- in ETFs , Research by Cesar Alvarez

VIXY & SVXY Strategies

My recent research has been on the volatility Exchange Traded Products. My focus has been on long trades using VXX and XIV. Although VXX has a very strong downtrend, I am not a fan of developing short strategies on it due to the huge upside risk. I wrote about XIV here and expressed some of the dangers of trading these ETFs.

UPDATE: These original results were published on October 26, 2016. Since then there have been lots of changes in the volatility ETFs/ETNs. Scroll down to Updated Results Through June 30, 2023 to see the updated results.

Issues

XIV has an inception date of 11/30/2010 and VXX inception date is 1/30/2009. Market has been in a strong uptrend during most of this period. Because of this, most people use synthetic data for before their inception to test the bear market scenarios. I will be using the data from Six Figure Investing which has synthetic data back to 2005 for both. A comparison of the daily return of the synthetic vs real data from 2011 to 2014 has a correlation of 0.999+. In the next post, I will investigate if this is good enough.

One big issue with the synthetic data is that we only get a closing price. I am not a fan of trying to enter at the close on the signal day. I prefer to enter at the open or close of the day after the signal day. We will see how each of these different entry times change the results.

Given we only have data back to 2005, this really does not give us enough to break up into in-sample and out-of-sample testing. For me, this is not a big deal because IS vs OSS testing is not a critical test for me. I like to be able to do it but it is not necessary

Idea Generation

There are lots of sites with strategies for trading XIV and VXX. My favorite site is Volatility Made Simple. Unfortunately, they have not done a new blog post since January and I hope this does not mean he is no longer updating the site. They have tested lots of strategies. I started with “Brute Force Optimization of VRP Strategy” and modified to what I will show next. I was also curious to see how the strategy has done this year.

Original Rules

This strategy is in either XIV or VXX depending on the difference between the current volatility and VIX. Calculate the MaDiff which is 5-day average of the [VIX index – (10-day Historical Volatility of SPY)].

If MaDiff is greater than zero then go long XIV. If MaDiff is less than zero then go long VXX. Nice and simple.

My Change to the Rules

I wanted to optimize some of the parameters, in particular the ‘zero’ value. But I did not want to simply change that to value because the difference between when volatility is low vs high would not be the same. So I change it to a ratio.

Steps

- MAVolRatio = (1 to 8)-day average of (VIX/((2 to 15)-Day HV of SPY))

- If MAVolRatio greater than (.75 to 1.25 in steps of .05) then go long XIV

- If MAVolRatio less than (same value as previous rule), then go long VXX

The spreadsheet will have the full set of the results.

Results

How has it done?

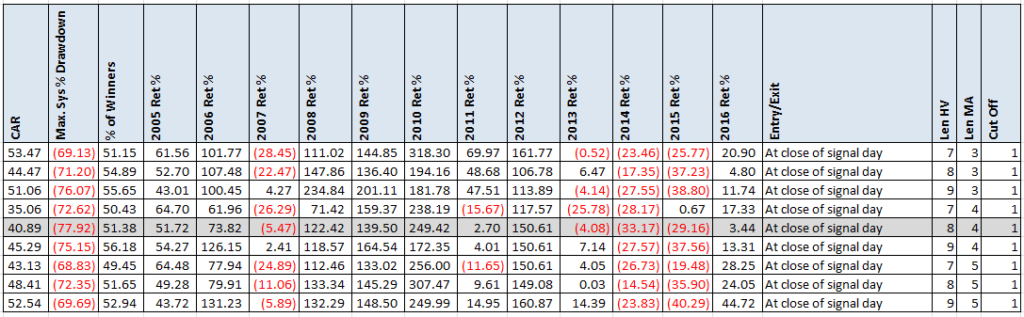

My first question how has this choosen parameters done since he published this in mid-2014. I used a a cut off value of 1, which is the equivalent of zero in his test. The moving average value is 4 and the volatility length is 8.

Click to see larger image.

Wow, it has collapsed. I guess this failed the real life walk forward test. Could have the values picked been unstable ones? Now, so far this year it is doing better. Is it back?

