to know how this has done on stocks. Could something so simple work on stocks?

Stock Rules

Buy

- Stock is member of index (tested both SPX and NDX)

- The Index close is above the index 200 day moving average (added because I strongly believe in these. Especially for mean reversion strategies)

- Close is above 200 day moving average

- Close is a 7 day low of closes

- Buy on next Open using.

- 10% per position for a maximum of 10 positions

Sell

- Close is a 7 day high of closes

- Sell on next open

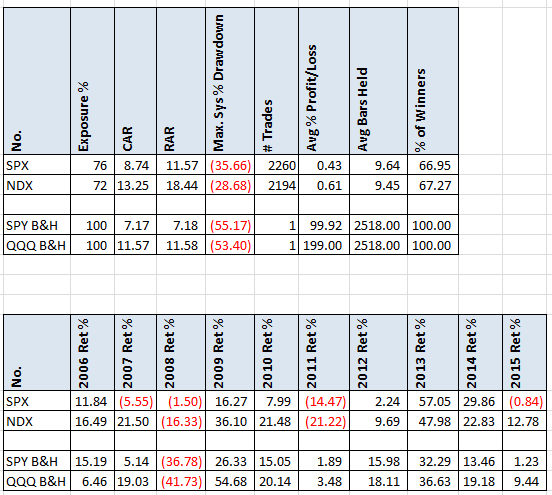

Stock Results

The returns are only a little better than buy and hold. The drawdowns about one-third better. Not great numbers. What I found interesting was the results the last couple of years. It looks like 2013 and 2014 where great mean reversion years while 2015 was not.

Spreadsheet

Fill the form below to get the spreadsheet with lots of additional information. This includes yearly breakdown, worst 5 drawdowns and additional statistics.

Final Thoughts

There is ‘simple’ and then there is ‘too simple.’ The Double 7’s Strategy may have worked in the past because mean reversion trading was not as popular. Now the strategy may be too simple so there is no to little edge there anymore.

Backtesting platform used: AmiBroker. Data provider:Norgate Data (referral link)

Good Quant Trading,

Fill in for free spreadsheet:

![]()