- in ETFs , Market Timing by Cesar Alvarez

Market Timing and Bond ETFs

In my last two posts, Market Timing with a Canary, Gold, Copper, LQD, IEF and much more and Day of Month and Market Timing, I assumed that we earned no interest in cash. Most methods did a good job of telling us when to be in the SPY and when to be in cash. How much could we boost returns by investing the cash in a bond fund?

Which Bond ETFs?

I tested these ETFs in what I would consider increasing risk profile

- SHY – iShares 1-3 Year Treasury Bond ETF

- IEI – iShares 3-7 Year Treasury Bond ETF

- AGG – iShares Core US Aggregate Bond ETF

- IEF – iShares 7-10 Year Treasury Bond ETF

- TLH – iShares 10-20 Year Treasury Bond ETF

- TLT – iShares 20+ Year Treasury Bond ETF

When the market timing method tells us to be out of the market, I will invest in one of the above ETFs.

I also want to try an idea in Trend Following on Steroids. We have a basket of Bond ETFs to choose from. We generate the momentum value for each one and invest in the one with the highest momentum. The formula is

Momentum = 12 times 1-month return plus 4 times 3-month return plus 2 times 6-month return plus 12-month return. Then divide by 4.

The baskets I will be testing are

- IEF, TLT

- SHY, IEF, TLT

- SHY, IEI, IEF, TLH, TLT

Test Parameters

For the details for each method read the previous posts mentioned at the top of this post.

The test range is from 2008 to 2018. The start date differs from the previous posts because some of the ETFs did not trade until 2007.

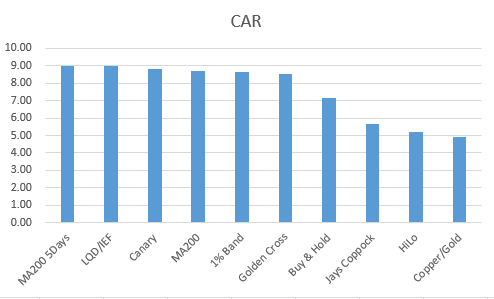

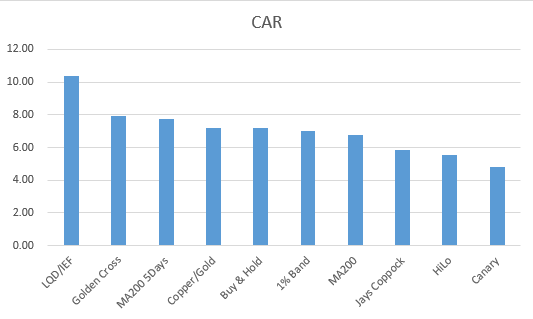

End of Month – No Bond ETF

First, I want to see which methods did best since 2008 using no bond ETF for cash.

The results are sorted from highest CAR to lowest. We can see that 6 beat buy and hold and have very similar returns. From 8.55 to 9.00.

Two big changes from the original post. The Canary method with a CAR substantially higher than all the methods now is in the middle of the pack. While the LQD/IEF jumped up to rank 2 from rank 6.

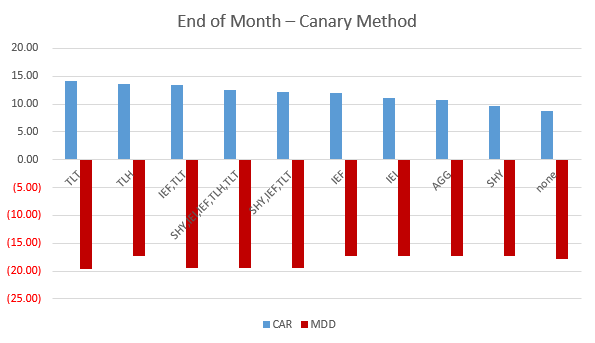

End of Month – Canary Method

Of those six, I picked the one with the highest Sharpe Ratio, .93, which is the Canary method to see how it did with all the Bond ETFs.

Again, the results are sorted by CAR. Looking at the CAR and the bond ETF used, these results make sense. Trading the risker, longer-term bond, led to higher returns. What is surprising is how much more they improved from 8.82 using no bond ETF to 14.09 for using TLT.

I did find very surprising that the maximum drawdown changed little. The range is from 17.30 to 19.61. I expected using TLT to increase the drawdown.

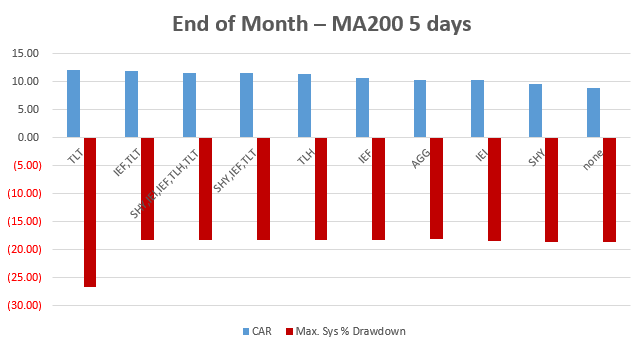

End of Month – MA200 5 days

Will these results hold on another method?

Using TLT produces the highest CAR again but this time the MDD increases dramatically. All the other ETFs had MDD in the 18s while using TLT has a MDD of 26.59.

Using the basket of ETFs increases results over IEF. Is worth the extra work and complexity?

