Author Archives: Cesar Alvarez

- in General by Cesar Alvarez

Brazilian Jiu-Jitsu & Trading – Shiny New Toy

A very strong parallel between Brazilian Jiu-Jitsu (BJJ) and trading is the chasing of the shiny new toy. In BJJ, we often want to learn the new submission (Peruvian Necktie or Snake in the Grass Choke) we saw on YouTube. Or the new type of guard (Lapel Guard or 50/50 Guard). In trading, this is chasing the new technical indicator or new position sizing method or new strategy we read on some blog.

- in ETFs , Market Timing by Cesar Alvarez

Market Timing and Bond ETFs

In my last two posts, Market Timing with a Canary, Gold, Copper, LQD, IEF and much more and Day of Month and Market Timing, I assumed that we earned no interest in cash. Most methods did a good job of telling us when to be in the SPY and when to be in cash. How much could we boost returns by investing the cash in a bond fund?

- in General by Cesar Alvarez

Brazilian Jiu-Jitsu and Trading – Focus

I have been practicing martial arts for the last 21 years and Brazilian Jiu-Jitsu (BJJ) for the last 9 years. Over the years I have come to appreciate how BJJ helps my trading. And also, how my trading helps my BJJ. The lessons and similarities go both ways.

Due to a recent injury, more details at the end, I am out of BJJ for the next 6 weeks. I plan to write several posts about how BJJ influences my research and trading to keep thinking about BJJ. These posts will be short and interspersed between my regular posts.

Icons made by Freepik from www.flaticon.com is licensed by CC 3.0 BY

One of my favorite parts about BJJ is that it forces you to focus. At the start of class, I am often still thinking about the research and trading day. I may be happy with my trading results for the day. Or thinking about a solution to research project or how to improve a client’s strategy.

But I must quickly focus on the class and my training partner. He will soon be actively be trying to break my arm or shoulder or leg or choke me. There is nothing like being “attacked” to force you to focus.

Being a smaller, older & lighter guy with most of the other students being 50% or more heavier than I, means I have little room for error. The focus comes quick and I forget about the day I had.

The benefit to this focus usually comes after class in the shower. That is when I will frequently come up with new trading ideas or solutions. The time of not thinking about the day lets ideas ruminate in the back of my brain.

As much as I love researching and trading the stock market, this time to not think about it is critical. Find your activity that forces you to stop thinking about the market. Even going for walks in nature, my best method for finding solutions, works surprisingly well.

solvitur ambulando

Injury report. I tore my left medial meniscus. To be more specific, I had a bucket-handle tear. As to how it happened. Well it was wear and tear of 21 years of martial arts, plus a previous ACL surgery plus getting old. The straw that tore the meniscus, was a 6 inch jump in the air.

I just got surgery last week to fix it. All is going well and pain free. Now comes the hard part. Taking it easy to allow it to heal.

Good quant trading,

- in Market Timing , Research by Cesar Alvarez

Market Sell-off Analysis How often does a 5% market sell-off become a 10% sell-off?

We often hear that the market is 5% off its highs or that it is down 5% from the high of the year. This alone does not tell us much. The question I want answered is how often does that 5% loss become a 10% loss? Or worse yet a 20% loss?

Read the rest of my guest post, Market Sell-off Analysis: Baseline Historical Facts, over at Alpha Architect.

Good quant trading,

- in ETFs , Market Timing by Cesar Alvarez

Day of Month and Market Timing

In my previous post, Market Timing with a Canary, Gold, Copper, LQD, IEF and much more, I tested several market timing methods. The signal was checked on the last day of the month. Now the question is what happens if we check on a different day? How different will the results be?

- in ETFs , Market Timing , Research by Cesar Alvarez

Market Timing with a Canary, Gold, Copper, LQD, IEF and much more

One commonality in my strategies is the inclusion of a market timing component. This could be a signal to go into cash or reduce position size or enter a ‘safe’ ETF. This applies to my swing trading strategies, my monthly rotation strategies and my Tactical Assert Allocation strategies. As a researcher, I am always on a looking to improve this part of my strategies.

There have been a handful of market timing methods I have been wanting to test and compare with my current 200-day moving average version. I collected enough of them to test all at once and to compare the results.

- in General , Research by Cesar Alvarez

Quantopian Review and Comparison to AmiBroker

In my last post, Avoiding Trades Before Earnings, I mentioned that I used Quantopian to do the research. Several readers asked about my thoughts about Quantopian and how it compares to AmiBroker. Some asked if I had left AmiBroker for Quantopian. What follows are my impressions after using Quantopian for several months and how it compares to AmiBroker.

The big question is will I be switching from AmiBroker to Quantopian for my backtesting?

- in Mean Reversion , Stocks by Cesar Alvarez

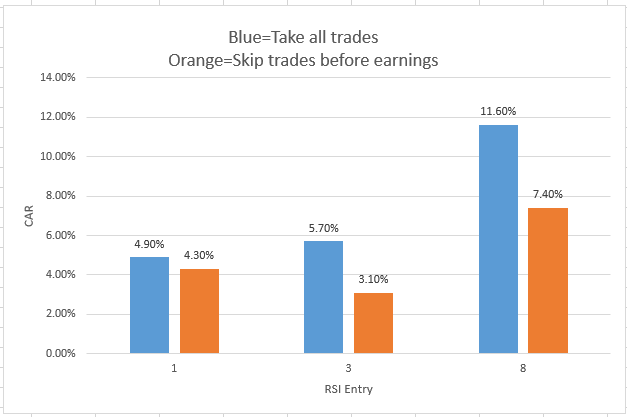

Avoiding Trades Before Earnings

Over my last 16 years of research, one of the most asked questions is should you not take trades before an earnings release. I could never answer this question because I did not have the data. I can easily recall trades were a stock came out with poor earnings and crashed 25%. But without testing this, I would still take stocks into earnings. Because that is how the testing was done.

A few months ago, I discovered that Quantopian has data for the earnings dates for stocks. I had been looking for a good reason to try out Quantopian and this looked like a good project.

- in ETFs , Trend Following by Cesar Alvarez

The 50/50 SPY Strategy

I was talking to my trading buddy about the annoying part of trend following strategies. They may get you out of the major sell off but then you miss part of the run up. Using a 200-day moving average on the SPY would have got you out in late 2018. This would have been within 10% from the top and you would not had the pain of the additional 10% drop in December. But one would not have gotten back in until late February, missing a good part of the run up.

There is a dual nature of trend following strategies. They generally reduce your drawdowns during the bad years at the expense of underperforming during the good years. This underperformance can be big and difficult to deal with. Now if one is in the conserve wealth (vs grow wealth) part of their life, then this may be okay, but still difficult to deal with.

What follows is a possible way to balance these issues.

- in Mean Reversion , Research , Stocks by Cesar Alvarez

How is mean reversion doing? Dead, Shrinking or Doing Just Fine

A common question I get from readers is “does mean reversion still work?” The last time I wrote about this topic was in 2015, a long time ago, in the post “The Health of Stock Mean Reversion: Dead, Dying or Doing Just Fine” I did not realize it had been so long. Time to look at it again.

The Test

Date Range: 1/1/2001 to 12/31/2018

Entry:

- Stock is member of the Russell 3000

- Two period RSI crosses below 1

- As traded price is above $2

- Entry on next open

Exit:

- Two period RSI crosses above 70

- Exit on next open