- in General by Cesar Alvarez

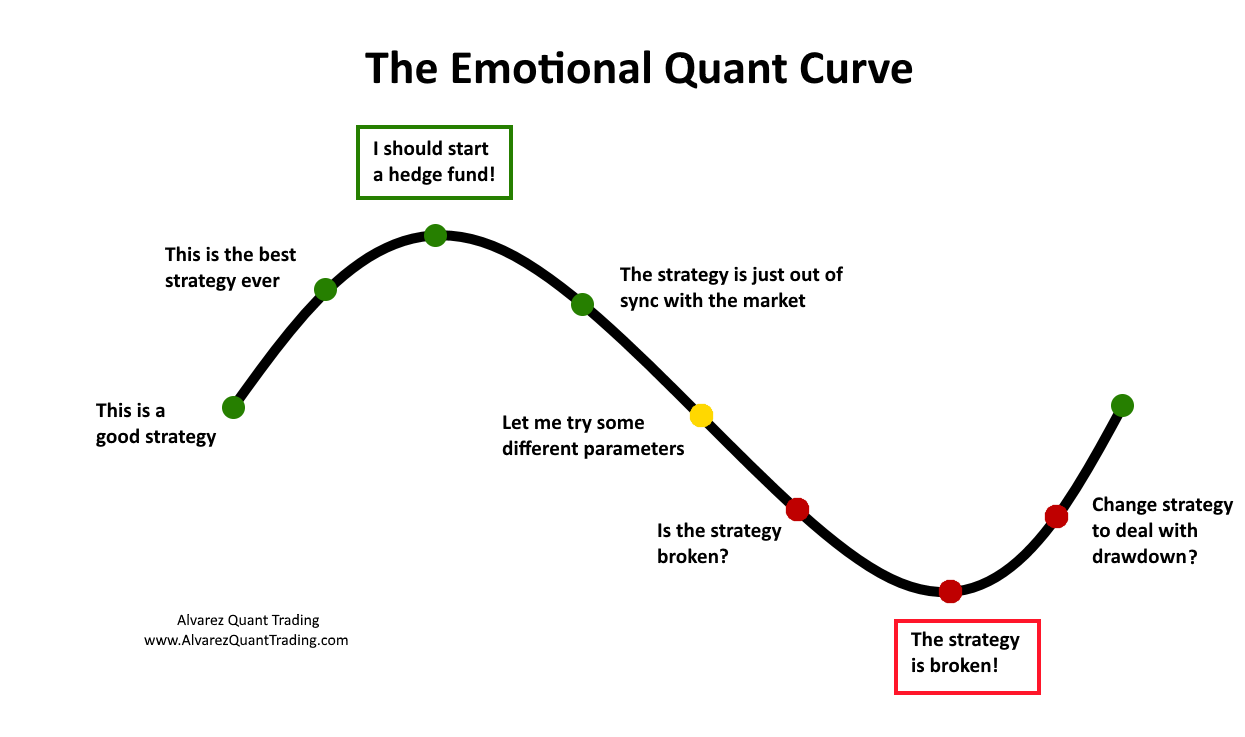

The Emotional Quant Curve

While writing my presentation for TradersFest 2018, I wanted to add the trader’s emotional curve. But looking at it closer, it did not capture my feelings as I go through the cycle of up and downs of trading a strategy. Here is my curve.

I have been on every part of this curve multiple times. October and November caused several strategies to go into the red part of the curve.

The top box of the curve, “I should start a hedge fund!” does not apply to me since I do not want to manage money. But lots of traders think about it and I chose that. For me, I would have changed it to “I can retire!”

Where are your strategies right now?

Good quant trading,