- in Rotation , Stocks by Cesar Alvarez

StockCharts Technical Rank (SCTR) Rotation Strategy

My post last week on the analysis of SCTR produced lots of emails and comments with great ideas. One idea that I liked was a simple rotation strategy using SCTR. I mentioned in the post that maybe using SCTR as ranking method would produce different results.

Normally I don’t post this quickly but I wanted to share these new results because they give a different view of SCTR.

The Test

Date range: 1/1/2007 to 6/30/2018.

Buy Rules

- Stock is a member of the S&P500

- It is the last day of Quarter

On the rotation day, sell all open positions at the close. Buy 20 positions at the close equally weighted. Either rank by either high or low SCTR.

The spreadsheet contains monthly and semi-annual rotation.

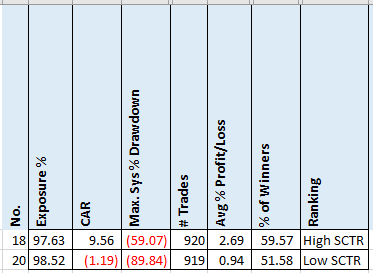

Base Results

Wow, this gives a completely different story than my previous analysis. Now trading the high SCTR stocks is definitely better. This shows how testing differently can give different results. More importantly test on how you will trade.

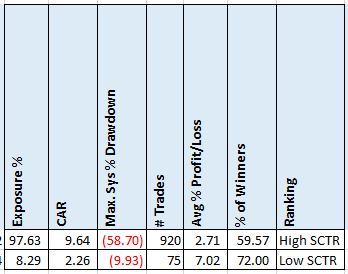

Stock Above 200 Day Moving Average

Now let’s add a buy rule that the stock must be above its 200 day moving average.

Same pattern but notice there are only 75 trades for low SCTR. This just does not happen often. But when it does, these are great trades. They produce over 2.5x times the profit.

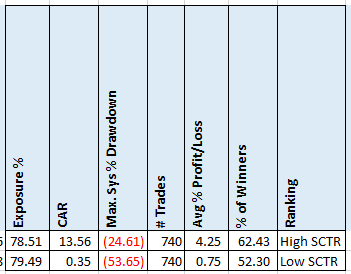

Market Above 200 Day Moving Average

From our base test, let’s add the rule that the SP500 index is above its MA200.

No surprise here to see that high SCTR results improve on both CAR and MDD. I expect that from adding the market timing.

First Thoughts

I am happier to see that trading SCTR stocks above 90 did way better than trading low SCTR stocks. The lesson here is test as you plan to trade.

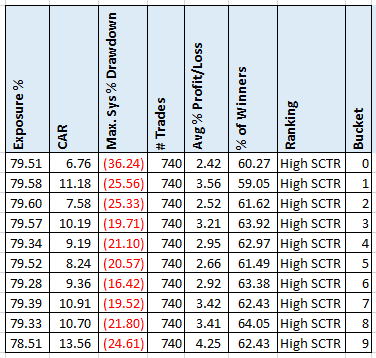

Each Bucket

How well is SCTR doing for each of the 10 buckets? Meaning do the results get better as you go from rank 0-10 to 10-20 to 20-30, etc? For each bucket, I trade the top 20 stocks. This will include the market timing rule.

The trend in CAR is not quite what I would want to see but still the higher bucket do better than the lower buckets.

SCTR vs Other Methods

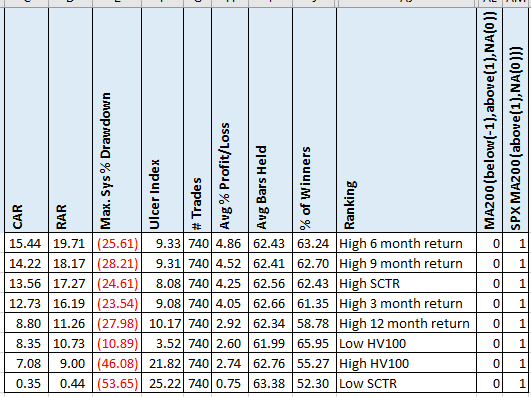

The next question is how good does the high SCTR compare to other ranking methods.

The ranking methods to compare are

- High 3 month return

- High 6 month return

- High 9 month return

- High 12 month return

- High SCTR

- Low SCTR

- High HV100

- Low HV100

The simple ranking by 6 or 9 month return does better than SCTR. Not by a lot but by a much simpler method. Notice the low MDD for using low HV100 ranking. A good sign for SCTR is that the low SCTR produces poor returns and the high SCTR produces good returns. Sometimes you will find that the inverse of the ranking produces about the same results. Which tells you it may not be doing much.

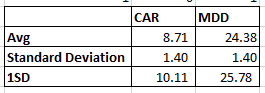

Better Than Random?

One test I like to do, is a comparison to random. I ran 100 runs of using random value for the ranking.

It is good to see that the top CAR from the ranking runs are more than one standard deviation from the random method. But interestingly the MDD is about the same.

Spreadsheet

Fill in the form below to get the spreadsheet with lots data. Included is monthly and semi-annual rotation and different max positions.

Final Thoughts

This post reminded me of the lesson to test as one plans to trade. My previous post indicated that trading high SCTR stocks was not better than average. But when I used it as a ranking method, the high SCTR stocks greatly outperformed the low ones. Understand that neither post is wrong. It is how you decide to test that can greatly determine what you get in results.

Will I use SCTR in my longer-term strategies for ranking? No. Not because it does not work but because simpler methods work just as well.

Again thank you for all the emails and comments.

Backtesting platform used: AmiBroker. Data provider: Norgate Data (referral link)

Good quant trading,

Fill in for free spreadsheet:

![]()