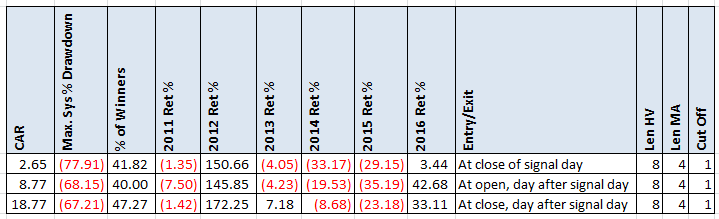

Comparison of Entry/Exit times

I want compare the different results of entering on signal day vs the next open vs next close. Since we are using the open, we have to test from 2011.

We can already see a substantial change in the CAR using the different entry/exit times. With an average hold of 26 market days, I was surprised to see such a difference in results. As expected the drawdowns are huge given you are in the market all the time. But as the Taming High Return and High Risk post pointed out, we do have one method of reducing the drawdown but at expense of the CAR which there is not much of.

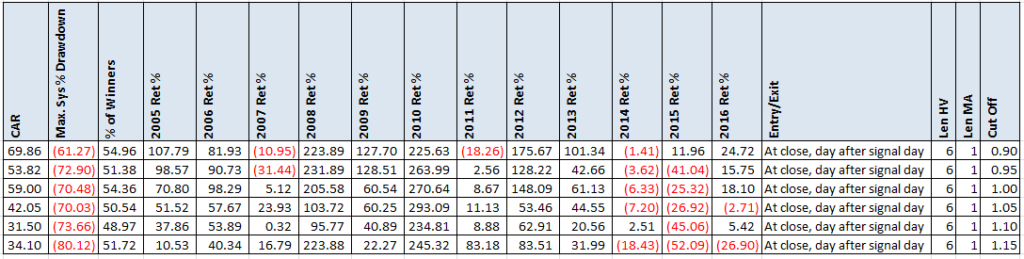

Testing back to 2005 with different parameters

Let us look at different parameters.

(Click on image for larger version)

These results still show a poor performance for the last few years. I also don’t like how sensitive the results are to the cut off value. It looks like the search must continue.

Final Thoughts,

It was interesting to see a strategy that was doing so well, with relatively simple rules, just collapse over the last few years. Would I trade this? I would not due to the poor performance recently. I would want a higher return given the risk. Even if I used cash to help reduce the drawdowns. I wish the parameters where a little bit more stable. The biggest question I still have is using the synthetic data valid? That will be explored in the next post.

Updated Results Through June 30, 2023

Trading the volatility ETFs continues to be popular though a lot has changed since I published this. XIV collapsed in February 2018 and ceased to trade. SVXY was tracking to the inverse (-1.0x) of the daily performance of the S&P 500 VIX Short-Term Futures Index. Then in February 2018, it changed to track one-half the inverse (-0.5x) of the index. UVXY went from -2.0x to -1.5x. VXX stopped issuing new shares in March of 2022.

Given all these changes, I wanted to test the rules again. The original tests used VXX & XIV. I do not want to use VXX because of the suspension of shares issue. XIV no longer trades. Instead, I will run the test using VIXY, which is also a 1x to the index, and SVXY which is a -0.5x to the index. These different tracking amounts will mean the position sizing rules will be a little complicated in order to even out the risk exposure. One benefit of running the tests now is that we do not need to use synthetic data.

New Rules

- MAVolRatio = (1 to 8)-day average of (VIX/((2 to 15)-Day HV of SPY))

- If MAVolRatio is greater than (0.75 to 1.25 in steps of .05) then go long SVXY

- If MAVolRatio is less than (same value as previous rule), then go long VIXY

- Enter either at the close or the next day’s open

When long VIXY, use 50% position size. When long SVXY before March 1, 2018, use 50% position size. After this date use 100% position size. What this does is equate the risk when going long for each of these ETFs. Before 2018, this is the same as always being in at least 50% cash. After this date, this is done to equalized the factor to the index. Because of this, we are forced to use the idea from Taming High Return and High Risk.

