Author Archives: Cesar Alvarez

- in ETFs , Rotation by Cesar Alvarez

ETF Bond Rotation

In my last post I discussed SPY/TLT rotation strategies. Today, I will be using the same ideas from the post but on a basket of bond ETFs.

- in ETFs , Rotation , Trend Following by Cesar Alvarez

SPY TLT Rotation

For my retirement accounts, I like to trade ETF strategies that require little work. One strategy we have all seen is the SPY/TLT strategy. There are many flavors of this concept. Some pick the best one over the last N months. Then there are different ways of allocating a portion of the portfolio to each. I currently don’t trade any SPY/TLT strategy and wanted to see if there was something interesting here.

- in Research by Cesar Alvarez

How Bad Was 2018’s Volatility?

I have a Google Home in my bathroom that I play a morning routine while I shave, brush my teeth and get ready for the day. One step is to play The Indicator podcast from Planet Money. This morning they were talking about how “2018 was one of the most volatile years on record for the stock market.” Of course that caught my attention and I wanted to discover how they measured that. The volatility last year did not seem that bad given my trading since 90s. They mentioned the VIX and that had increased 157% from the previous year. But there was no other mention on how they came up with that statement. Well during my shower, I thought of all the “easy” ways they could have done it.

So how does 2018 volatility rank compared to all years since 1995?

- in General , Research by Cesar Alvarez

What to do when you find the Holy Grail

As I have mentioned in several interviews, I am always looking for new strategies. One area that fascinates me is stock options. Because it is difficult to get good data and to do backtests, I believe that there are good edges here to be found. A few weeks ago, I found myself with lots of time and having read presentations on options, I went into a testing frenzy.

After lots of work, I found a strategy that greatly exceeded my expectations. It seemed to be the Holy Grail. I ran the strategy by my trading buddy, Steven, and he thought it was great too. We were so excited!

