Author Archives: Cesar Alvarez

- in ETFs , Mean Reversion , Stocks by Cesar Alvarez

Double 7’s Strategy

In the book, Short Term Trading Strategies that Work, which Larry Connors and I published in early 2008, we wrote about a simple strategy called “Double 7’s Strategy.” Through the years people often ask about this strategy. Does something that simple really work? How does it do in a portfolio? Does the concept work on stocks? Today, we will be answering these questions.

- in Research by Cesar Alvarez

Revisiting Strategies

Two years ago, I wrote an article, The issues with back testing a short stock strategy, about my short strategy and the issues I had with short backtests and shorting. Soon after publishing that article, I stopped trading my short strategy. I like to retest strategies 2 to 3 years after I stop trading them. I will admit that I do not do this with all my strategies because I forget to do so. I am looking to see how the strategy has performed since then and if the reasons I stopped have changed. Maybe it is time to start trading it again. The current market conditions and the fact that I wrote about this strategy gave me the push to remember to do it. So how has my short strategy held up since I stopped?

- in Research , Trend Following by Cesar Alvarez

Using Stops: The Good, The Bad and The Ugly

I recently gave a presentation on Better System Trader about using stops on a breakout strategy. The research produced results I was not expecting and may be surprising to you. The stops tested are

- No stops

- Maximum Loss using ATR (Intraday and End of Day)

- Maximum Loss using percentage (Intraday)

- Trailing ATR (Intraday and End of Day)

- Profit target using ATR (Intraday and End of Day)

- in Research by Cesar Alvarez

Equity Curve Correlation Analysis

A reader recently asked how to do equity curve correlation. For detailed information on correlation you can read Correlation and dependence or for simpler explanation read Correlation at Math is Fun. For steps on how to do this in Excel, which is where of course I did it, read Correlation at Excel Easy. I will cover here how one can use correlation analysis between equity curves.

- in ETFs , Rotation by Cesar Alvarez

Five ETF Monthly Rotation Strategy

I was working on another blog post when I saw this post Inferences From Backtest Results Are False Before Proven True on Price Action Lab. Mike has a challenge to replicate a very simple test. I often get email from people trying to replicate results from one of my blog posts and thought this would be fun to do. I cover some of this topic on my post Backtesting is Hard.

- in Mean Reversion , Stocks by Cesar Alvarez

Hi-Lo Index as a Market Timing Indicator

My strategies use a market timing indicator to tell me when I should not be trading the strategy. The blog post, Avoiding Stock Market Crashes with the Hi-Lo Index of the S&P500, presented a very simple idea of using new highs vs new lows. The post tests trading the SPY & IEF but I wanted to know how well would it work on a S&P500 mean reversion strategy.

