- in ETFs , Research by Cesar Alvarez

XIV Barbell Strategy

Well that was fun! I have been telling my trading buddy and anyone else that would listen that I fully expected XIV to open at zero one day. Now I did not expect it to happen so soon or the way it did. I trade a strategy that can be long XIV or long VXX or in cash. Because of the very likely possibility of XIV blowing up, I had constructed my portfolio using ideas from the barbell portfolio and this post, Taming High Return and High Risk. I was lucky and not in XIV when it did implode on Feb 6, 2018. Could a buy and hold trader of XIV made money even after the crash using these concepts? I was curious.

Barbell Portfolio

The idea of the barbell portfolio is that you put a small percentage of your assets (say 10%) in a very risky, high return asset like XIV. Then with the other 90%, you have it in something very safe like cash. Then at predetermined periods, you rebalance to be back to 10/90 allocation. These rebalance periods can be monthly, quarterly, semi-annual and yearly. What rebalance period you choose and the when can have a huge impact on your results.

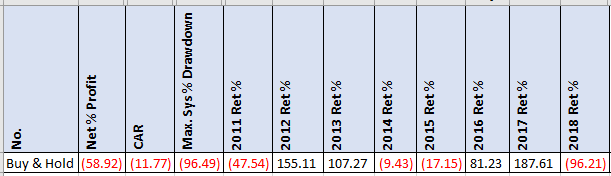

Buy and Hold

What are the results of simply doing buy and hold on XIV since inception? You would have lost 59% of your money. All test results are through 2/8/2018.

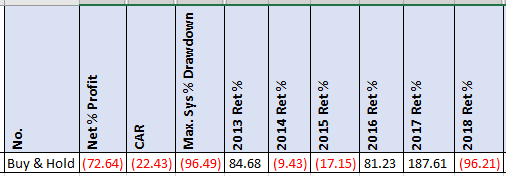

I wanted to see the results from 2013 because this is about the time I really wanted to trade XIV. A net loss of 73%.

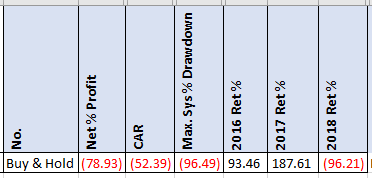

Another time I wanted to see was since 2016 because I know a trader doing this since about then. A net loss of79%.

Ouch, a loss of 79% of your capital. None of these horrible numbers should be surprising

.

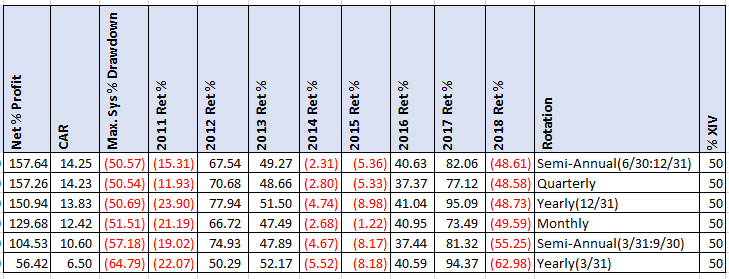

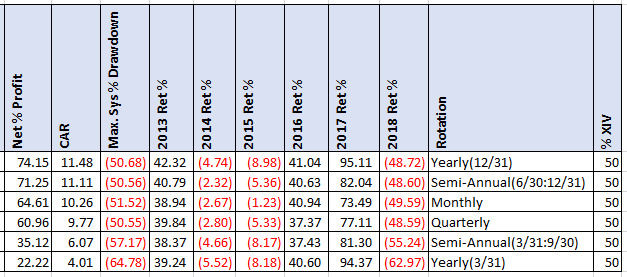

2011 Various Rebalance Times – 50% Allocation

At the rebalance time, the strategy allocates 50% to cash and 50% to XIV. The first thing I notice is that we end up with a decent CAR even though we lost 96% in XIV at the end. Rebalancing yearly exposes you to bad/good timing. I picked these two dates on purpose to show how big of an effect this has. Your CAR is cut in half depending on when you did it. Not as a big impact as semi-annual but still there. Personally, I like monthly.

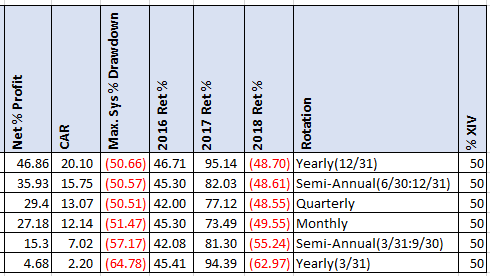

2013 Various Rebalance Times – 50% Allocation

The monthly rebalance has a net profit of 64%. Not bad considering.

2016 Various Rebalance Times – 50% Allocation

Would you come out ahead of if you started in 2016?

Surprisingly yes for all of these.

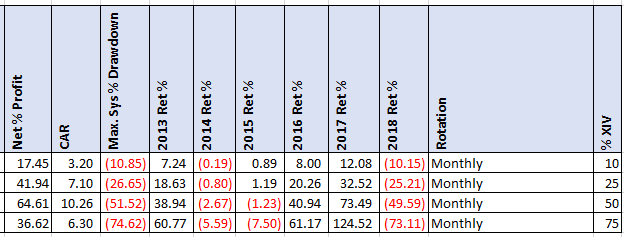

2013 Monthly Rebalance – 10%, 25%, 50%, 75% Allocation

How do different allocation amounts look like?

Interesting to see the spike at the 50% allocation level. The 20% allocation has a a CAR of 7% and not too painful MDD of 27%.

Spreadsheet

Fill the form below to get the spreadsheet with all the results and additional stats. See allocations from 5 to 100 percent. Top 5 drawdowns and draw-lengths

Final Thoughts

For aggressive strategies or those strategies likely to blow up, using this method is a great way to reduce the possibility of losing all your money. If I were trading or “investing” in cryptocurrencies, I would use this concept.

Backtesting platform used: AmiBroker. Data provider: Norgate Data (referral link)

Good quant trading,

Fill in for free spreadsheet:

![]()