The test range is from 1/1/2012 to 6/30/2023. We now have a good sized in-sample data to play with.

The spreadsheet will have the full set of results.

Results

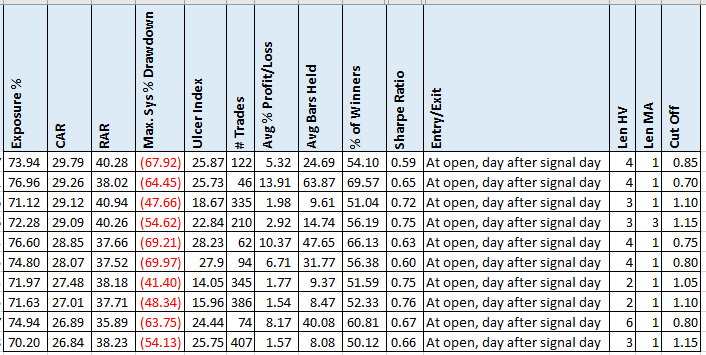

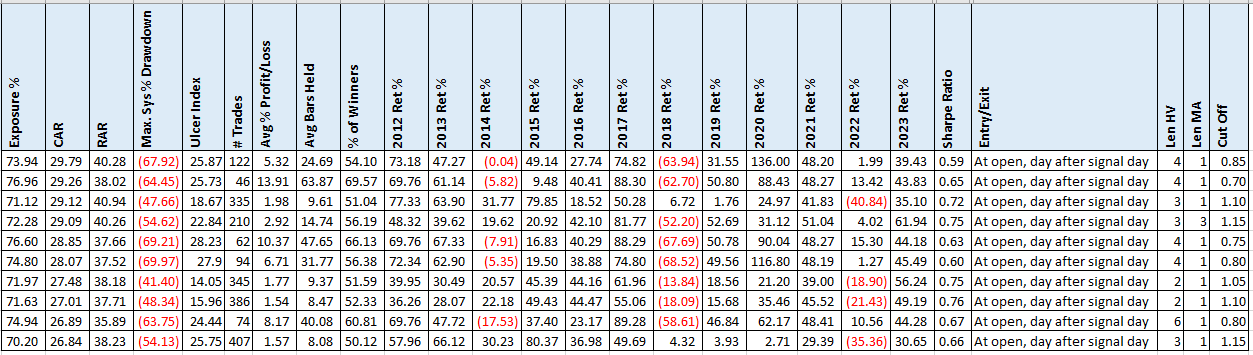

Here are the top 10 results from the optimization run. Get the rest in the spreadsheet.

These CARs are much lower than the original results. But these are trading one-half the VIX. Those MDDs are huge, which I will come back to. Interestingly both LenHV and LenMA are much smaller than the original results meaning the strategy wants to react faster.

Yearly breakdown

Looking at the yearly numbers, we see one bad year. In 2018, XIV imploded which also caused SVXY to crash. Two of the variations don’t have huge losses in 2018 but you can still see that have large drawdowns in the 40s.

Final Thoughts 2

When we first tested this, there was not enough data to really feel comfortable using the strategy. And using the synthetic data did not help. Now we have almost 10 years of data. The CAR from the tests are good but as expected they come with very high MDD which would make this a hard strategy to trade. Can the 2018 implosion happen again? Yes, it can but since SVXY is now a -0.5x, it would not be as bad.

I continue to trade my own volatility strategy, Volatility Trend Trader, which survived the 2018 meltdown. However, I do limit the size it takes in my overall portfolio of strategies because of the volatility. These types of strategies are good to trade because they can give you some outsized returns for the year as long as you properly manage the risk

Spreadsheet

Fill out the form below to get the spreadsheet which contains all the variations tested and additional statistics.

Backtesting platform used: AmiBroker. Data provider:Norgate Data (referral link)

Want to follow the VIXY/SVXY strategy that I trade? Click here to see Volatility Trend Trader.

Good Quant Trading,

Fill in for free spreadsheet:

![]()