- in Mean Reversion , Stocks by Cesar Alvarez

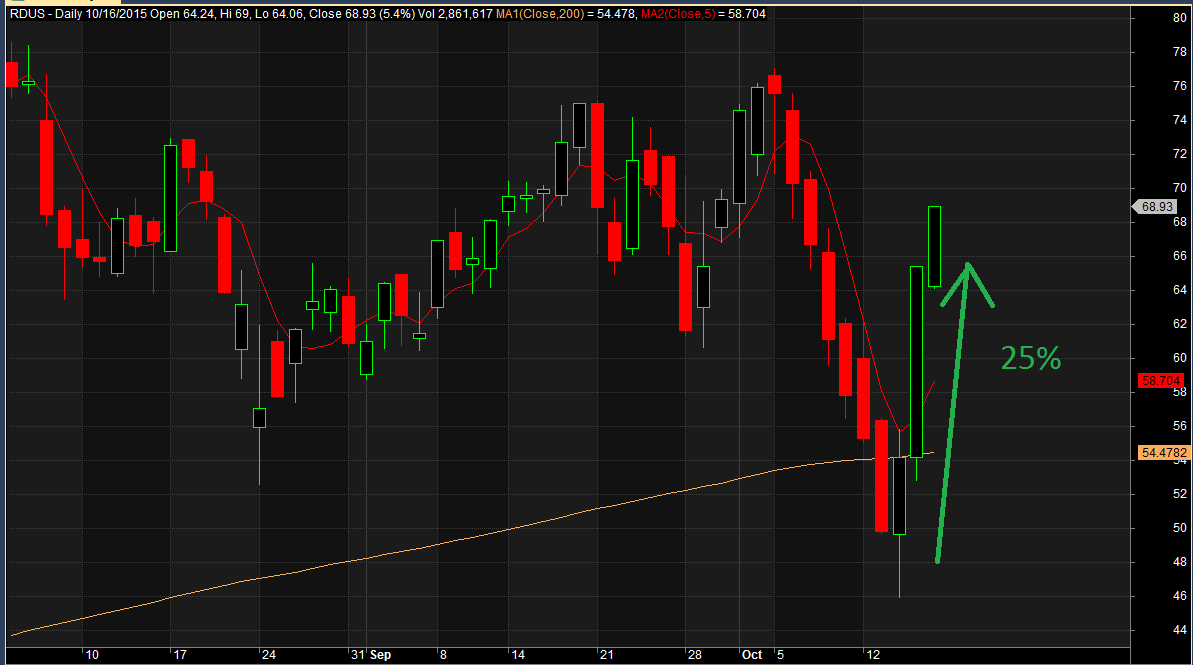

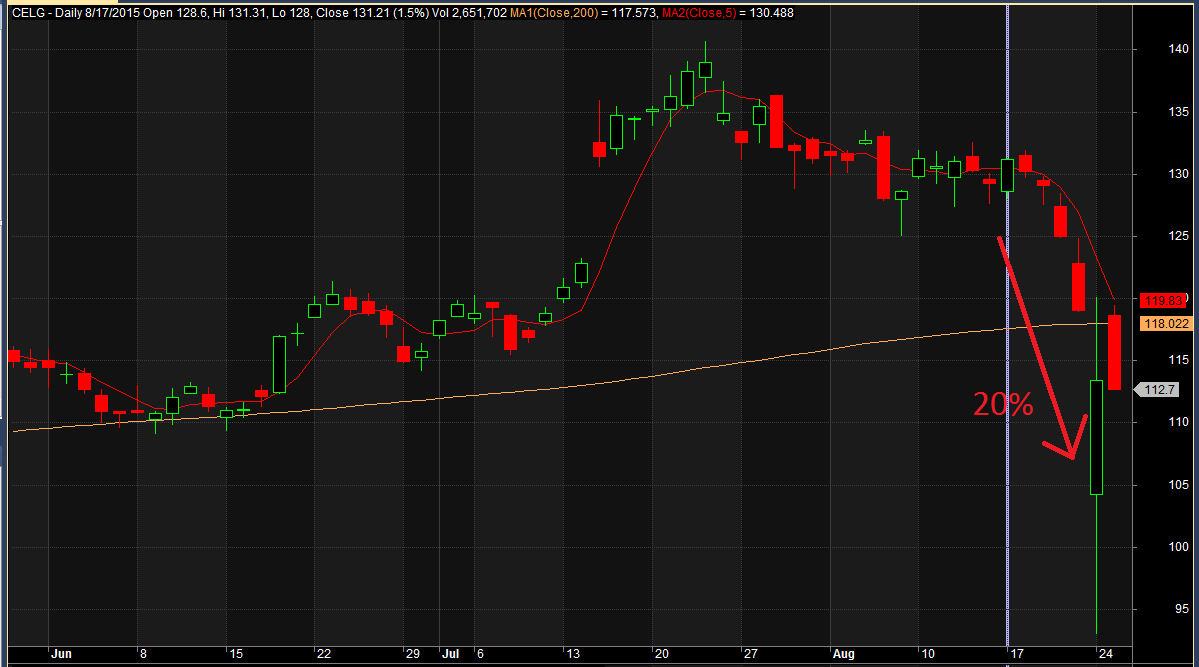

Biotech: My love-hate relationship

My love

My hate

The two charts above are from recent trades I have taken. Charts created in AmiBroker.

On July 20, 2015 IBB, iShares Nasdaq Biotechnology ETF, made a closing high of 398. About three months later it closed at 289 for 27% loss. A very common thing I hear from traders is that they “don’t trade biotechnology or pharmaceutical stocks.” I completely understand. These stocks tend to be very volatile and news driven. But does removing these stocks really reduce your drawdowns? What happens to your Compounded Growth Rate? Time to see what the research shows us.

- in Mean Reversion , Stocks by Cesar Alvarez

Stop Losses and Profit Targets. Plus Happy Birthday Excel!

In the post, Maximum Loss Stops: Do you really need them?, we looked at how maximum loss stops changed the results of a mean reversion strategy. At the end of the post I asked the readers to vote for what to try next. Let us see how these are ideas turn out.

- in Mean Reversion , Research , Stocks by Cesar Alvarez

The Health of Stock Mean Reversion: Reader’s Ideas

My previous post The Health of Stock Mean Reversion: Dead, Dying or Doing Just Fine generated good reader’s suggestions on other ways to check on mean reversion health. Let us see what these tests tell us.

- in Good Reads by Cesar Alvarez

What I am reading: Sept. 2, 2015

Recent articles that I found interesting and made me think. For more articles see the quant mashup Quantocracy.

Was Monday’s ETF Collapse Just A Warmup?

“The ETF can’t be more liquid than the underlying, and we know the underlying can become highly illiquid.”

Computers are the new Dumb Money

“Rational, experienced people understood that an ETF with holdings that were down an average of 5% should not have a share price down 30%.”

Avoiding the Big Drawdown: Is Downside Protection Helpful or Heresy?

‘Chasing the Investing Unicorn: Give me “High Returns with Limited Risk”’

Algorithm Aversion — Why people don’t follow the model!

“However, given this knowledge that models beat experts, forecasters still prefer to use the human (expert) prediction as opposed to using the model.”

Good Quant Trading,