- in General by Cesar Alvarez

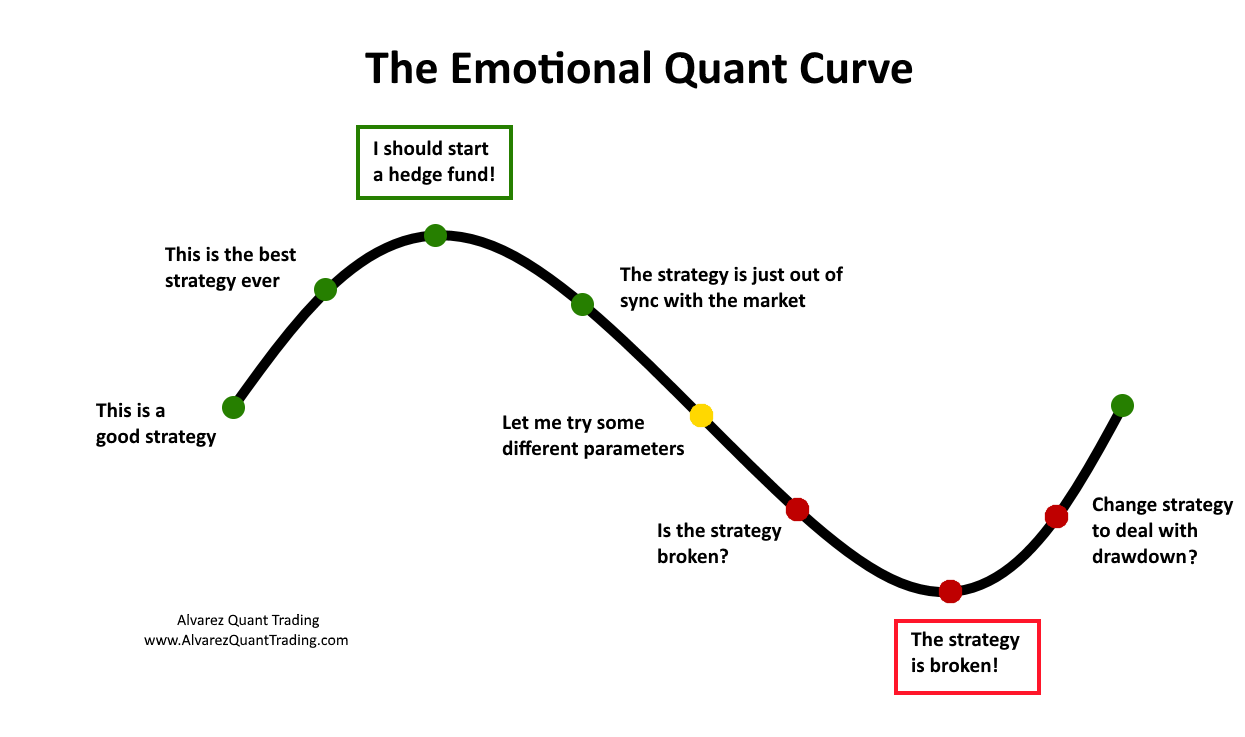

The Emotional Quant Curve

While writing my presentation for TradersFest 2018, I wanted to add the trader’s emotional curve. But looking at it closer, it did not capture my feelings as I go through the cycle of up and downs of trading a strategy. Here is my curve.

I have been on every part of this curve multiple times. October and November caused several strategies to go into the red part of the curve.

The top box of the curve, “I should start a hedge fund!” does not apply to me since I do not want to manage money. But lots of traders think about it and I chose that. For me, I would have changed it to “I can retire!”

Where are your strategies right now?

Good quant trading,

- in Research , Trend Following by Cesar Alvarez

Stiffness Indicator Analysis

A reader pointed me the November 2018 issue of Technical Analysis of Stocks & Commodities to an article about a trend following indicator on S&P500 stocks. I liked the concept of the indicator and the article had backteted results and AmiBroker code. How could I resist not looking into this?

Little did I realize this would lead to Backtesting is Hard and How much does not having survivorship free data change test results?.

- in General by Cesar Alvarez

Upcoming presentation: Getting started in Quantified Trading

I will be giving a free online presentation, Getting started in Quantified Trading with a mean reversion strategy, at TradersFest 2018 on December 11, 2018. What to see my presentation?

Then sign up for TradersFest 2018.

It’s a FREE 2-day online event where you’ll learn trading strategies & techniques.

Topics from other presenters:

- Quantitative trading for retail traders

- How to develop a killer trading instinct

- How to trade Options for profit and protection

- How to find winning stocks in good times and bad

- How to level up your trading and become a confident trader — even if you’ve been losing for years

Topics that I will cover include:

- What is quant trading and what it is not

- Tools of the trade

- The importance of strategy goals

- The creation of a mean reversion strategy

- Rules that keep you trading

- Needing a trading buddy

- And much more…

If you want to join TradersFest, then click the link below and claim your spot (it’s free).

Here’s the link ==> Yes, Reserve My Spot!

See you at TradersFest!

Good quant trading,

- in Research by Cesar Alvarez

Missing the best or worst market days

This morning I saw the chart on Ritholz.com of what happens when you miss the best X days of the market. I see a variation of this chart often and is used to argue why someone should not try and time the market. One concept I like to do is to invert. Meaning try the opposite idea and see what you get. What I rarely see is the chart if you missed the worst X days. Given it is a rainy Sunday morning here in Seattle and I had nothing better to do, I wanted to see that chart.

- in Research , Rotation , Stocks by Cesar Alvarez

Backtesting a Dividend Strategy

I was recently at a NWTTA presentation about the “S&P 500 Dividend Aristocrats” and how to trade these stocks. The strategy was part quantitative and part discretionary. It was popular talk with lots of good questions. People always seem interested in dividend stocks but for me they are just another stock with another reason to go up or down. I don’t like to dismiss ideas without testing. The strategy relies on fundamental data that I do not have access to but I have dividend data from Norgate Data. Would that be enough to create a strategy worth trading?

- in Rotation , Stocks by Cesar Alvarez

StockCharts Technical Rank (SCTR) Rotation Strategy

My post last week on the analysis of SCTR produced lots of emails and comments with great ideas. One idea that I liked was a simple rotation strategy using SCTR. I mentioned in the post that maybe using SCTR as ranking method would produce different results.

Normally I don’t post this quickly but I wanted to share these new results because they give a different view of SCTR.