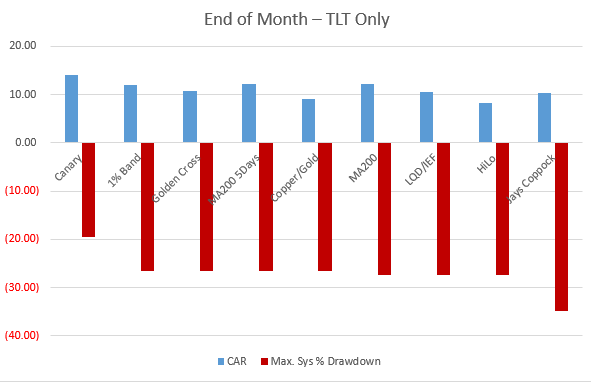

Is the Canary Method tuned to TLT?

End of Month – TLT Only

Next I want to compare all the methods with using TLT only. I want to understand what is going on with the drawdown.

These results are sorted by MDD. We can see that all the other methods have MDD in the mid 20s. That is a more realistic expectation of using TLT.

Any Day – No Bond ETF

How much does allowing signals any day of the month change things?

Compared to results from 2004, the order here stays about the same. The biggest stand out is LQD/IEF, where it is now easily outperforming all other methods.

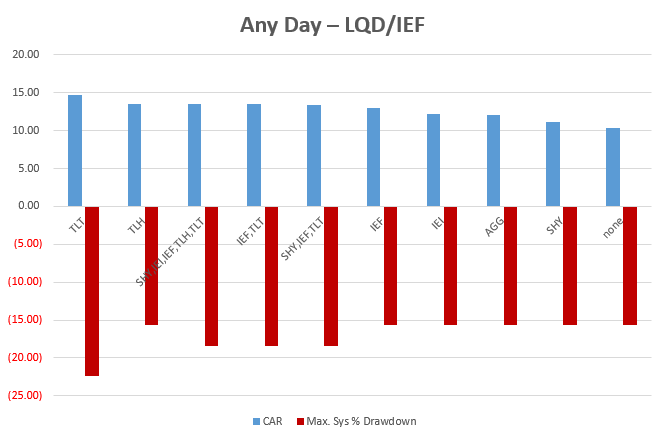

Any Day – LQD/IEF

We see the same pattern of higher returns when using the longer dated bond ETF.

Using the basket of stocks has returns slightly better than using IEF with slightly higher MDD. Not sure if it is worth the complexity.

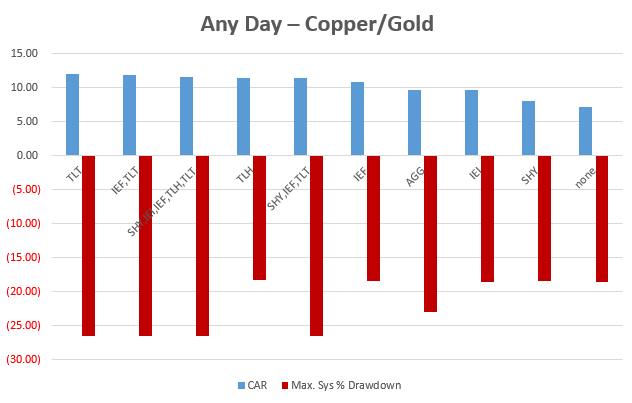

Any Day – Copper/Gold

This I do just out of curiosity. I would probably never trade this method. It just is too off-beat. Maybe that is the reason to do?

What I find interesting in these results, is that any ETF basket that uses TLT has significantly higher drawdowns.

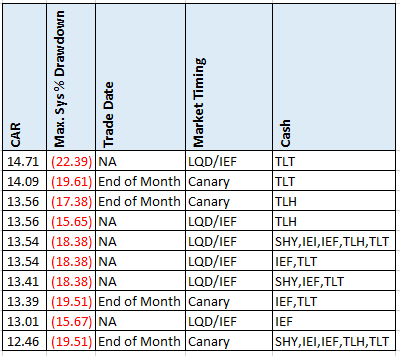

Best CAR

Looking at all the combinations these are the top 10 CARs.

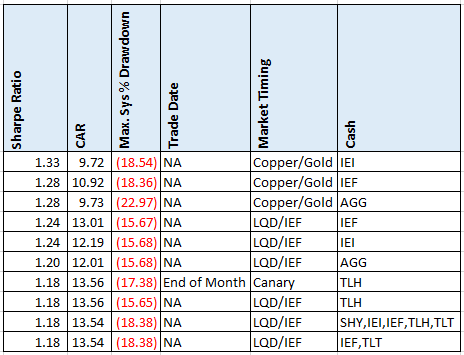

Best Sharpe Ratio

Looking at all the combinations these are the top 10 Sharpe Ratios.

This was going to be a throw away table until I looked at it closer. Somehow the Copper/Gold method came out with the best values and by substantial amount when compared the bottom methods.

Interesting.

Spreadsheet

File the form below to get the spreadsheet with lots of additional information. See the results of all variations from all the combinations. This includes top drawdowns, trade statistics and more.

Final Thoughts

As expected we can boost returns by using a Bond ETF. In some cases by quite a bit. I would stay away from anything that uses TLT or TLH just because these longer duration bonds can really be volatile.

I like the results for using IEI or the basket of (SHY, IEF, TLT).

A next step in the research would be trying to different ranking methods for the Bond baskets.

The Canary method looks like an overfit result when using TLT. Something to watch out for.

Backtesting platform used: AmiBroker. Data provider: Norgate Data (referral link)

Good quant trading,

Fill in for free spreadsheet:

![]()