- in ETFs , Market Timing , Research by Cesar Alvarez

Market will be up 9.7% in 3 months!

When this sell-off indicator triggers, it is correct 100% of the time! On average the market is up only 2.6% in 3 months.

OR NOT!

After big moves in the market, we often see “research” saying that “when the market has done X it will move Y%.” I had a reader send me such research asking for my thoughts on it. The indicator was that the market had closed down 3 days in a row with volume each day above the top Bollinger Band. When this happens, this is good for the market 3 months out.

There was no mention of the parameters used for Bollinger band. Or what “good” was exactly.

I will walk through my investigation of this idea. The first step is how I got that headline number. Yes, it was a cherry-picked number. That is the only reason people show these numbers is because they look great.

Test date range: Inception of SPY in 1993 to 2/26/2020.

On average the market is up only 2.6% in 3 months with 71% winners.

Rules Headline

- SPY closes down 3 days in a row

- Volume each day is above the 20 day and 1.5 standard deviation of the top Bollinger Band

- Buy at the close and hold 63 trading days

I take every signal even it overlaps with the previous signal. In general, allowing overlapping signals will improve your results and give you more trades.

Results:

Trades: 17

Avg % profit/loss: 9.7%

% Winners: 100

Two issues I have with this. First the low number of trades. Second, allowing overlapping trades. I care about the first signal. As of this post, we have had two consecutive signals: February 24 and February 25.

Rules No Overlapping Trades

What happens if we do not allow overlapping trades?

Results:

Trades: 12

Avg % profit/loss: 9.5%

% Winners: 100

As expected, the number of trades came down. I was surprised at how the overall numbers held up. But still too few trades.

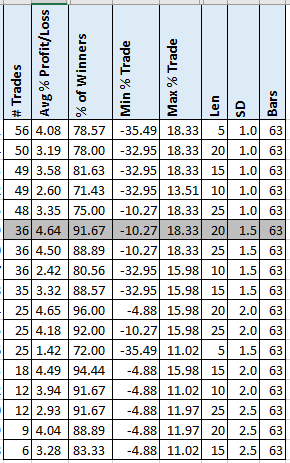

Rules different parameters

Now I want to see if I can get more trades. I like to see over 50.

- SPY closes down 2 days in a row

- Volume each day is above the (5,10,15,20,25) day and (1.0,1.5,2.0,2.5) standard deviation of the top Bollinger Band

- Buy at the close and hold 63 trading days

Results

The highlighted row is our previous test but with only 2 days down. We get 36 trades and the results are still better than the normal 63 return of 2.6%.

Looking at the first few rows with trades over 47, we see most have better returns than the normal. But we are not near the eye-popping headline of “Market will be up 9.7% in 3 months!”

Spreadsheet

Fill in the form below to get the spreadsheet of the results. Also, includes other hold times.

Final Thoughts

I always take those indicator headlines with a big grain of salt. You never know how they got to it. And often they are missing details.

Understand these were cherry-picked results to get a point across. This research and post were quickly done, so the likelihood of coding error is higher.

The funny part is after this analysis, I would bet on the market being up 3 months from now. I was expecting conflicting results. But my trading is not based on random indicators that I just find. At the end of the day, I will keep following my strategies.

Backtesting platform used: AmiBroker. Data provider: Norgate Data (referral link)

Good quant trading,

Fill in for free spreadsheet:

![]()