- in Mean Reversion , Stocks by Cesar Alvarez

Exiting using limit orders

Most of us focus our research time looking to find better entries. We don’t spend enough time thinking about our exits. I am definitely guilty of this. A popular way to enter a mean reversion trade is by using a limit order. I use that on the strategy on RSI2 Strategy: Double returns with a simple rule change post.

The exit on that strategy is on the open. Many people don’t like exiting on the open because of the volatility and the belief that you will get a bad fill. What if we exit instead using limit orders? I tested this idea years ago. Time to revisit an old idea.

Just because the limit price gets touch or exceeded does not guarantee we will exit or fully exit in real trading. We must live with that issue for these tests.

The Initial Strategy

Test range from 1/1/2007 to 9/30/2019.

Set up Rules

- Stock was a member of the Russell 3000 index, is not currently a member of the index

- Stock is traded a major exchange.

- The as traded price is greater than $1

- The 21-day moving average of close*volume greater than $500K

- Close is greater than the 100-day moving average

- Two period RSI is less than 10

Entry Rules

- If we have a set up, then enter a limit order for the next day at 5% below the close. Order good for one day only.

- Only place enough orders so if they are all filled you are not in over 10 positions

- If have multiple set ups, then rank from high to low by the 100-day historical volatility.

Exit Rules

- Two period RSI is greater than 50 or after 10 trading days

- Exit on next open

Simple mean reversion exit of waiting for the bounce.

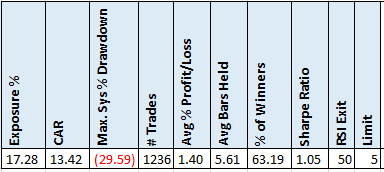

Base Results

These are the results we will compare against.

The Limit Exit

The exit rule will now be changed to:

Exit Rules

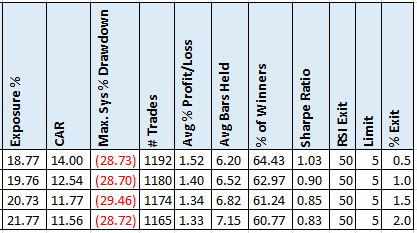

- If RSI is greater than 50 at the close, place a limit order to close the position [.5,1,1.5,2]% above the close

- Order is good for one day only

OR

- After 10 trading days

- Exit on next open

Limit Exit Results

A small change in the numbers. Not sure what I was expecting. For a little piece of mind of not having to deal with the open, this is an interesting way to get out.

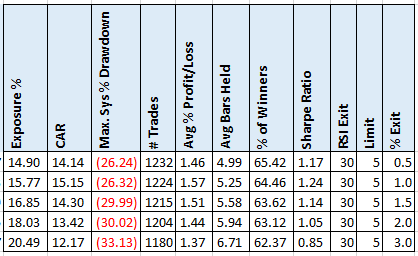

Limit Exit with Lower RSI

Instead of waiting until the RSI2 is above 50 to place the limit order. What if we changed that to 30?

Now all the results are slightly better than the original test. CAR, Avg % p/l, % winners are all up with average hold down.

Spreadsheet

Fill in the form below to get the spreadsheet with lots of additional information. This includes more RSI exit values and limit values than shown. See the results of all variations from the optimization run. This includes top drawdowns, trade statistics and more.

Final Thoughts

I will have to try this on my mean reversion strategies I trade. I like that for small percent exits most the stats I care about improved some.

There are two issues. Just because the limit price is touched or exceeded does not guarantee you will get out of the position or you may get a partial fill. These are always annoying to deal with.

Then comes the possible psychological problem of trading this. What if the stock is up big, then you place the order to get out but then it turns around and craters? I will have to look at any trade lists to see how often this happens.

Backtesting platform used: AmiBroker. Data provider: Norgate Data (referral link)

Good quant trading,

Fill in for free spreadsheet:

![]()